I sold my Rolls-Royce (LSE:RR) shares earlier in the year. It was a gradual reduction in my position, but I probably came close to doubling my money with the engineering stock.

Of course, I possibly sold some or all of my holdings too early. However, I wasn’t aware of the sheer strength of the positive momentum behind the stock. I also underestimated the company’s ability to continue outperforming the market.

So, the question today is ‘could I double my money again from here’?

Should you invest £1,000 in Scottish Mortgage right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Scottish Mortgage made the list?

Valuations

The current share price infers a forward price-to-earnings of 29 times. That’s clearly not overly cheap, but it’s important to highlight that Rolls remains a company in transition. It’s getting back on its feet after being severely damaged by the pandemic.

Looking forward, however, valuation based on earnings forecasts improves. A forward multiple of 16.5 times isn’t particularly expensive.

| 2023 | 2024 | 2025 | |

| EPS forecast (p) | 7.17 | 9.82 | 12.71 |

| P/E at current share price | 29.3 | 21.3 | 16.5 |

By comparison, Rolls’s rival in the US, General Electric, currently trades at 14.2 times forward earnings for 2023. However, it looks increasingly expensive in the coming years due to a falling earnings forecast. Interestingly, General Electric’s FY2025 P/E would be almost on par with Rolls-Royce’s.

| 2023 | 2024 | 2025 | |

| EPS forecast (c) | 7.68 | 5.19 | 6.63 |

| P/E at current share price | 14.2 | 21 | 16.4 |

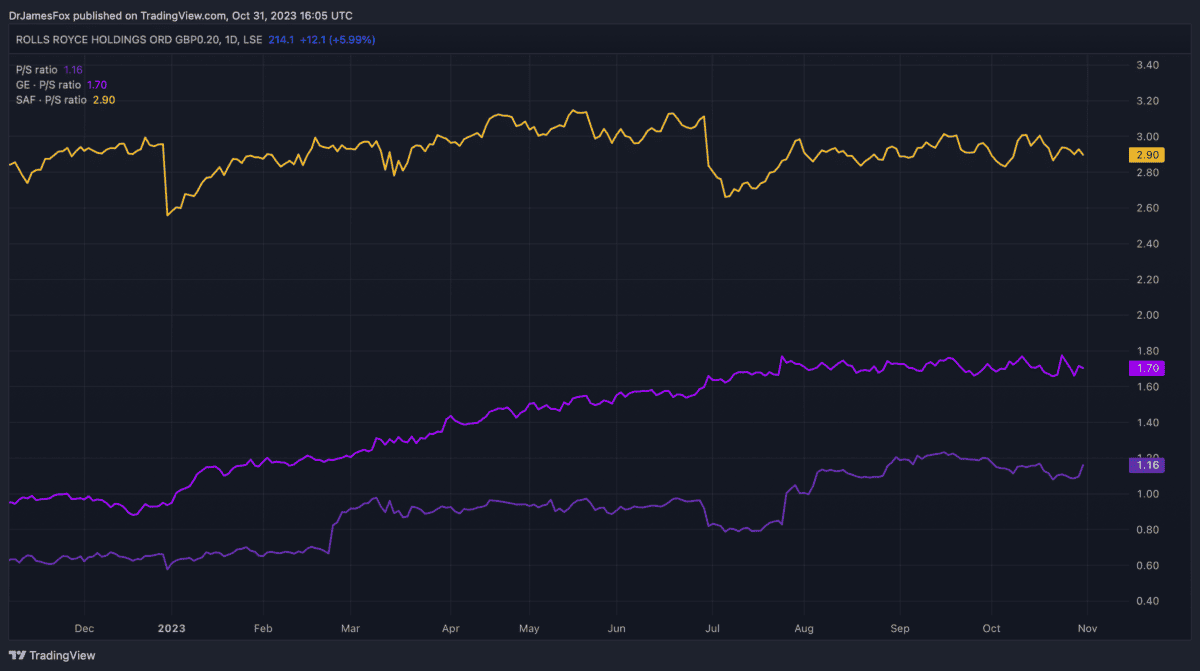

We can also look at metrics, including the price-to-sales ratio, to provide further near-term comparisons. The below chart shows that Rolls-Royce trades at a discount to General Electric, and Safran — which General Electric recently partnered with.

Although the valuation metrics are highly appealing, they do not imply that the fair value should currently be twice the current price. That’s not to say the company won’t continue to grow earnings beyond the medium term, and thus earnings a higher valuation.

Long-term growth

Rolls-Royce earns the vast majority of its revenues from three segments: civil aviation, defence, and power systems. The biggest of these, by some distance, is civil aviation.

As such, the investment hypothesis for Rolls-Royce is heavily linked to this sector. Thankfully, the civil aviation sector is expected to receive a major boost over the next two decades, primarily from a growing global middle class.

For example, Airbus’s Global Market Forecast for the next two decades predicts demand for over 40,000 new commercial jets between 2023 and 2042. However, the vast majority of this demand is for single-body aircrafts — Rolls stopped producing engines for this market a decade ago.

The company’s decision to leave the market could prove a huge mistake looking at the forecast. CEO Tufan Erginbilgiç doesn’t see Rolls re-entering the sector for a decade, primarily due to the logistical challenges associated with partnering with aircraft manufacturers and other parts of the supply chain.

So, could Rolls-Royce shares double from here? I really wouldn’t be surprised to see shares trade around £5 in three or four years time. However, there are plenty of variables, including its ability to benefit from growing civil aviation demand and investor sentiment.

Right now, I don’t have a position in Rolls, but I’ll consider it when I have more capital available.