When I look at the long-term chart for NIO (NYSE: NIO) shares, I’m taken back to my childhood. In particular, I’m reminded of those big dipper rollercoaster rides, where an almost vertical ascent is followed by a series of stomach-churning moves on the way back down.

At $7, NIO shares are almost back where they started in September 2018 when the Chinese premium electric vehicle (EV) maker went public. However, they soared as high as $62 in 2021.

This means that if I’d invested £1,000 in NIO at its IPO, I wouldn’t have made much so far. However, the same amount invested in Tesla shares when they debuted on the Nasdaq back in 2010 would now be worth around £160,000!

In fact, due to a weakened pound, my hypothetical returns would be even greater.

NIO is often compared to its larger US rival and has even been dubbed ‘The Tesla of China’.

So, could buying NIO shares at $7 today be like investing in Tesla stock years ago?

Price wars and margins

The EV market in China has encountered some teething problems this year. Its rate of growth is slowing as dark economic clouds have descended over the Chinese economy.

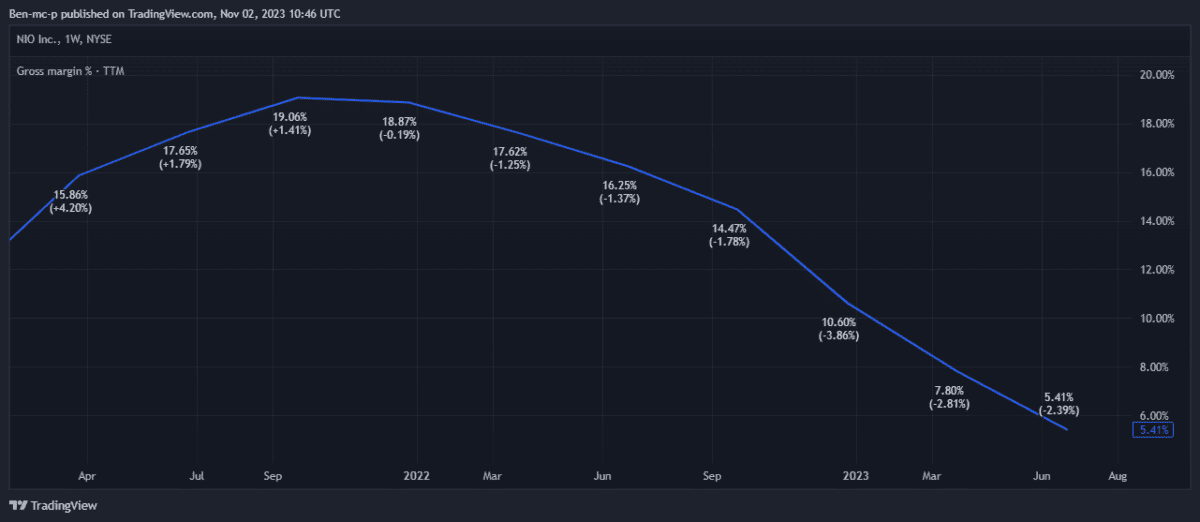

More specifically, NIO has battled inflation, supply chain problems and has recently (and reluctantly) entered into the EV price war that Tesla started last year.

The price war is a tricky one because NIO can’t lower prices too much without damaging its premium brand image. Meanwhile, these issues are putting huge pressure on the loss-making company’s margins.

October deliveries

Despite these headwinds, the innovative firm continues to push ahead.

In October, it delivered 16,074 vehicles, an increase of 59.8% year on year. This means it has delivered 126,067 vehicles year to date, a 36.3% rise.

These are very encouraging numbers, though the company still isn’t expected to reach profitability anytime soon.

Massive growth market

In 2022, there were nearly 6m EVs sold in China, which represented over half of all global sales. But that figure is expected to more than double by 2030. So the potential growth runway here is very long.

Of course, carmakers (both old and new) know this and most are operating in China. Tesla already has a huge gigafactory in Shanghai, where it recently produced its two millionth vehicle. So increasing competition is an ever-present risk for NIO.

However, to stand out from the crowd, the firm has focused relentlessly on innovation, notably battery-swap stations. These allow NIO drivers to swap a depleted battery for a full one in a few minutes.

It now has 2,079 of these stations globally, with 621 of them strategically located along motorways in China.

Recently, it even released the world’s first smartphone designed for EVs. A NIO owner can use the phone to instruct the car to drive itself to their location, which is allowed in China in restricted spaces and at low speeds.

The next Tesla?

NIO recorded a net loss of $2bn last year. Looking ahead, it will have to do a better job of showing a path towards profitability.

Until it can demonstrate this, I doubt its shares will generate Tesla-like returns, even from $7.

That said, I like the firm’s innovations, so the shares remain on my watchlist.