Aston Martin (LSE:AML) disappointed investors on Wednesday (1 November) with its Q3 results, but kept its guidance for the year. At one point, the stock was down as much as 15%.

So, what did the earnings report say, and can Aston Martin ever join the blue-chip FTSE 100?

Q3 disappoints

Aston Martin reported a larger-than-anticipated third-quarter loss, coupled with a revised volume projection for the DB12 model.

Should you invest £1,000 in Admiral right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Admiral made the list?

In the quarter concluding in September 30, the adjusted operating loss came in at £48.4m. That was down from the previous year’s £55.5m, but fell short of estimates at £37.5m. On a positive note, revenue increased substantially to £362.1m from £315.5m.

The luxury car manufacturer reiterated its full-year guidance but adjusted the volume outlook of its DB12 model. Aston Martin had hoped to ramp-up production in the third quarter, but faced delays noting “supplier readiness” issues.

The Lawrence Stroll-run company revised its total production down to 6,700 units, down from a forecast 7,000.

The board confirmed its commitment to attaining its financial goals, aiming for approximately £2bn in revenue and £500m in adjusted EBITDA by 2024/25.

FTSE 100 aims

I have no doubt that Stroll wants to see Aston Martin on the FTSE 100 one day.

Of course, he does. In fact, when the stock was listed, its market value wasn’t far away from the smallest company on FTSE 100.

However, Aston Martin stock is currently valued at £1.5bn, putting it £1.7bn behind the smallest company on the blue-chip index.

So, is it achievable?

Well, I certainly think so. To start with, it’s worth highlighting that companies in luxury markets tend to trade with very high multiples.

Take Ferrari for example. The US-listed Italian sports car manufacturer trades at 46 times earnings. It has a market cap of $54bn.

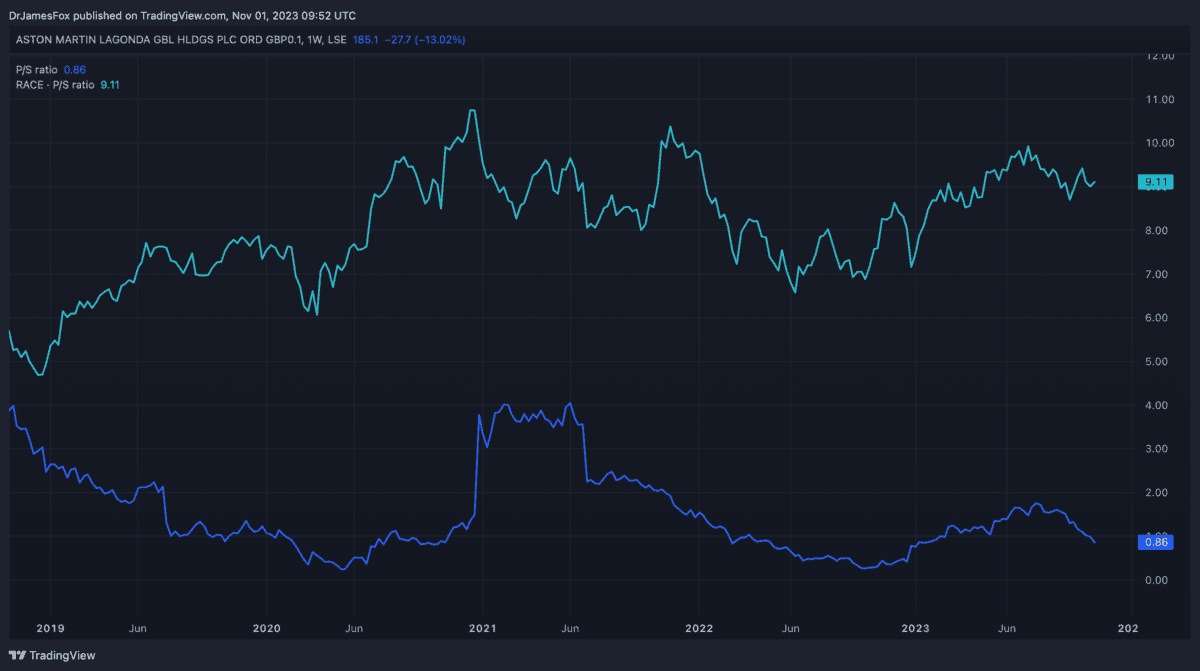

Aston Martin’s current discount to Ferrari can be seen in the price-to-sales ratio.

Plenty to overcome

Aston Martin still has plenty of obstacles to overcome if it wants to join the FTSE 100. Firstly, given the debt burden, currently £750m, the path towards profitability isn’t straightforward.

In other words, EBITDA needs to grow substantially to cover the cost of debt repayments and allow for further investment in new models, and the eventually electrification of the range. Interest costs this year are expected to come in at £120m — this is a huge challenge for the business.

Following this, we need to see investor confidence pick up. US-listed firms like Ferrari tend to trade at greater multiples than UK-listed firms. But it’s not unimaginable to see Aston trading around 25 times earnings in the future.

Personally, I’m a believer. Debt is slowly being reduced — it fell by 10% over the past 12 months — revenue is improving, and average sales price continues to increase. These are very positive metrics. It’s also worth noting that Aston has successfully introduced new customers to the brand with its latest models — 55% of DB12 customers are new to the firm.

Earlier in 2023, the board announced new mid-term financial targets for 2027/28. By this time, the company expects revenue to reach around £2.5bn and EBITDA to reach £800m. If debt continues falling, I’d expect to see Aston Martin on the FTSE 100 by then. As such, if I had spare capital, I’d buy more shares today.