I own many different stocks and funds in my SIPP. And that’s unlikely to change any time soon.

However, recently, I was thinking about the stocks I’d buy for my account if I could only choose three. And here’s the trio I came up with.

Microsoft

Now, I don’t plan to retire for at least 15 years. So I’m looking for long-term growth. With that in mind, my first pick for my SIPP would be technology powerhouse Microsoft (NASDAQ: MSFT).

Should you invest £1,000 in BT right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BT made the list?

Why Microsoft? Well, there are a few reasons.

One is this company is one of the most dominant players in cloud computing. This is an industry projected to grow significantly in the years ahead and the company is already seeing excellent results. Last quarter, for example, cloud revenues were up 29% year on year.

Another is the company is leading the artificial intelligence (AI) revolution. Not only is it a part-owner of ChatGPT, but it has also developed a ‘copilot’ AI feature for apps like Word, Excel, and Teams.

“With copilots, we are making the age of AI real for people and businesses everywhere,” CEO Satya Nadella said recently.

Now, Microsoft is a relatively expensive stock. At present, it has a forward-looking P/E ratio of about 29, which is a risk. But this company is a genuine winner and, in my view, it has bags of potential.

Alphabet

My next pick would be Google and YouTube owner Alphabet (NASDAQ: GOOG).

This is another tech company with huge growth potential.

Like Microsoft, it’s a major player in the AI space. Already it’s released Bard – its rival to ChatGPT. And in the near future we can expect to see the launch of Gemini – an assortment of AI tools used for chatbots, text generation, software coding, and more.

Alphabet is also a leader in the digital advertising space. This is another industry that looks set for long-term growth. The part of the business that excites me the most here is YouTube. This platform is getting bigger by the day and its growth potential is limitless, to my mind. Last quarter, YouTube ad revenue was up 12% to $8bn.

Alphabet does face a few risks. Intense competition from Microsoft and other tech companies is one. Regulatory intervention is another.

I reckon a lot of risk is baked into the share price already however.

Currently, Alphabet’s P/E ratio is just 19. I think that’s a steal.

Nvidia

Finally, my third pick would be Nvidia (NASDAQ: NVDA). It specialises in ‘accelerated computing’ hardware and software.

The reason I’d pick Nvidia is that it looks set to play a major role in the AI revolution.

AI requires a huge amount of computing power and all the big players in the space are turning to Nvidia’s products to power their AI applications (it currently has an 80% market share of the related chip industry).

So I see it as a great ‘pick-and-shovels’ play on AI. No matter who wins (there will probably be multiple winners), it should do well.

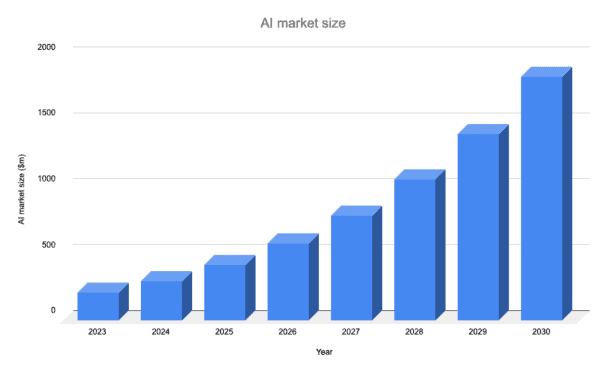

Source: Statista, Next Move Strategy Consulting.

Now, this is a volatile stock. So, I’d have to be prepared for some wild swings in its share price.

In the long run, however, I’d expect it to generate powerful gains for my SIPP.