FTSE 100 banks have experienced a challenging week. Barclays (LSE:BARC) fell as much as 8% on Tuesday (24 October), while on Wednesday, Lloyds (LSE:LLOY) dipped to 38p a share after its results. Interestingly both stocks beat earnings expectations.

Here’s why I believe they’re both oversold.

Net interest margins

Barclays and Lloyds fell primarily on concerns that net interest margins (NIMs) are falling. Lloyds’s NIM for the last quarter came in at 3.08% while Barclays revised its annualised NIM to 3.05%-3.1%, down from 3.15%-3.2%.

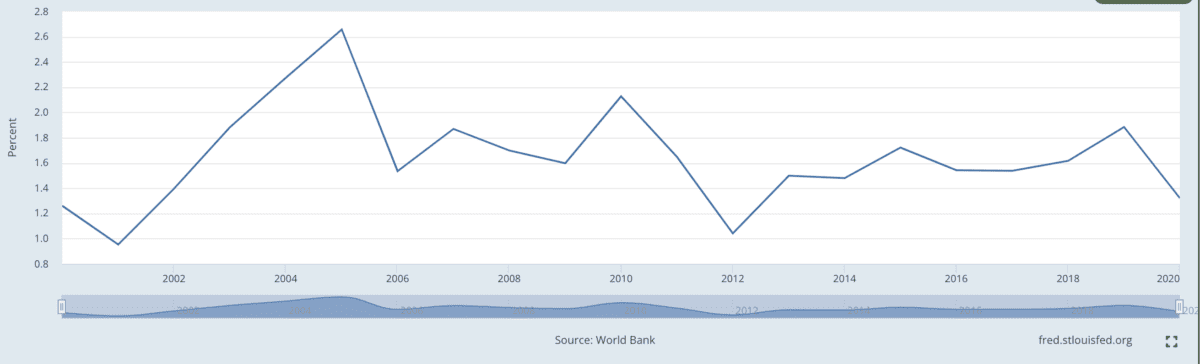

However, it’s worthwhile putting this data into context. The current NIMs we’re seeing are far above the average seen over the past two decades in the UK, as the below chart shows.

As we can see, the current NIMs of the two banks in question are significantly above the long-run average for the UK.

Valuations

These are the two cheapest FTSE 100 banks by several metrics. They’re also considerably cheaper than their US counterparts.

For example, while Barclays and Lloyds trade at 4.2 and 4.9 times TTM (trailing 12 months) earnings, JP Morgan and Bank of America trade at 8.4 and 7.1 times, respectively.

It’s a similar story on a forward basis too. Barclays and Lloyds trade at 4.8 and 5.5 times forward earnings while JP Morgan and Bank of America trade at 8.5 and 7.5 times forward earnings.

While investors tend to have a more positive outlook on the US economy and US banks, it’s not straightforward. For one, Barclays earns around a quarter of its revenues in the US.

However, looking at metrics including the return on equity (RoE), we can see some patterns emerging, connecting business performance with stock valuation.

RoE at Barclays and Lloyds is 9.5% and 12.6%, respectively, while at JP Morgan and Bank of America it’s 16.9% and 10.9%.

The net interest margin, in percentage form, shows a similar story. Barclays and Lloyds have NIM percentages ratios of 27.3% and 32.2% while JP Morgan and Bank of America ratios come in at 36% and 31.5%.

As a final comparison to their US peers, we can see that Barclays and Lloyds trade at 0.5 and 0.67 times book value while JP Morgan and Bank of America trade at 1.41 and 0.78 times, respectively.

Forecasting

While investors and analysts focused on NIM forecasts in the last tranche of results, for about a year, investors were more concerned about impairment charges amid growing defaults.

However, it does appear that the worst-case scenario — one in which there would be a host of credit defaults — has been avoided.

Of course, there’s still a threat that a hard landing would cause untold damaged to house prices, and job losses would mean a slew of credit losses.

But right now, we’re not seeing that. Lloyds actually said its customers were dealing well with higher interest rates — the caveat being the average Lloyds mortgage customer earns £75,000.

With interest rates remaining elevated, but likely to moderate in the medium term, coupled with more resilient borrowers, I think there are reasons to be positive.

But more specifically, I think there’s very little reasoning for the discounts afforded to Barclays and Lloyds. Both these stocks remain core parts of my portfolio.