The Meta (NASDAQ:META) share price is up 130% over 12 months. The Mark Zuckerberg-owned company has seen its share price recover near the heights achieved in late-2021, registering three earnings beats in a row.

Another earnings beat

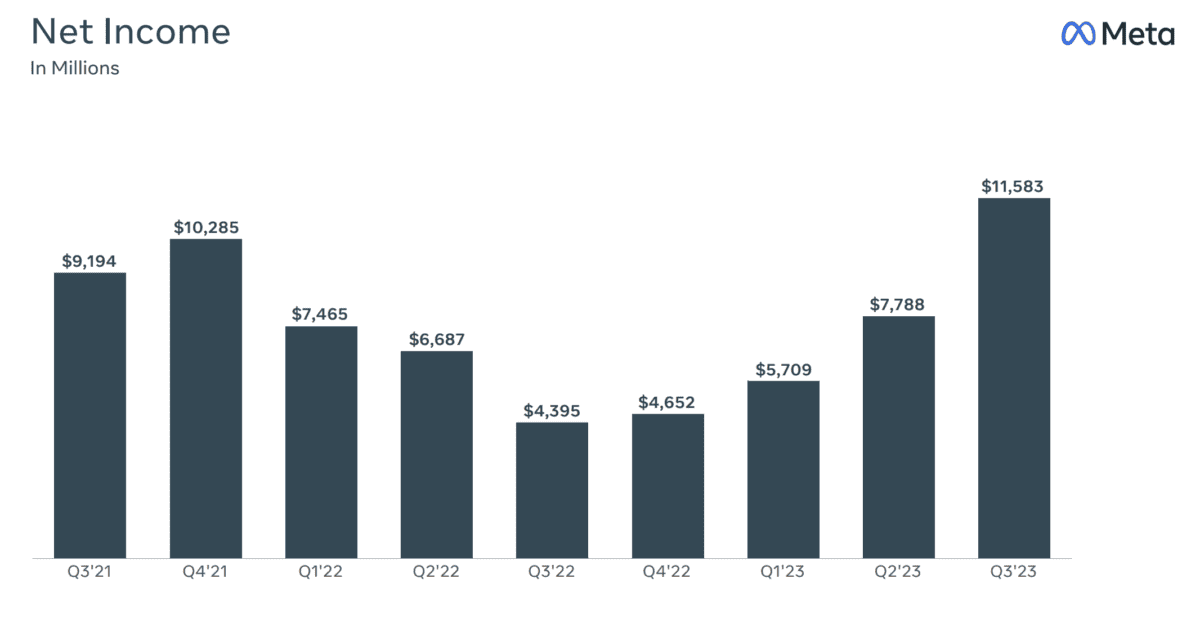

In its third-quarter earnings report, released after the market closed on Wednesday 25 October, Meta exceeded analyst forecasts.

The company noted third-quarter revenue of $34.15bn, surpassing the anticipated $33.56bn, representing a 23% year-over-year increase.

This reinforced investor confidence in the tech firm’s resurgence after experiencing several turbulent years. Zuckerberg said that the company achieved its “highest operating margin in two years”.

According to the social media giant, time spent on Facebook increased by 7%, while time spent on Instagram rose by 6%.

Growth was attributed to enhancements in content recommendations, while Reels had driven a 40% increase in time spent on Instagram since its launch.

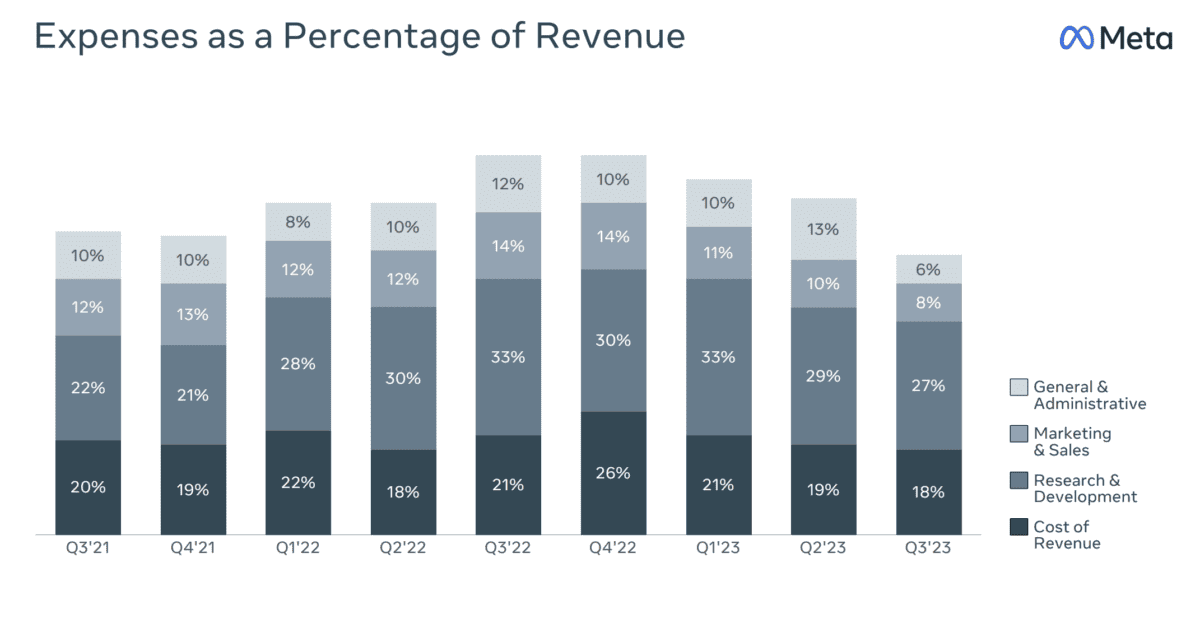

Core to these earnings beats has been cost cutting. The below chart from the company’s Q3 results highlights falling expenses as a percentage of revenue.

Further growth hypothesis

Meta is undoubtedly at the forefront of disruptive technologies, leveraging virtual reality, social media, and innovation driven by artificial intelligence (AI) to create products that facilitate social connections and sharing.

Threads, its latest release, is the fastest-growing social media application in history, with 130m active users. The social media application is now expected to contribute $5bn in revenue by the end of 2023, as Meta moves to monetise its latest product.

There’s also the AI play. In the Q3 results, Zuckerberg said he expected conversations with businesses, likely facilitated by AI, to be “the next pillar of our business”. New AI products like Threads, Reels, and Llama2 will likely be core to any success.

Meta’s move into virtual reality (VR) is also exciting analysts. For now, it’s hugely costly. The division incurred a $13.7bn loss in 2022 alone. However, VR extends far beyond mere gaming novelty. It holds boundless potential with various applications, particularly training and education.

$400?

Meta shares currently trade hands for around $290. So, $400 might seem far off. However, it’s certainly not unimaginable. After all, Meta’s share price has grown by an average of 37.18% a year over the past 10 years.

Despite its relative premium valuation, Meta is making solid progress with Reels and Threads, among other new applications.

While its valuation is relatively high compared to the sector, its forward PEG ratio (1.06) suggests impressive growth potential — PEG builds on the P/E ratio by considering expected earnings growth and not just current earnings.

Yes, Meta has plenty of competition within the advertising space, fighting off tech peers like Alphabet. However, it’s more than just a one-trick pony, with operations and growing interests in various fields.

I certainly believe Meta shares will reach $400, but I’m not sure when. It remains a volatile stock, but one I intend to hold for the long run. The general trend is upwards, and the fundamentals are positive.