I’m definitely not anti-FTSE 100 but I think now’s a great time to scour the wider London stock market for brilliant bargains. Recent market volatility leaves scores of quality UK shares trading well below their true values.

Let me show you the proof! I’ll also reveal three top British stocks on my wishlist today.

Bargains galore

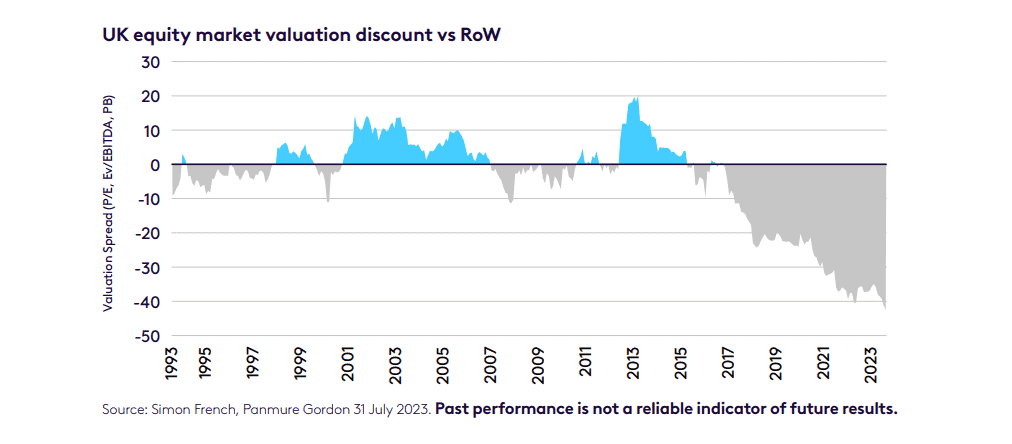

In a new report, analysts at Octopus Investments say that British stocks are now trading at a near-40% discount to the rest of the developed world. As the chart above shows, this disparity has been rapidly growing during the past six years.

The study notes that “the FTSE 100 is at a material discount to long-term average multiples” too. Right now, the average price-to-earnings (P/E) ratio for London’s leading share index sits at around 11 times.

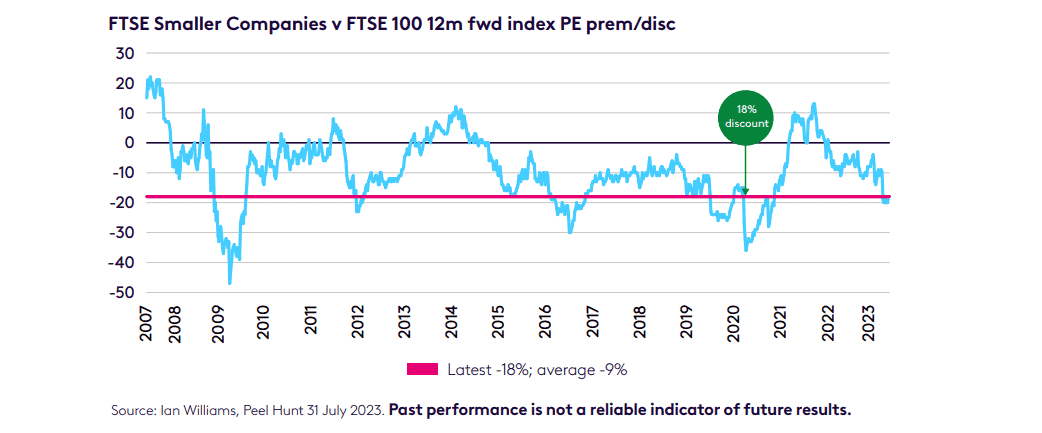

However, Octopus notes that UK shares outside the lead index “appear even more attractively priced“. It says that smaller equities are now trading at an 18% discount to FTSE 100’s forward P/E ratio. This is double the historical average of 9%, as the graphic below indicates.

It seems that a case can be made that such rock-bottom valuations aren’t justified. As Octopus says: “Solid trading continues to be reported across small- and mid-cap stocks“, and adds that “companies are well capitalised, and the outlook remains solid, with the potential for interest rate stabilisation“.

3 UK shares on my radar

I’ve been bargain hunting outside the FTSE 100 in recent times. Just last week, I added more Games Workshop shares to my portfolio following heavy price weakness. And I’m on the lookout for more dirt cheap stocks to snap up.

Bank of Georgia Group is one FTSE 250 company currently on my shopping list. Right now it trades on a forward P/E ratio of 4 times and carries a 10% dividend yield.

While the broader banking sector remains under pressure, adjusted profit here soared 29% between January and June. While it faces fierce competition from TBC Bank, I’m expecting earnings to continue booming as financial services demand in its emerging market grows.

Central Asia Metals also looks too cheap to miss, in my opinion. It trades on a P/E ratio of 6.2 times for 2023, while its dividend yield sits at a whopping 10%.

I think its share price could soar from current levels as consumption of so-called energy transition metals balloons. The company owns the Kounrad copper mine in Kazakhstan and Sasa lead-zinc project in North Macedonia.

Finally, I’m considering adding Bluefield Solar Income Fund to my shares portfolio. As the name implies, this company makes money by investing in renewable energy assets. As a result, earnings can be at risk during periods of bad weather.

Yet over a longer time horizon, I’m expecting it to thrive as demand for clean electricity rockets. This isn’t reflected in its forward P/E ratio of just 8.5 times, I believe. Bluefield also carries a huge 7.7% dividend yield.

These are just a handful of the exceptional stocks investors can snap up for a low price today.