As someone looking to bolster my financial security and create a second income stream, I’ve explored various options, and investing stands out as the most time-efficient and financially rewarding choice.

Unlike traditional part-time jobs, which often come with fixed hours and limited potential for growth, investing in stocks offers flexibility and the potential for significant returns.

Here’s what I’m doing.

Treat it like a pension

Like a pension, looking at my investments with a long-term view encourages regular contributions and disciplined saving.

By consistently adding to my investments over the years, I can harness the power of regular investing and mitigate the impact of market fluctuations.

Regular contributions don’t have to be huge, but I should recognise that they can really add up over time.

If I can only afford £50 a month — after all, I’ve already got pension contributions to find — that’s a great place to start.

Over time, £50 a month invested in a well-managed portfolio can transform itself into a very significant figure.

Moreover, pensions are often structured with specific retirement goals in mind, and my investments can serve a similar purpose.

By setting clear financial objectives for my investments, I can work toward achieving milestones like earning a second income to fund my child’s education, pay my mortgage, or cover the cost of holidays.

Compounding

As suggested above, a well-managed portfolio can grow significantly over time. That’s partly because of a concept called compound returns.

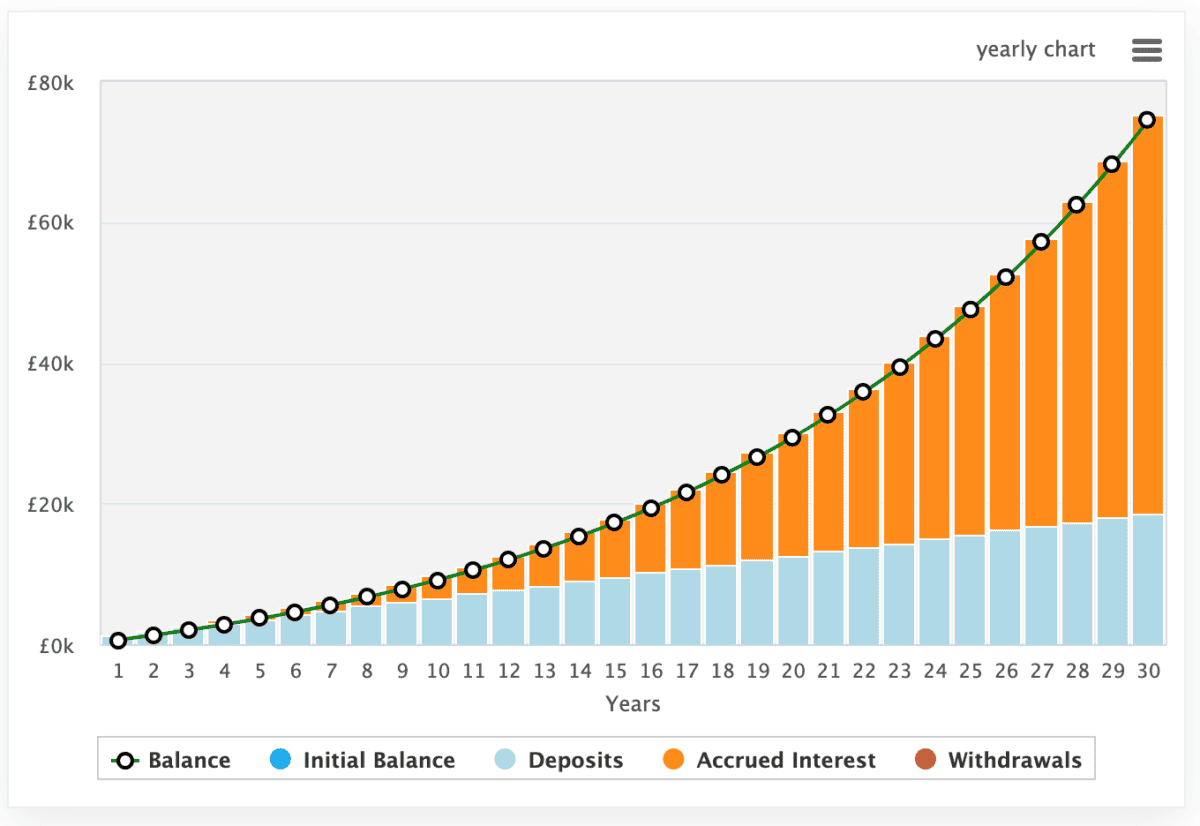

This is where we, as investors, reinvest our returns year after year. This means we’ll start earning interest on our interest as well as our contributions. It might not sound like a winning strategy, but it really is. It means growth becomes exponential.

The below chart shows how this works with the pace of growth speeding up over the allotted time period. In this example, I’d be making a £50 a month contribution. Over 30 years, assuming an annualised yield of 8%, I’d turn my empty portfolio into one worth £74k.

With £74k invested, I could easily generate around £5,000 a year. That would involve me investing in stock with yields around 7%. Of course, while those yields are easy to come by at this moment in time, it might not be so easy in the future.

It’s not straightforward

As that proves, while the above strategy sounds great, I’ve got to be aware of the pitfalls. If I invest poorly, compound returns can work against me, amplifying my losses year after year.

As such, I need to make the most of the advice and learning materials available online. Platforms like The Motley Fool provide content that helps democratise investing.

In turn, I need to do my research and apply my learning. By taking an informed and disciplined approach, I can strive to make the most of my investments and harness the power of compound returns in a way that aligns with my long-term financial goals.