I didn’t expect Manchester United (NYSE:MANU) shares to come to mind when multimillionaire tech mogul Scott Galloway gave a talk entitled ‘Provocative predictions for the future of tech’.

The talk – from earlier this year at an event called Summit at Sea and available on YouTube – touched on topics ranging from AI, to the rise of the mega rich and space tourism.

Galloway is an American academic and entrepreneur specialising in brand management and digital marketing.

Should you invest £1,000 in Apple right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Apple made the list?

With an estimated net worth of $40m, he’s best known for his analysis of the Big Four tech companies and his various podcasts on business and technology.

So, what did he say that turned my attention to Manchester United shares?

Football clubs as global brands

Galloway argues that football clubs are rapidly becoming global brands. He says it’s a trend powered by billionaire investors and nations wanting to boost their image.

“You’re going to see a massive increase in the value of sports teams over the next 10 years,” he said. That will happen “as long as we’re producing more and more billionaires who happen to be in the midst of a mid-life crisis,“ the professor also quipped.

One of his key points was the enduring power of live sports as a medium for advertising. In today’s world of streaming and ad blockers, the commercial break is on the brink of death. Enter live sports, one of the few contexts where people still watch television ads. Clubs profit (indirectly) through the sale of TV rights.

Galloway also pointed out that individuals and entities from Gulf nations have begun investing in football teams as a brand-improvement strategy. These oil-exporting nations are replete with investment capital, and they’re looking to diversify out of fossil fuels.

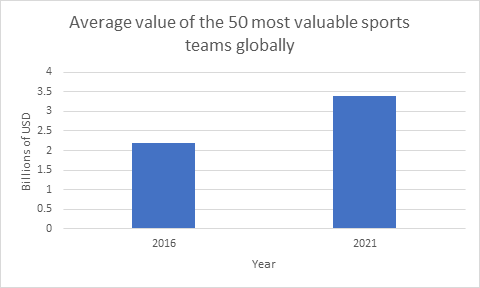

To back up his case, Galloway presented data showing the average price tag of the top 50 sports teams globally had soared 55% from 2016 to 2021.

Source: Prof G Media

What about the Red Devils?

Few football clubs are as globally recognised as Manchester United. What’s more, regular punters like me can become mini-owners of the Red Devils by buying shares, which are listed on the New York Stock Exchange. Currently, the stock price sits at just under $20 (£16.50). Other major football clubs that trade on public exchanges are Celtic (on the London Stock Exchange), Borussia Dortmund (on the Frankfurt Stock Exchange) and Juventus (on the Italian Stock Exchange).

The Manchester United stock price has been volatile recently, largely due to a bidding war for control of the club. Initially, it was a tussle between Qatari banker Sheikh Jassim bin Hamad Al Thani and British businessman Sir Jim Ratcliffe. However, the Sheikh has now withdrawn from the process, reportedly frustrated by the Glazers’ valuation and demands.

Ratcliffe’s Ineos group is now poised to take over the football operations side of Manchester United, pending approval of a 25% offer worth an estimated £1.3bn. The British billionaire appears increasingly confident that this will be the first step in a complete buyout of the club.

Frankly, the situation remains uncertain, and I wouldn’t want to risk any of my hard-earned capital on its outcome.

Relegation risks

I think Galloway makes a convincing point that football teams are likely to become more valuable over time. But it’s important to remember that this might not be true for every single club.

A team could lose a lot of its value for specific reasons, like being moved to a lower league.

Ideally, I’d like to buy shares in a diversified group of top-flight clubs through an exchange-traded fund (ETF). For now, that’s not a possibility. So, I’ll be watching from the sidelines.