Over the past month, the Aviva (LSE:AV.) share price has gained around 10.5%. That’s great for investors but the stock is still far below highs achieved earlier in the summer.

The surge came on the back of takeover speculation. Markets blog Betaville suggested there were rumours that Aviva has attracted interest from a buyer.

However, the source of the rumours remains a secret. Moreover, it seems unlikely, as I’d have expected Aviva to have informed shareholders if there had been a genuine approach.

Yet despite my view of the recent rally, I still think Aviva has a lot further to go.

Performance ignored

Insurers are grappling with a formidable challenge posed by high inflation. This primarily stems from its potential to erode the value of their assets under management and disrupt the balance between premiums collected and claims paid out. In such an environment, Aviva must constantly adjust its pricing.

Despite this, it has performed well to date in 2023. Operating profits in H1 jumped 8% year-on-year to £715m as written premiums in general insurance rose 12%, reaching £5.27bn. There was also a remarkable 26% increase in the generation of its Solvency II own funds, amounting to £648m.

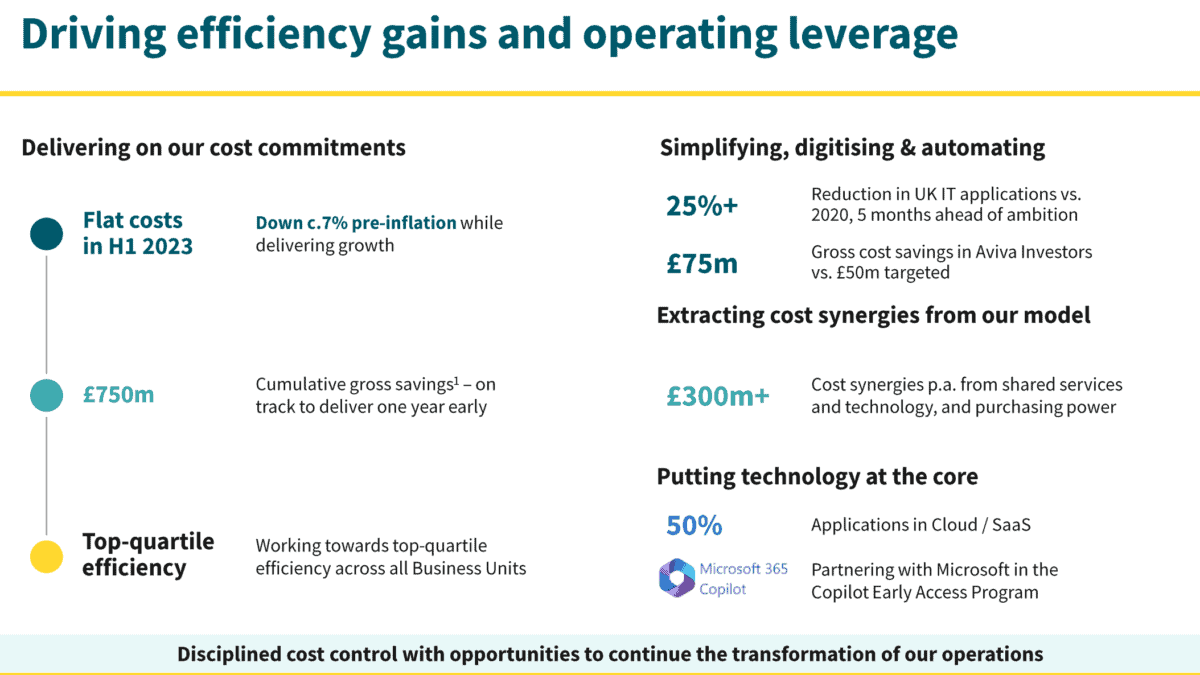

However, this positive performance has largely been ignored by the market, with macro factors taking precedence. That’s certainly not unusual this year. Moreover, it’s worth highlighting Aviva’s impressive cost-saving initiatives, as shown below.

More streamlined

Aviva is in a much better financial shape today compared to just a few years ago, and a significant part of the credit for this turnaround goes to its CEO Amanda Blanc. She took the helm in 2020 and embarked on a mission to streamline and improve the company’s operations.

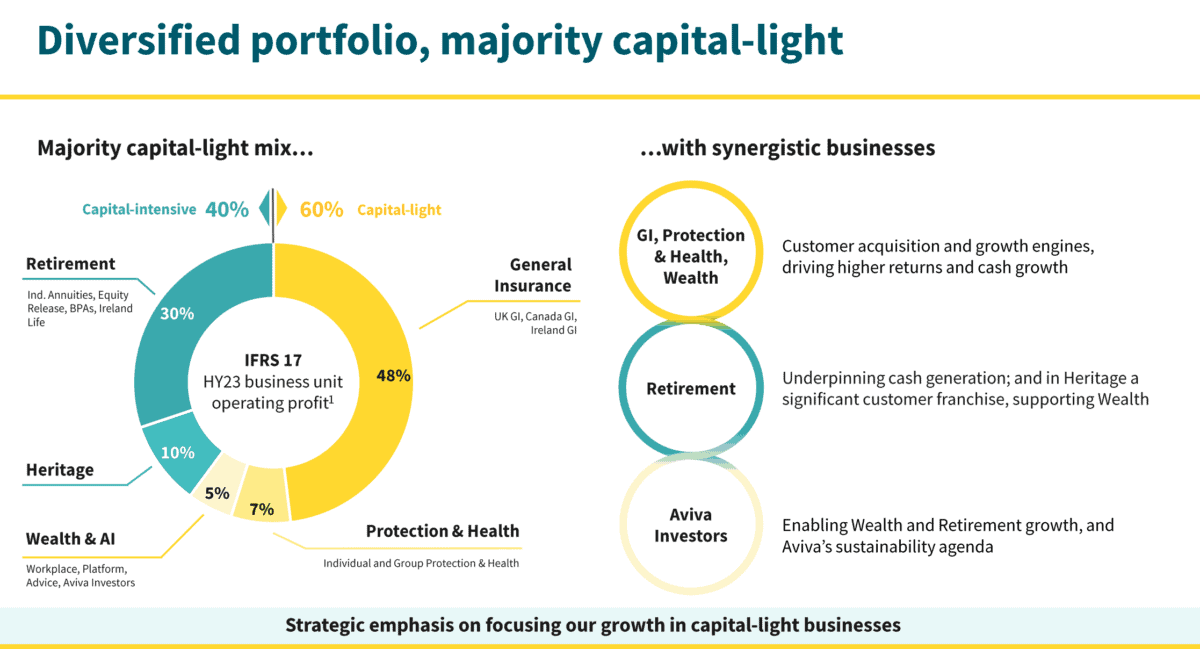

One of the key changes was to make the business more efficient and profitable. Aviva achieved this by selling off non-core assets and businesses, bringing in a total of £7.5bn. Notably, it divested operations in Italy, Turkey, and France, among other assets.

As a result, the company has shifted its focus to core markets, primarily the UK, where it serves a substantial customer base of 18m, as well as Ireland and Canada. It’s certainly a more agile business, although investors may see some risk in investing such a UK-focused firm — 16m customers are in the UK.

Undervalued

Similar to many UK-listed stocks, Aviva’s long-term performance has faced challenges, with the share price declining of 2.5% over the past five years. It’s not a favourite with investors.

However, when it comes to business performance, analysts are optimistic. They anticipate a positive trajectory with anticipated earnings per share (EPS) of 52.5p in 2023, projected to rise to 61.1p in 2024 and further to 67.3p in 2025.

These projections translate into a forward price-to-earnings (P/E) ratio of 6.7 times, representing a valuation that’s nearly half of the FTSE 100’s average. Coupled with the 7.4% dividend yield, I feel it’s a highly attractive stock.

So, when might Aviva shares hit £5? Well, if it does achieve 67.3p in EPS in 2025 — or looks like its going to — and attains a P/E ratio of 7.5 times or above, the share price would exceed £5. This is very achievable, although not at all guaranteed, of course.