A rocketing oil price has sent Shell’s (LSE:SHEL) share price to record highs on Monday. At around £27.70 per share, the oil giant has (so far at least) proved to be one of the best FTSE 100 stocks to buy in 2023.

Yet despite its 17% share price rise since 1 January, Shell still offers market-beating dividend yields. A figure of 4.2% for 2023 comfortably beats the Footsie’s forward average of 3.8%.

And things get even better for the following two years. Shell’s yields for 2024 and 2025 march to 4.5% and 4.7%, respectively.

Could Shell be one of the best income stocks to buy right now? And should I add it to my UK shares portfolio?

Balance sheet strength

Strong oil prices have helped dividends here soar since the end of the pandemic. Shareholder payouts have risen 60% between 2020 and last year, to 103.75 US cents per share.

City forecasts suggest this strong momentum will continue, too. A full-year payout of 140.1 cents per share is expected for this year, and rewards of 150.7 cents and 156.3 are tipped for the following two years.

This reflects the current strong outlook for oil prices for this period. It also illustrates how cash generative Shell’s operations are, and how rapidly the company’s balance sheet has improved.

Further reduction in its net debt (to $40.3bn) in the first half pushed net debt to adjusted EBITDA to a manageable 1.1 times. This allowed Shell to raise the interim dividend 24% and launch a fresh $3bn share buyback programme.

Strong dividend cover

As we saw in 2020, the company’s dividends could suffer a sharp and unexpected shock if oil demand suddenly slips. While the chances of a new Covid-19 explosion may be remote, energy consumption might sink if interest rates keep rising, putting extra stress on a spluttering global economy.

But earnings forecasts through to 2025 suggest Shell could still have plenty of scope to pay the dividends analysts are also expecting. Dividend cover ranges between 2.8 times and 2.1 times for the next three years, well ahead of the minimum safety benchmark of two times.

So should I buy Shell shares?

Shell’s share price has been lifted by the worsening conflict in the Middle East. Oil prices have spiked and could continue marching higher as Israel ramps up military action against Hamas.

Yet I’m not tempted to buy the FTSE company today. I buy shares with a long-term view in mind. And as the world steadily transitions from fossil fuels to cleaner energy sources, oil and gas producers face an uncertain future.

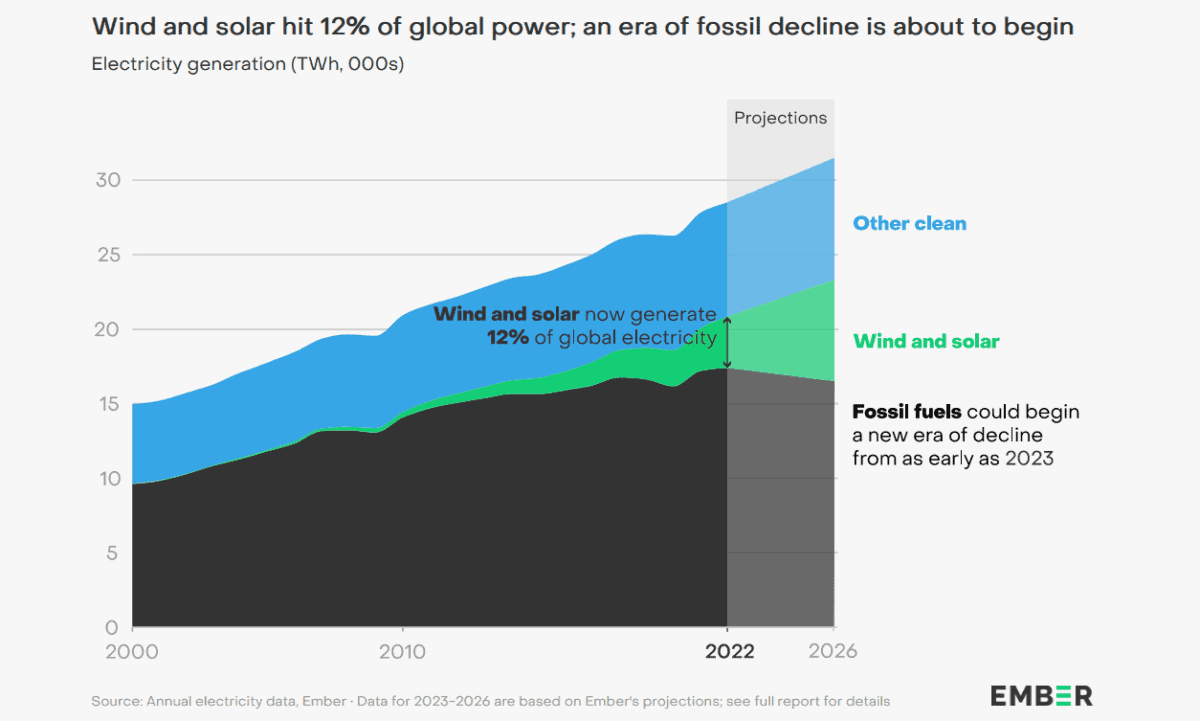

The above graphic from think tank Ember suggests fossil fuel usage could actually begin to decline from this year. But like most oil majors, Shell has made only marginal changes to adapt to this new reality.

The firm’s Renewables and Energy Solutions arm was responsible for just 3% of total adjusted EBITDA in the first half of 2023. The company continues to prioritise capital expenditure on oil and gas, too, and has also ditched earlier plans to cut oil output each year through to 2030.

Analysts at Hargreaves Lansdown recently warned that oil and gas companies “risk the fate suffered by tobacco companies”. It’s a fear that I share, so I’d rather buy other UK shares for dividend income.