The London stock market has long been a popular destination for investors seeking a second income. The UK is packed with mature, cash-generating companies, and so it is a great place to find top dividend shares.

Buy-to-let has also become a well-liked asset class in recent decades. The stable nature of the residential rentals market has provided a steady flow of income to investors. Rampant property price growth meanwhile has allowed landlords to supercharge their returns.

But conditions in the buy-to-let market have deteriorated rapidly of late. Tax changes, like the removal of mortgage interest tax relief, coupled with tighter regulations and higher costs following the Tenant Fees Act, have made the sector a much less appealing place.

Should you invest £1,000 in Big Yellow Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Big Yellow Group Plc made the list?

2 dividend stocks I’d rather buy

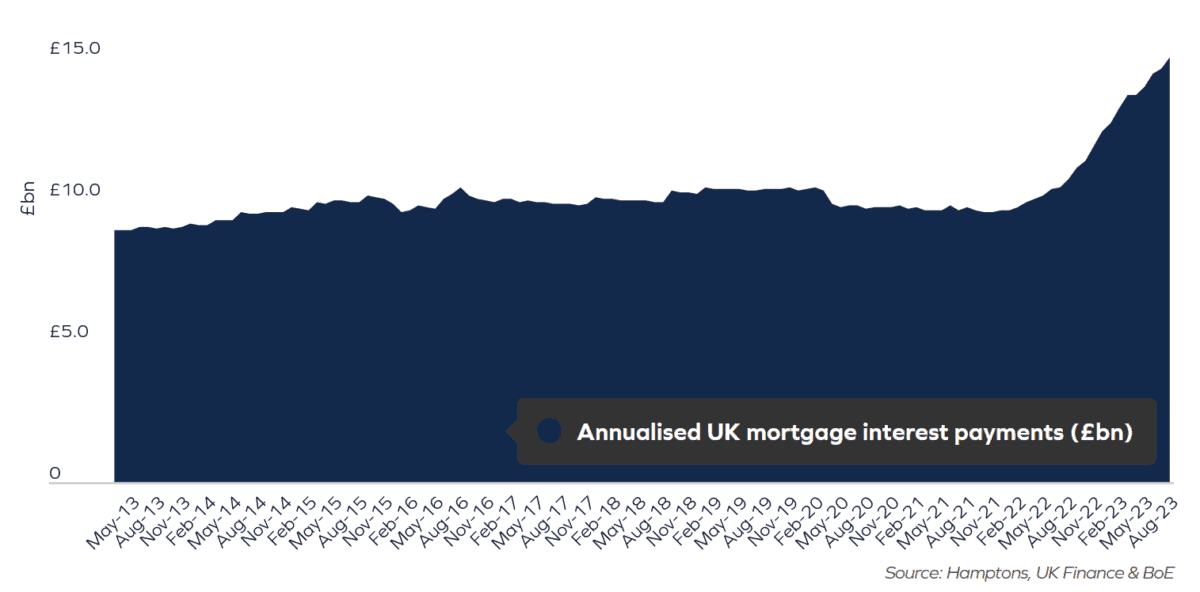

Things have got especially difficult over the past 18 months. Rising interest rates have crushed home price growth and pushed mortgage costs through the roof.

As the chart below shows, landlords in the UK are now paying 40% more mortgage interest than they were in August 2022. Payable interest now stands above a whopping £15bn a year.

Conditions will remain tough for new and existing buy-to-let investors too if inflationary pressures persist and the Bank of England keeps interest rates higher for longer.

Considering those other problems I mention, along with the huge upfront costs buy-to-let involves, I’d rather buy dividend shares to make a second income. Here are two I think are better investments right now.

1. The PRS REIT

Real estate investment trust The PRS REIT (LSE:PRSR) — which has has more than 5,100 family homes on its books — provides exposure to the residential property market without the excessive costs and day-to-day involvement that private landlords must endure.

What’s more, because it invests in a wide range of properties it carries less risk to investors.

This property stock carries a healthy 5.7% dividend yield for the current financial year (to June 2024). This is thanks to rules that state that REITs pay at least 90% of annual rental profits out in the form of dividends.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

PRS isn’t immune to rising interest rates, with the value of its property portfolio falling due to Bank of England action. Borrowing costs are also moving northwards. But on balance it’s still a better choice than buy-to-let.

2. Big Yellow Group

Another REIT I have my eye on now is Big Yellow Group (LSE:BYG). This income share carries a mighty 4.7% forward dividend yield for this fiscal year (ending March 2024).

This dividend share doesn’t provide exposure to the defensive residential lettings market, which means rent collection may be more challenging during tough times. However, its focus on fast-growing self-storage still makes it a top buy to me.

Demand for storage is tipped to grow strongly over the next decade. A rising number of UK renters, a lack of space in new homes, increasing urbanisation, and the growth of e-commerce should all drive long-term revenues.

Big Yellow is expanding to capitalise on this lucrative market, too, and has a development pipeline of 11 new assets.