The FTSE 100 has been exhibiting the same volatility we’re seeing elsewhere in the world. And in recent months, markets have become even more sensitive to macroeconomic commentary and geopolitical events.

But it’s also been an eventful year in general. Hamas’s tragic attack on Israel being the latest example, sending energy and defence stocks higher, and most other stocks lower.

EFA Forecast

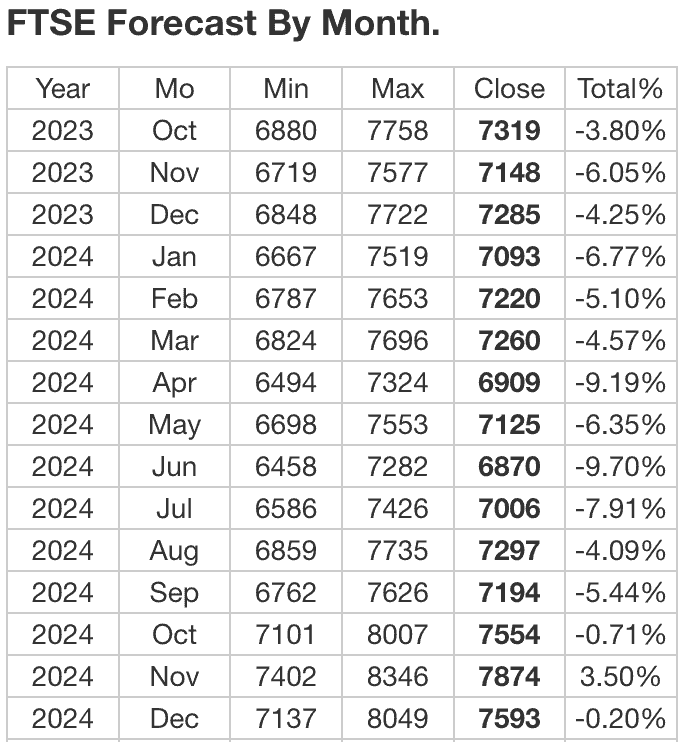

The Economy Forecast Agency (EFA) regularly updates its predictions for the trajectory of the FTSE 100. In the past, the EFA has demonstrated surprising accuracy. Its forecasts have been largely on target, providing valuable insights for investors navigating through these uncertain times.

However, in recent months, I noticed that the agency has frequently changed its forecast trajectory for the index, indicating some degree of uncertainty. Under the current forecast, the EFA doesn’t see the FTSE 100 reaching 8,000 again until next October. And that’s in its most optimistic scenario.

Of course, this doesn’t paint the best picture of the index’s outlook. And in reality, it’s likely that the forecast will change regularly over the coming months.

Interest rates

Interest rates can have a big impact on markets, and often in ways investors don’t properly consider.

Higher interest rates, currently at 5.25%, can lead to increased borrowing costs for businesses and consumers, potentially reducing corporate profitability and slowing economic growth.

However, as rates moderate to 2%-3% over the medium term, the reduced borrowing costs may enhance profitability and stimulate economic activity, benefiting companies in the FTSE 100.

This is frequently noted by investors.

However, the second way is arguably more profound. With rates where they are today, investors have been turning to cash and debt for lower risk and often guaranteed returns.

Lower interest rates can make stocks more attractive relative to bonds, potentially driving investment back into shares, including those listed on the FTSE 100. As such, falling rates could push the index upwards.

Economics and geopolitics

Some of the sectors most heavily represented in the FTSE 100 include financial services, oil and gas, healthcare, consumer goods, and mining. This means that the index can be pulled in two directions by geopolitical events and economic data.

For example, the awful events in Gaza sent most stocks downwards, while energy and defence companies moved upwards on stronger oil.

Conflict in the Middle East is never good for markets in general, however. There are several ‘chokepoints’ for oil in the region, including the Persian Gulf and the Straits of Hormuz. Clearly there are fears the conflict could spread.

Looking forward, it’s impossible to forecast what may happen next. An end to conflict in Ukraine and an early conclusion to the conflict in Gaza would undoubtedly be positive for markets.

Such outcomes often reduce geopolitical risk, alleviate concerns about supply disruptions, and bolster investor confidence in global markets.

Nevertheless, it’s essential to remain vigilant and adaptable, as geopolitical developments can move swiftly, influencing market sentiment and investment decisions.

So, while the FTSE 100 isn’t forecast to hit 8,000 for a while, a changing geopolitical environment could speed up this process.