Warren Buffett is among the most successful investors of all time. The so-called Oracle of Omaha has amassed a fortune worth over $123bn.

He’s done this using his tried and tested investment strategy. Buffett, as many others do, invests in top-quality companies that appear to be trading at a discount versus their intrinsic value.

Let’s explore in further detail.

Should you invest £1,000 in Water Intelligence Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Water Intelligence Plc made the list?

Buffett’s strategy

Buffett’s core strategy is value investing. He looks for undervalued companies whose stock prices are trading below their true value. He does this by focusing on businesses with strong basics, including a competitive advantage, reliable cash flows, and a history of profitability.

Finding undervalued stocks requires me to do my own research. This means looking at fundamental metrics such as the price-to-earnings, EV-to-EBITDA, and the price-to-sales ratios. These ratios mean very little on their own, but require comparisons with peers. More detailed research often revolves around the discounted cash flow model.

But that’s not Buffett’s only criteria. The Oracle of Omaha often invests in companies with economic moats, which means they have a sustainable competitive advantage that protects their market share. This can be in the form of a strong brand, network effects, patents, or other factors that make it difficult for competitors to challenge the company.

And this contributes to the notion of a top-quality stock. It’s a company with a strong identity, commanding position in the market, and good financial position.

Hargreaves Lansdown

So, would Hargreaves Lansdown (LSE:HL) meet Buffett’s investment criteria? Well, I think it would.

Firstly, it’s important to note that this is very hypothetical, and that Buffett doesn’t tend to invest in UK stocks. He very much believes in the perennial strength of the US economy and American businesses.

However, when looking at Hargreaves, it’s possible to observe that the stock is trading at a discount versus peers, and it’s own historical average. The Bristol-based firm trades at 11.2 times earnings versus its five-year average of 29.4 times.

This P/E ratio indicates a sizeable discount to its peers, which trade with an average P/E around 18 times.

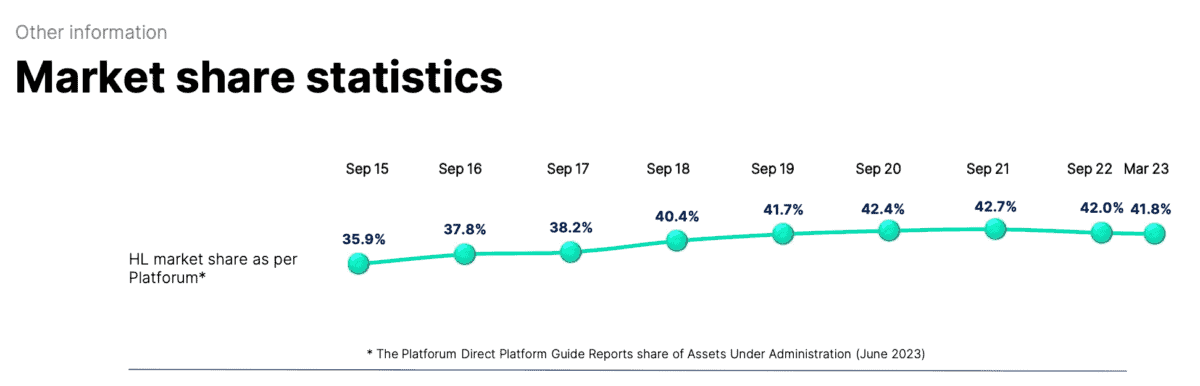

Moreover, Hargreaves has a significant moat. The company has 41.8% of the UK brokerage market, representing a commanding advantage over its peers.

Retail investors frequently choose Hargreaves for its easy-to-use platform, and unbeatable customer services. However, due to higher fees, investors with less investment capital often choose cheaper alternatives.

Personally, I don’t see the presence of cheaper peers as threat to Hargreaves Lansdown’s commanding market share. Looking at the data, the company has continued to grow its lead despite cheaper alternatives entering the market.

In fact, I believe Hargreaves is in prime position to dominate the market further when economic conditions improve. The cost-of-living crisis hasn’t been good for new user figures, but a more stable environment should result in more Britons returning to the world of investing.