FTSE 100 stock Phoenix Group (LSE:PHNX) offers a huge 10.8% dividend yield. It’s currently the biggest yield on the index, tipping peers like Legal & General and M&G.

So, is the stock worth buying? I think so. In fact, I’ve recently topped up my position in the insurance giant.

Why is the yield so high?

Insurers tend to focus on dividend yields in the UK. The companies prefer to reward shareholders in the form of dividends rather than share buybacks.

However, these yields have been rising this year as we’ve seen downward pressure on share prices. Share prices are closely linked to dividend yields.

One reason for the falling share price and increasing yields is the movement in asset prices. That’s because insurers manage a lot of money, and return this money to policyholders in the form of payouts.

Naturally, these liabilities need to be accounted for. So Phoenix and its peers invest the money they manage, often in safe fixed-income assets, like bonds. But with interest rates pushing upwards, the value of older bonds and other assets have largely pushed downwards.

Negatives overplayed?

As noted, insurers are major investors in bonds. They aim to generate income and to match their long-term liabilities, such as life insurance policies.

However, the unrealised bond losses that insurers are experiencing aren’t a major concern. Insurers are well-capitalised and they have long-term investment horizons. This means that they can afford to wait for bond prices to recover — unlike Silicon Valley Bank, for instance, which crashed in March.

Tailwinds

Phoenix is one of the UK’s premier players in the realm of long-term savings and retirement, serving a vast customer base of approximately 12m individuals and overseeing a substantial £270bn in assets under administration.

Despite its traditional focus on acquiring and managing legacy life insurance and pension funds that are closed to new business, the group is seeing plenty of organic growth. Auto-enrolment pensions and trends in bulk purchase annuities have served as tailwinds that are due to continue.

Worth the risk?

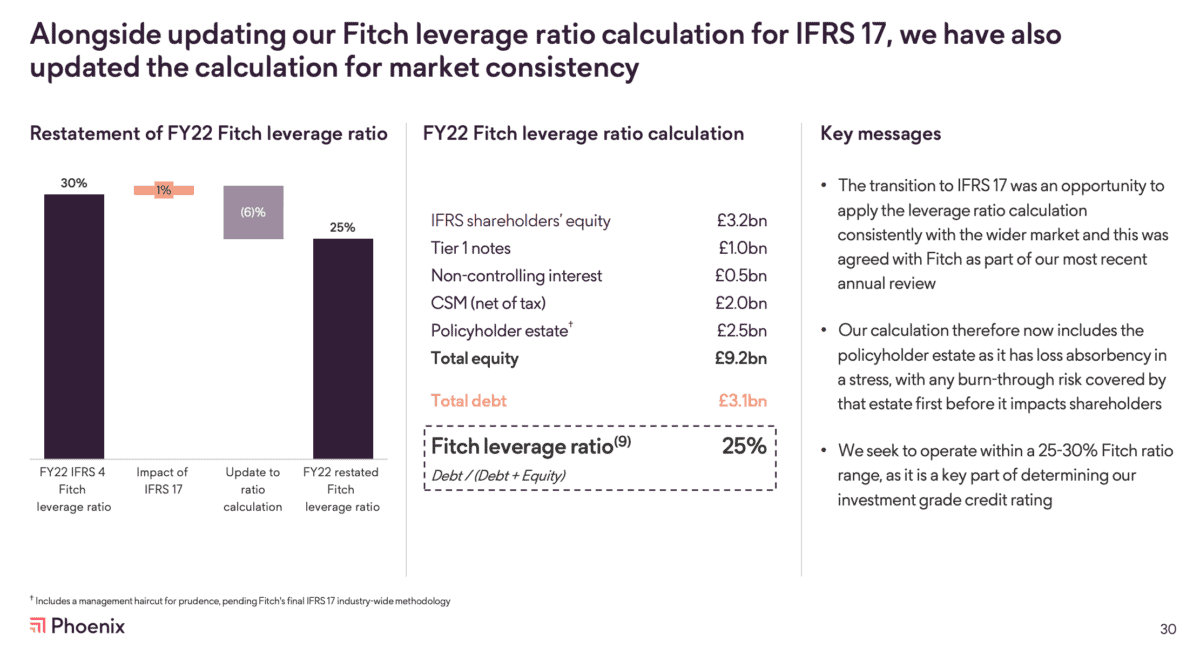

That said, one concern is debt or leverage. At the end of FY22, the insurer had £4.1bn of debt outstanding. However, Phoenix Group disagrees with the likes of JP Morgan — which cut its price target on the back on debt concerns — claiming that it has the capacity to increase its leverage.

As highlighted above, Phoenix Group says it is operating towards the lower end of its targeted leverage range. But with interest rates where they are, this could concern some investors.

Moreover, it’s worth noting that the dividend was only covered 1.6 times by earnings in 2022. This figure should improve for 2023, however, following a bumper first half.

So, is this stock worth the risk? I believe it’s worth it for me. Phoenix Group is trading at its lowest level in 10 years, despite some serious tailwinds, and trading at just 5.7 times earnings. With a 10.8% yield, I just need the share price to stay still!