Barclays (LSE:BARC) shares represent one of my biggest holdings. It certainly hasn’t performed overly well for me so far. However, analysts, including those at AJ Bell, have forecast that banking and financial stocks will be among those making the strongest gains over the coming year. So, could we see Barclays pip £2 a share soon?

P/E

One of the simplest valuation metrics to consider is the price-to-earnings (P/E) ratio, and this is where Barclays’ discount compared to its peers becomes readily apparent.

Britain’s second largest bank is currently trading at 4.24 times earnings, and 5.6 times forward earnings. This is phenomenally cheap and a fraction of the index average of around 13 times. It’s also notably below the financial sector average of approximately 10 times.

Barclays is the cheapest FTSE 100 bank when using the P/E ratio lens. It’s also considerably cheaper than US peers including Bank of America (9 times) and Goldman Sachs (15 times).

P/B

The price-to-book (P/B) ratio is an important financial metric for investors because it provides insights into a company’s valuation relative to its book value, which is essentially the net asset value of the company.

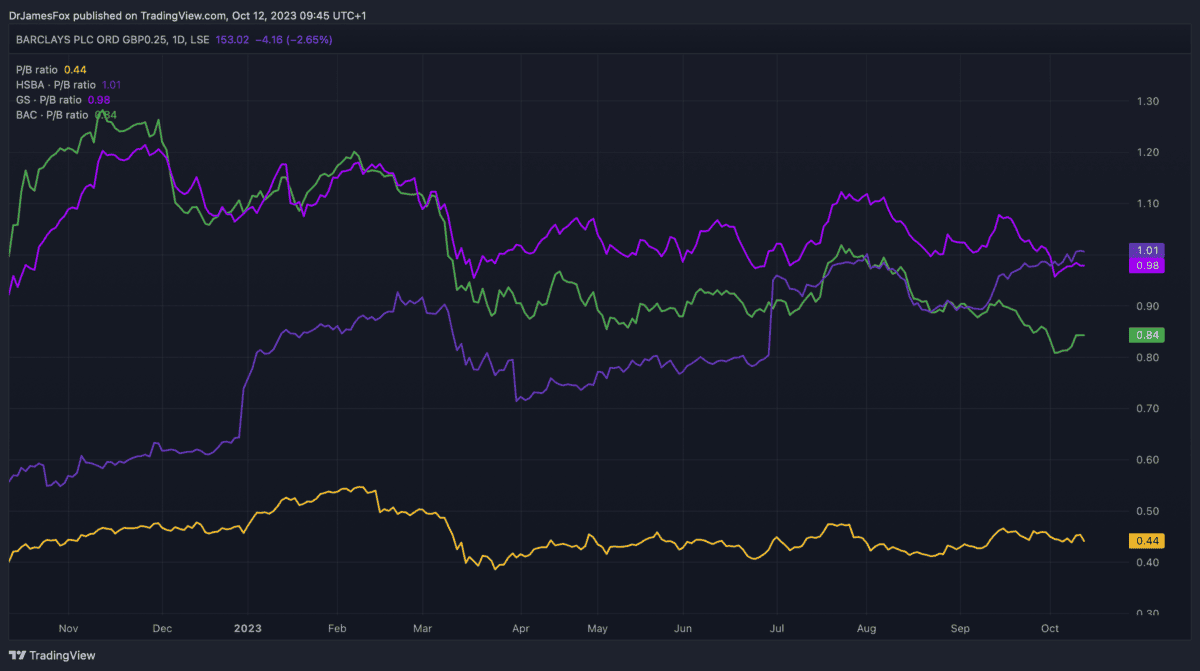

When we look at Barclays P/B ratio, we can see that the stock is massively discounted versus its tangible net asset value. The company’s P/B ratio is 0.42 times, inferring a 58% discount versus net asset value.

The above chart shows how Barclays compares to peers HSBC (1.01 times), Bank of America (0.84 times), and Goldman Sachs (0.98 times). The discount afforded to Barclays is pretty much unprecedented.

Negatives overplayed

Like banks in the US and Europe, Barclays is facing some challenges as interest rates extend beyond the levels considered optimal. These elevated interest rates can exert pressure on the bank’s operations and profitability.

If the situation were to worsen, Barclays could expect credit losses to more than double its current forecast. These are essentially the impairment charges the bank would incur from bad debt. This is because, with interest rates pushing above 5%, individuals and businesses are struggling with their repayments.

However, to date, higher interest rates have had a positive impact on bank earnings. That’s because net interest income has been greater than impairment charges.

The concern is that this could change if the economy takes a turn for the worse, or interest rates rise further. Currently, it appears as if a worst-case scenario will be avoided.

Nonetheless, it’s worth noting that Barclays was the worst performer in the UK regulators bank stress test — under a stress scenario, with Common Equity Tier 1 (a measure of liquidity) levels falling to 8.6% — which is still some way above the pass threshold.

The big question is whether Barclays deserves this considerable discount when its peers are exposed to very similar pressures.

For me, it’s an easy one. The risks are more than priced into the Barclays share price. If we apply a fair P/E ratio of eight times, the Barclays share price would be closer to £3 than £2. A similar result appears when we use a fairer P/B ratio.