These FTSE 100 and FTSE 250 stocks look dirt cheap right now. Are they brilliant bargains, or classic investor traps?

Travis Perkins

Builders’ merchant and home-improvement retailer Travis Perkins (LSE:TPK) is back in the news on Wednesday. Unfortunately, it’s for all of the wrong reasons.

Sales are crashing at the company as the housing market cools and repair, maintenance and improvement (RMI) spending sinks. Today, it said that like-for-like sales dropped 1.8% between July and September, a result that forced it to reduce its full-year profits forecast.

Adjusted operating profit is now tipped to range from £175m-£195m, down significantly from an estimated £240m it spoke of just two months ago.

Travis Perkins shares have fallen around 7% on the news and are trading around 52-week lows. So the business now trades on a forward price-to-earnings (P/E) ratio of 10.8 times. This sits just above the widely regarded value benchmark of 10 times.

But I believe the company merits such a low rating. The UK economy is tipped for a prolonged downturn, while higher-than-usual interest rates also look set to persist. Therefore, any turnaround in its end markets could be a long way off.

Travis Perkins has a huge retail footprint, which should put it in a good position when conditions eventually improve. But the prospect of sustained profits pressure and a steadily-rising debt pile still makes it one cheap share I’m keen to avoid. I believe it’s share price could keep collapsing.

JD Sports Fashion

Sportswear/lifestyle retailer JD Sports Fashion’s (LSE:JD.) shares have been on my watchlist for some time. And following heavy share price weakness in 2023, I’m thinking about making it my next share buy. Today, the FTSE 100 company trades on a forward P/E ratio of 10.6 times.

On the one hand, the low valuation of JD shares could be considered fair given the uncertain outlook for the world economy and therefore consumer spending. Sellers of premium products like branded sportswear and trainers could be considered especially vulnerable to customer cutbacks.

However, the retailer’s resilience in spite of recent difficulties suggests this rock-bottom rating is undeserved. Organic sales soared 12% during the six months to July, with revenues helped by market share gains in key markets.

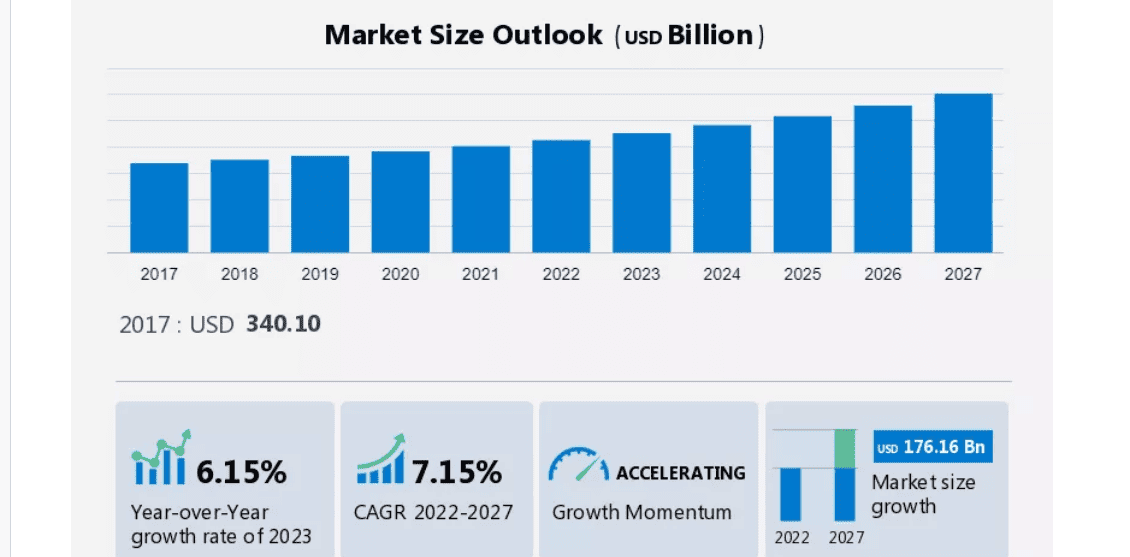

As a long-term investor there are two things I’m especially excited about when it comes to JD shares. Firstly, the global athleisure (casual sportswear) market is tipped to continue growing strongly, as the graphic below shows.

Secondly, the company remains committed to rapid expansion to fully capitalise on this opportunity. JD — which operates more than 3,300 stores across Europe, North America and Asia — is on course to open 200 new outlets in the current financial year alone. It’s also investing heavily in its e-commerce channels.

Analysts at Shore Capital recently described the company as “materially undervalued”. I’ll be looking to add JD shares to my portfolio when I next have cash to invest.