After almost tripling in 12 months, can Rolls-Royce (LSE:RR) shares go even higher?

Of course, the answer is that nobody really knows for sure. But you’d like to think that professional analysts covering the stock at some of the top brokers would have a better idea than most. After all, it is literally their job to dig into the numbers to provide earnings estimates and a likely share price trajectory.

So, what is the broker consensus on Rolls-Royce shares right now? Let’s take a look.

A positive outlook

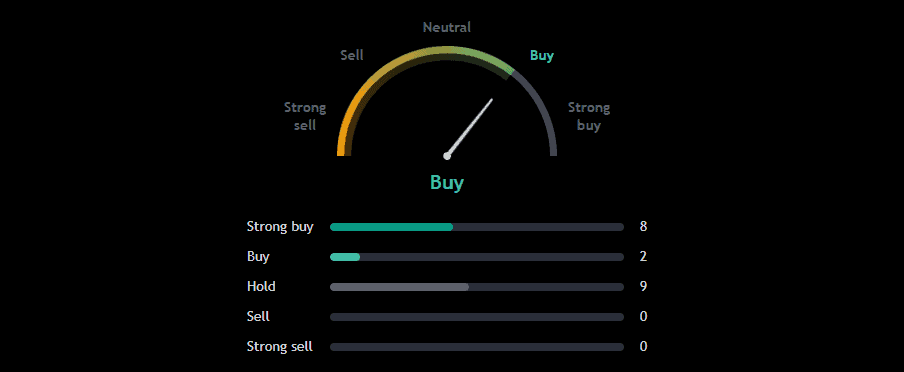

Overall, analysts are bullish. Of the 19 brokers covering the FTSE 100 stock in the last three months, not a single one currently has a ‘sell’ rating on it.

The last bear, investment bank JPMorgan, lifted its sell recommendation in August. In a note to clients, its analysts wrote: “We had been very skeptical that Rolls-Royce would be able to raise its prices so significantly, but it appears we were mistaken“.

Over half (10) of the brokers have Rolls-Royce shares down as a ‘buy’ or ‘strong buy’.

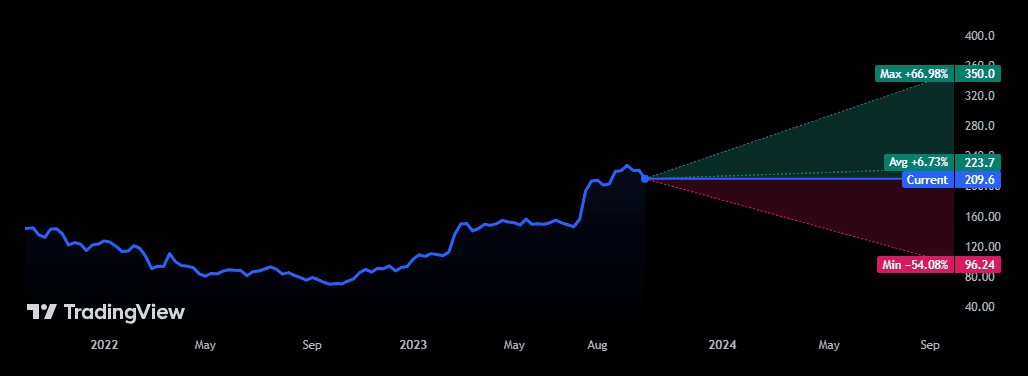

Moreover, from the 17 analysts offering one-year price targets (not all do), we get an average estimate of 223p. That’s around 6.7% higher than the current share price of 209p.

As is often the case, though, there is quite a lot of variation in the minimum and maximum estimates. For example, some see it rising as high as 350p (67% higher) in a bullish scenario. Others have it falling back to just under 100p (a 54% decline) if the turnaround plan underway at Rolls-Royce fails.

Bank of America is bullish

To take an individual case, Bank of America analysts released a note on 21 September. In this, they estimated that the company has managed to recover 88% of its pre-Covid engine flying hours (EFH).

This is being powered by the ongoing recovery in the Chinese aviation industry, which the pandemic brought to a virtual standstill for three years. The broker now anticipates that a 92% recovery to pre-Covid EFH levels could be on the cards for the full year.

If so, that would be above Rolls-Royce’s own estimates and could support higher free cash flow.

More good news

Away from brokers, there has been more positive news recently. Rolls-Royce has passed the first stage of a UK government competition to select developers of small modular reactors (SMRs).

By 2050, the government is hoping to ramp up the UK’s nuclear capacity to around 25% of total electricity generation (up from around 15% last year). The advantage of SMRs over large-scale reactors is that they can be made in manufacturing facilities before being transported to anywhere in the country or overseas.

Rolls-Royce’s SMR technology is also under review by European regulators. So this market could prove to be an enormous long-term growth opportunity.

Of course, there’s also a risk that future governments could row back on these nuclear power plans.

My move

Despite all this positive coverage, I won’t be adding to my holding just yet. After all, share price targets are just estimates and often prove inaccurate. And, besides, the consensus price target is only 6.7% higher.

No, I’ll wait to see what management says on the company’s Capital Markets Day next month before deciding.