Aviva (LSE:AV) is a high-yield stock that’s been on my shopping list for some time. So following further share price weakness this week, I finally decided to press the button and add it to my Stocks and Shares ISA.

Lasting worries about the state of the UK economy have pushed the FTSE 100 firm steadily lower. More recently, talk that interest rates could remain higher for longer — which would likely keep demand depressed across the company’s product portfolio — has weighed on investor appetite.

But I believe Aviva’s recent 13% share price slide so far this year is over the top. Here are four reasons why I’ve just bought the life insurance giant for my portfolio.

1. Huge dividend yields

At current prices of 386.9p per share, the forward dividend yield at Aviva smashes the FTSE 100 average of 3.8%. A predicted 31.8p per share reward means Aviva shares yield a huge 8.2%.

But this is not all. As the chart below shows, the company also offers higher yields than industry rivals AIG, Aegon, Prudential, AIG, Zurich and MetLife. Only British rival Legal & General offers a higher yield for the current financial year.

Created with TradingView

Despite the tough trading environment, City analysts expect annual dividends to keep growing over the next three years too. Consequently, the insurer’s yield marches to an enormous 9.4% for 2025.

2. Strong balance sheet

A cash-rich balance sheet underpins City predictions of huge and growing dividends. As of June, the company’s Solvency II capital ratio stood at an impressive 202%.

This also means the business continues to return large amounts of cash through share buybacks. Since 2021, Aviva has returned more than £5bn worth of capital to shareholders. This follows a £300m repurchase programme completed in the first half of 2023.

Of course, this financial strength also gives the firm the means to make acquisitions for long-term earnings growth. Last month, it shelled out £460m for the UK protection business of AIG.

3. Major structural trends

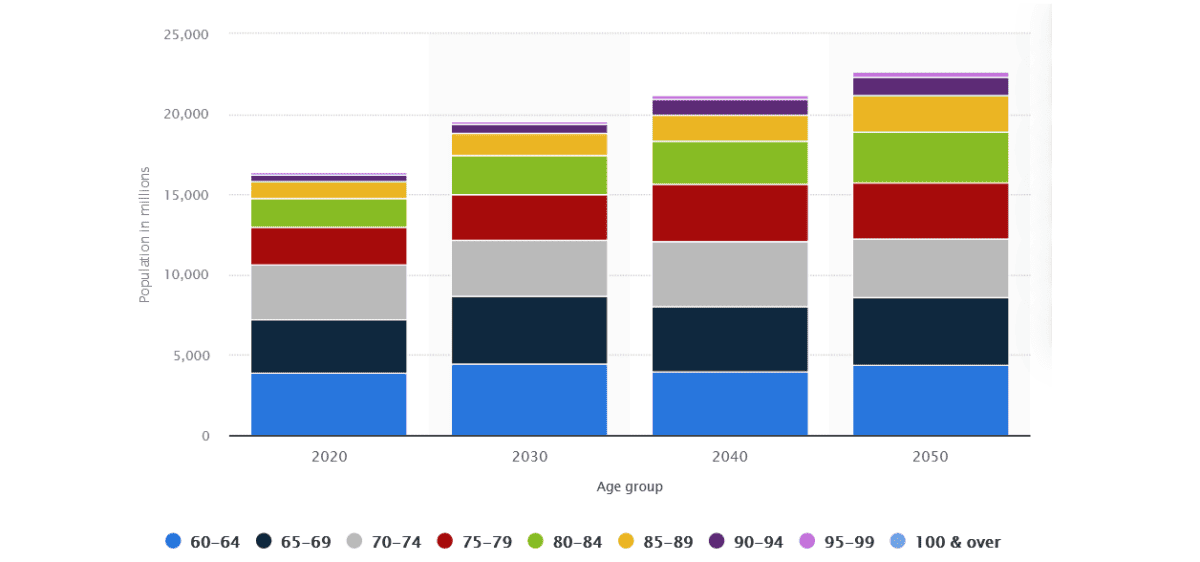

Populations are rapidly ageing in Aviva’s UK, Irish and Canadian marketplaces. The chart below shows how the number of over-60s in Britain, for instance, is tipped to balloon over the next three decades.

In this climate I expect demand for the company’s products to soar. Rising life expectancies and higher numbers of older people mean spending on life insurance and retirement products could go through the roof.

There are many other opportunities for Aviva to grow profits in the coming years too. Increasing strain on the NHS, for example, should boost sales of its private health insurance policies. The FTSE firm grew sales here by 58% between January and June.

4. Low P/E ratio

It’s my opinion that these exciting growth drivers aren’t reflected in the company’s rock-bottom valuation. Today, the company trades on a forward price-to-earnings (P/E) ratio of just 9.7 times.

This is well below the FTSE 100 corresponding average of 12 times. And it makes Aviva’s share price one of the best UK bargains out there right now.