The stock market has been choppy recently. With central banks stating that interest rates could be higher for longer, and bond yields rising, share prices have been volatile.

I remain bullish on stocks, however. And I actually think we could see a decent rally between now and the end of the year.

A Q4 stock market rally?

I’ll discuss the outlook for UK shares in a minute.

First though, I want to focus on the US market because it’s the largest and most influential in the world.

And many of us have exposure to it, either through global equity funds like Fundsmith or individual shares.

Now, the US market had a poor September, with the S&P 500 index falling around 5%.

But weakness in September is common in the US.

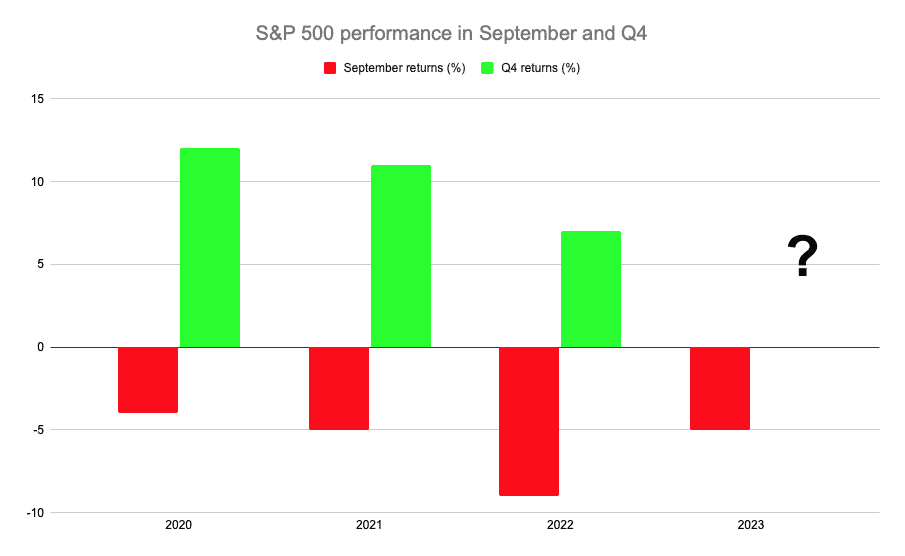

Between 2020 and 2022, US shares produced negative returns in September each year.

Yet here’s the thing. In each of those three years, US shares rallied hard in the fourth quarter.

And in two out of the three years, the market jumped more than 10% in Q4.

There’s no guarantee that history will repeat itself, of course. But I certainly think there’s a chance US stocks could rally again in Q4.

One reason I’m bullish is that, at the start of the year, many money managers were in defensive mode and therefore weren’t positioned for a rally. As a result, they missed the big gains that US stocks generated in the first half of the year.

This leads me to believe that there could be some performance chasing in the fourth quarter. This could push shares prices up.

Additionally, when US stocks are up more than 15% in the first eight months of the year (as they were this year), only twice in history have returns been negative in Q4 and the average return for the quarter is 4%. This historical data is very encouraging.

If we were to see a US stock rally in Q4, I’d expect Big Tech stocks like Microsoft, Alphabet (Google), and Amazon to do well. These companies have strong cash flows and balance sheets so they should be able to continue to thrive in a higher-for-longer interest rate environment.

I’ve been buying more of these stocks for my own portfolio recently.

I’m bullish on UK shares

Turning to UK shares, I’m quite bullish here too.

For starters, the UK market could get a boost if US shares rise.

Secondly, strength across the energy sector could push the UK market higher.

Oil prices have had a bit of a wobble in recent days, but they remain at high levels. And that’s good news for the FTSE 100 index as BP and Shell make up around 10% of the index.

If oil prices resume their upward trend, they could push the Footsie towards 8,000.

Third, UK share valuations are low. Right now, there are many companies that are attractively priced.

For example, HSBC currently trades at around six times earnings versus nine times for US-listed rival JP Morgan.

Similarly, Diageo trades at 18 times earnings versus 28 for US-listed Brown-Forman.

Given these low valuations, I’m excited about the prospects for the UK market, as sooner or later, investors are likely to realise that there are some bargains available.

Again, there are no guarantees that the market will do well in the near term. There is a lot of uncertainty.

However, my personal view is that there are going to be some big opportunities for investors in the months ahead. So, I think it’s a good time to be investing.