Oil prices have been rising for months. Largely as a result of production cuts, Brent crude is up 25% since 30 June. At $93, it’s still $40 below its 2022 peak. But, like many investors, I’ve always assumed that rising oil prices are generally bad for most FTSE 100 shares.

But history suggests I may be wrong.

The evidence

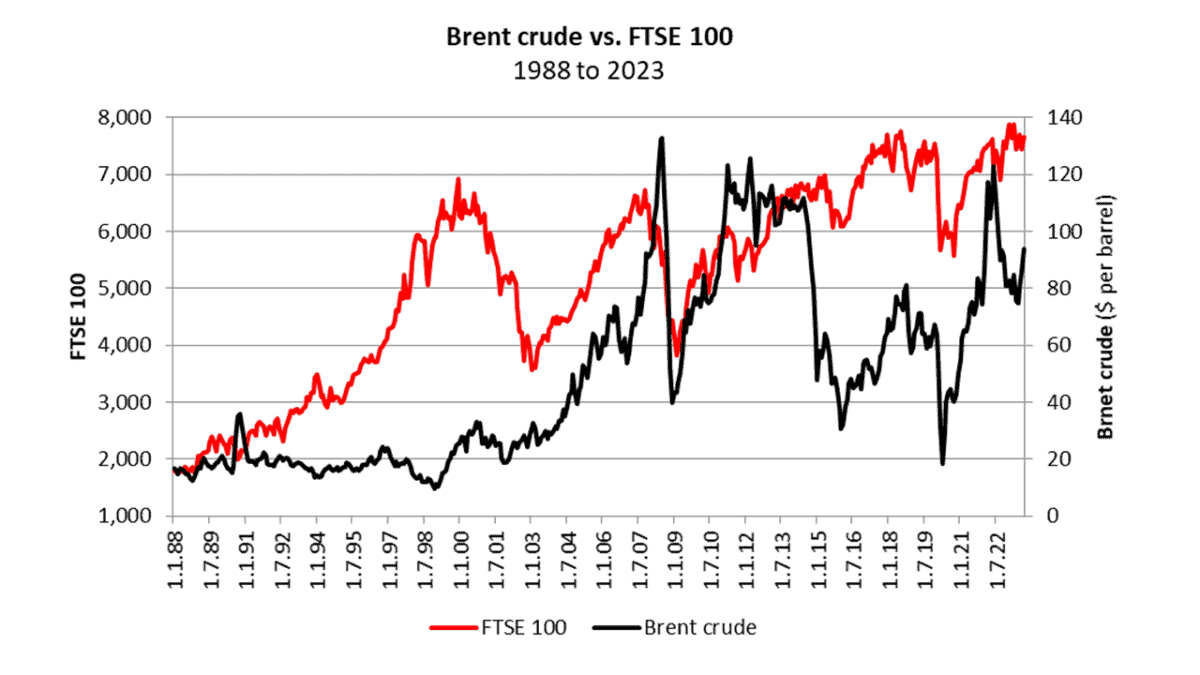

The chart below plots the month-end price of a barrel of oil, over the past 35 years, versus the FTSE 100. The data comes from the US Energy Information Administration.

To my surprise, there appears to be a reasonably strong correlation between the variables, particularly since 2003. When oil moves higher, so does the Footsie. And vice versa.

Caution

Of course, just because two factors appear to be closely related to one another, doesn’t necessarily mean that the movement in one causes changes in the other. As statisticians regularly remind us, correlation doesn’t imply causation.

For example, it’s been found there’s a 96% correlation (100% implies a perfect relationship) between the number of civil engineering degrees awarded by American universities, and the consumption of mozzarella cheese. Nobody believes these two factors are related in any way, but they do move in the same direction.

The data in my chart is 62% correlated. From 2018 to 2023, there’s a 75% match.

Possible explanations

Some of the movement can be explained by the presence of Shell and BP in the FTSE 100. But these two stocks only account for 13.1% of the total value of the index.

A more substantive explanation is that when the world economy grows, the profits of the UK’s largest listed companies will increase. That’s because approximately 70% of their revenues are earned overseas. At the same time, the price of oil will rise in line with demand.

Both variables are therefore probably reacting to changes in global economic conditions.

Whatever the reason, it appears that UK investors don’t have to fear rising oil prices.

Forecasts

World markets have always been manipulated by the actions of OPEC (The Organization of the Petroleum Exporting Countries) members.

But they need to be careful not to kill the goose that lays the golden egg. Keeping oil at elevated levels for an extended period, is likely to speed up the transition to renewable energy.

Saudi Arabia is currently producing 9m barrels a day, having reduced its output by 1m to keep prices high. But it would earn more producing 10m barrels at $85.

However, I’m not naive. High prices for an extended period will be damaging for UK shares. The rate of inflation could start to pick up once more, which will benefit very few.

But nobody’s expecting a return to the levels experienced after Russia invaded Ukraine in 2022.

Goldman Sachs is forecasting Brent crude to remain between $93 and $100 for the rest of the year. And $80-$105 in 2024.

If correct, I think BP and Shell will be the obvious winners. But the rest of the FTSE 100 won’t necessarily be losers.