The IAG (LSE:IAG) share price is up a respectable 15% this year due to roaring travel demand. With the Portuguese government putting its flag carrier, TAP, up for sale, I explore whether a potential acquisition could send IAG shares rallying higher.

Portugal TAPs out

IAG stock remains 66% below its pre-pandemic levels as the company claws its way back to its glory days. Revenue for the firm recently hit an all-time high. Even so, higher profits remain a challenge due to high fuel and labour costs. Subsequently, this has been weighing down IAG shares and preventing them from fulfilling their potential despite the relentless demand for travel. But with TAP now up for sale, this could be an opportunity for IAG to boost its share price.

For context, the Portuguese flag carrier earned €3.58bn in revenue in 2022. Meanwhile, load factors and passenger capacity have increased meaningfully since last year. As a result, TAP’s capacity, revenue per seat kilometre (RPK), and revenue per passenger trump its competitors as of Q2.

More encouragingly, the carrier’s operating profit turned positive, up from the €150m loss it incurred the year before. Therefore, this leaves room for more growth. This is especially the case if it can integrate its operations with IAG, as it would reduce costs due to integrated efficiencies. Thus, it’s no wonder IAG CEO Luis Gallego is eager to acquire TAP as he sees it being a key catalyst to boosting the share price.

Tapping into reserves

Having said that, the potential acquisition isn’t as straightforward for the Anglo-Iberian conglomerate. Doing so would require a substantial amount of funding. Although IAG’s cash reserves are substantial, it still has a mountain of debt to contend with considering its net debt position of €7.61bn.

Plus, given that TAP isn’t a public-listed company, ascertaining its enterprise value isn’t particularly straightforward. Nonetheless, the Financial Times estimates it could be worth approximately €1bn. But with Portuguese officials planning to keep a minority stake in the group, IAG may only need to fund half of its enterprise value.

Still, funding an acquisition via its cash reserves is a risky option with IAG’s debt position. As such, the more likely route the consortium might take is to issue more shares. Nevertheless, this could be a double-edged sword, as it could dilute IAG’s earnings per share (EPS) and cause the stock to decline. But considering IAG’s decent return on capital employed of 14.1%, shareholders may not mind seeing their positions getting diluted for bigger potential returns.

Can the IAG share price rise further?

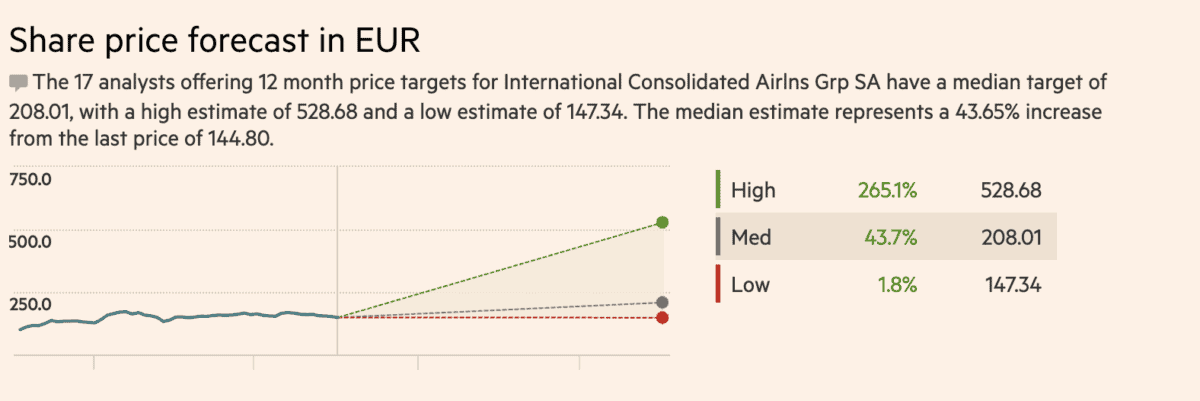

Regardless of the outcome, it’s still relatively safe to say that IAG shares have quite a clear path to continue rising in value. After all, Barclays, Bernstein, Deutsche, RBC, Goldman Sachs, Liberum, and Bank of America all expect the shares to hit 200p or higher in the next 12 months.

Moreover, taking bookings data for air travel into account while capacity continues to ramp up, I’m confident that IAG can continue performing; even more so if it can acquire TAP at the right price. There are risks, of course, including labour and fuel costs. But with a healthy fuel hedging strategy, and the potential to consolidate another airline at a good price, the IAG share price could rise to £2 in no time.