Airline stocks have been flying since recovering after travel restrictions were lifted. However, both Wizz Air (LSE:WIZZ) and easyJet (LSE:EZJ) have seen their shares stall after rapid climbs earlier this year. Here’s why and which stock could be the better buy, in my opinion.

The case for Wizz Air shares

Engine troubles have arguably been the main driver for the decline of Wizz shares. An ongoing issue with its Pratt & Whitney (P&W) engines has resulted in the airline having to ground several of its aircraft. Consequently, Wizz is expected to reduce up to 10% of its capacity. It’s no wonder investor sentiment has turned more sour for Wizz shares than easyJet’s in recent months, as the latter’s fleet doesn’t run on P&W engines.

Additionally, management’s decision not to hedge its fuel (a risk management strategy to protect against rising fuel costs) last year ultimately came back to bite the group. As such, the board recently opted to begin hedging its fuel again, although this has triggered numerous questions as to how effective the strategy will be. That’s because, unlike its peers, Wizz has hedged a lower portion of its fuel for the year, and at a higher spot price.

Should you invest £1,000 in Telecom Plus Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Telecom Plus Plc made the list?

| Airline | % of fuel hedged for fiscal year | Hedged price (per metric tonne) |

|---|---|---|

| Wizz Air | 62% | $897 |

| easyJet | 77% | $877 |

| IAG | 70% | $865 |

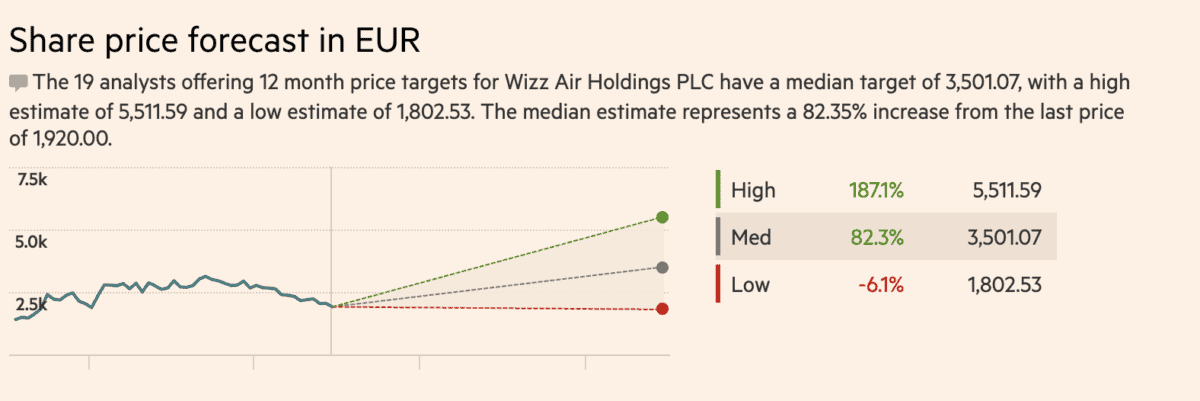

Having said that, Wizz has seen a strong tailwind in rampant travel demand — in July, it reached a new record-high number of passengers flown, with over 6m passengers travelling that month. Therefore, the case for buying Wizz Air shares over easyJet would be the fact that there’s more growth potential to realise. If the Hungarian firm can circumvent its current challenges successfully, its shares could rise by as much as 82%, according to analysts’ consensus, as indicated by the graph below.

The case for easyJet shares

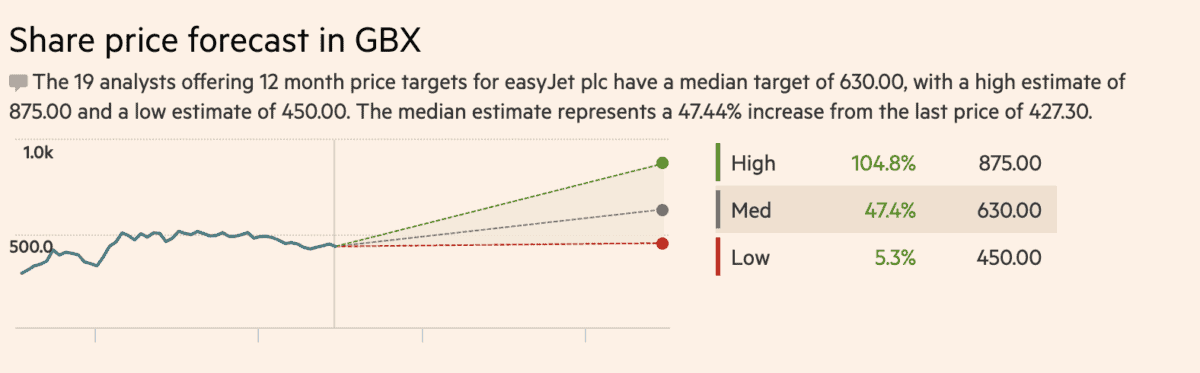

While the easyJet share price has been on a descent as well, analysts’ estimates for the orange-branded airline have gone in the opposite direction. This could present a buying opportunity as the projected earnings don’t support the current sour market sentiment. In fact, easyJet’s FY23 and FY24 earnings per share (EPS) estimates have grown 12% and 9%, respectively, over the past 90 days.

This shouldn’t come as a surprise, as third-party travel data continues to show that travel in and around Europe remains hot. And with discretionary spending also staying resilient for travel, easyJet will undoubtedly benefit from this.

More interestingly, the travel operator is also planning to expand its fast-growing Holidays business. With the holiday package business already expected to generate more than £100m in pre-tax profit this year, a Reuters report now indicates that the budget airline aims to expand its market to France and Germany. Entering such a massive market would only do the easyJet share price wonders, with more upward revisions surely to come.

Which is the better buy?

So which of these two airlines is the better stock to buy? Well, this depends on an investor’s risk tolerance. Wizz Air shares do offer a higher potential for higher returns. That said, there’s no guarantee if or when it can get through its current issues.

easyJet shares offer a lower share price growth potential. Nevertheless, I see it as a much safer bet with a much more robust balance sheet, all while boasting a promising line of earnings appreciation. For that reason, I reckon easyJet would be the better buy and would use this current period of weakness to increase my position.