Britain’s largest retailer is set to report its interim results this week. Tesco (LSE:TSCO) shares have been trading sideways since their Q1 update. So, here’s what investors can expect and whether I should rush to buy the stock before a potential rally.

Points to consider

When Tesco last reported its Q1 trading update in June, the board’s outlook for FY24 remained unchanged. That was for retail adjusted operating profit of £2.6bn, retail free cash flow of £1.4bn to £1.8bn, and Tesco Bank operating profit of £130m-£160m.

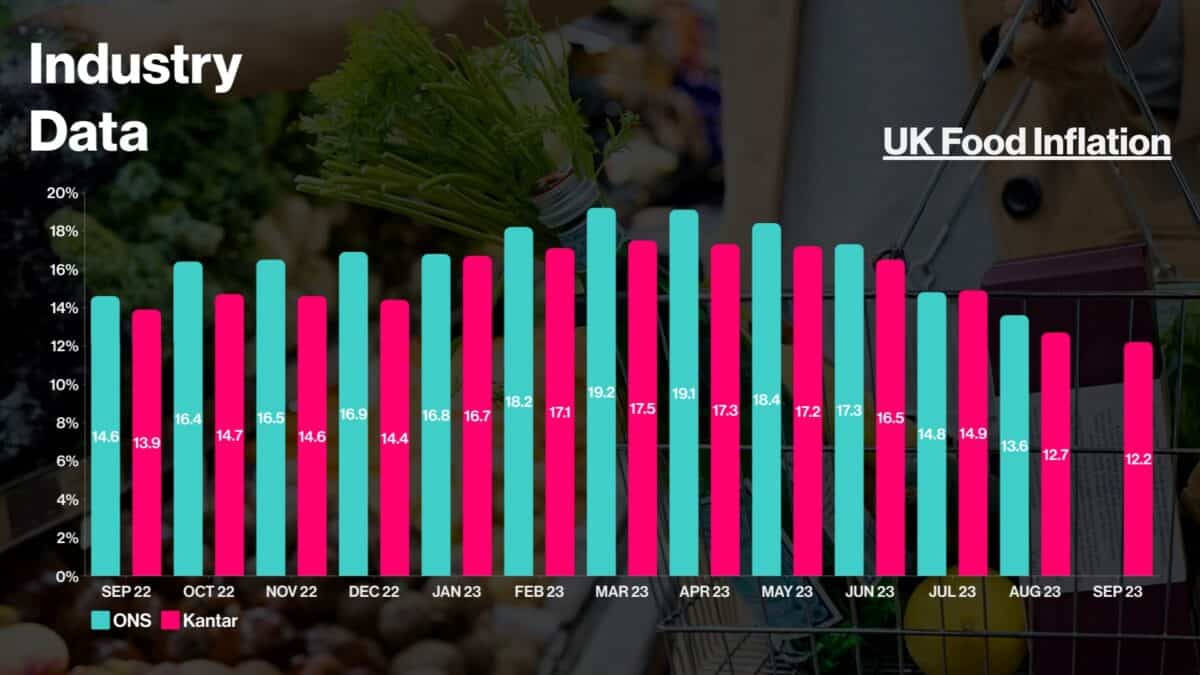

This doesn’t come as a surprise as the cost-of-living crisis and lower food inflation act as headwinds to the company’s earnings. Therefore, it’s no surprise to see Tesco shares failing below their May peak of 285p.

Should you invest £1,000 in Lloyds Banking Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Lloyds Banking Group made the list?

Nonetheless, quite a bit has changed since then, and encouraging trends have begun developing. Most prominently, food inflation has come down rather meaningfully. Although this limits Tesco’s revenue growth, this serves to be a net benefit because of a more critical development — real wage growth among its customers. I believe this will be Tesco’s main catalyst in driving its shares up moving forward.

What to expect

With wages now trending above inflation, there’s naturally been an uptick in disposable income. This should result in three favourable outcomes for the firm.

First of all, fewer shoppers may feel the need to trade down to cheaper supermarkets and lower-margin products. Second, more customers may begin purchasing higher-margin discretionary items once again, thereby growing Tesco’s margins. In fact, CEO Ken Murphy shared on the earnings call that he expects gentle trading up in discretionary products as cost pressures decrease and wages increase.

This thesis isn’t unfounded either. Kantar’s latest grocery reports have seen Tesco outperform its traditional competitors in sales growth. The grocer grew its sales in August and September, by 9.5% and 9.1%, respectively. Meanwhile, budget retailers Aldi and Lidl saw their sales growth slowing (albeit still beating Tesco), dropping to 16.6% in September from 20.5% in August.

I have an optimistic view of the group’s interim earnings and wouldn’t be surprised if Murphy upgrades its outlook for the year. That said, management might opt to maintain guidance to fend off potential ‘profiteering’ claims. Either way, I expect Tesco shares to rise on the back of a robust set of H1 numbers, with an improvement in gross margin due to falling wholesale commodity prices. Those numbers include:

- UK sales (ex. VAT, ex. fuel) to grow 13% to £22.68bn from £19.99bn

- Gross margin to improve 170bps to 7.0% from 5.3%

- Operating profit to drop 2% to £1.29bn from £1.32bn

Should I buy?

Tesco shares may seem overvalued with their price-to-earnings (P/E) multiple of 24.7. However, this is due to impairments relating to property disposals. On an adjusted basis, the stock actually trades at a more reasonable P/E of 12.1.

Given the promising developments and a strong share buyback programme, it’s no wonder analysts at large rate Tesco stock a Buy. I happen to echo the same sentiment as I expect the retail giant to achieve EPS of 23.10p for FY24, giving the stock a forward P/E of 11.4 with a price target of 300p. Of course, I could be wrong, but I’m confident that Tesco shares will generate meaningful returns over the long term. Thus, I’d buy the shares today if I had spare cash.