With Q3 earnings fast approaching, the investment cases for many companies could be set to change. As such, here are four standout FTSE 100 stocks I’d buy this month for long-term gains.

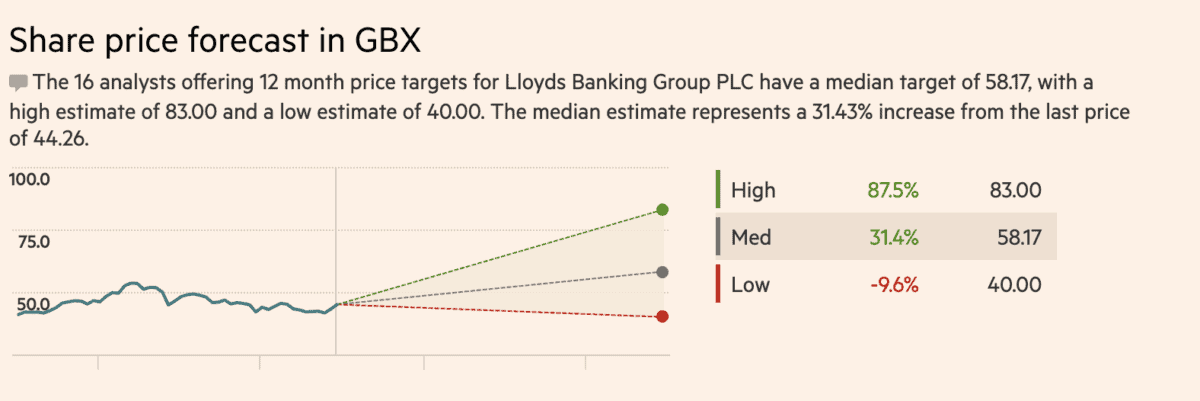

1. Lloyds

There seems to be light at the end of the tunnel for bruised and battered Lloyds (LSE:LLOY) shares. The stock rose by 8% in September, outperforming the FTSE 100. This came after positive inflation data gave investors hope the rate-hiking cycle may soon come to a halt.

This would be good news for the Black Horse bank. Fewer customers defaulting on loans or withdrawing deposits, would allow Lloyds to get back to growing its loan book and earnings.

Should you invest £1,000 in Thg right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Thg made the list?

Nonetheless, the road ahead is still bumpy. A recession could see its current rebound fall short. Still, Lloyds’ outlook is brightening. With the shares undervalued, now could be a prime time to buy into this banking giant.

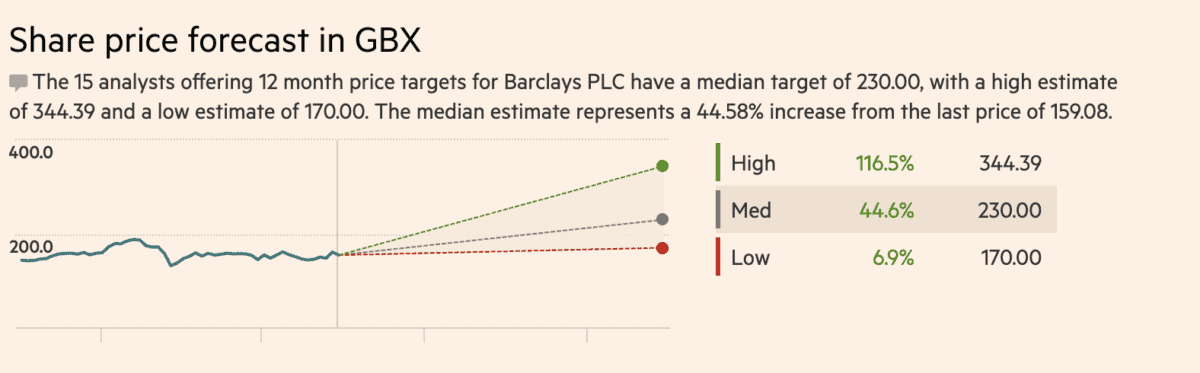

2. Barclays

I’m aiming to buy more shares of Barclays (LSE:BARC), one of the FTSE 100’s cheapest banks. After an upgrade by Morgan Stanley, the stock is also showing glimmers of recovery. Like Lloyds, its shares also rose by 8% in September, and more gains could come as analysts warm up to Barclays’ underappreciated credit card business, strong consumer approach, and profitable deals.

Encouragingly, investment banking activity has also perked up this summer. This should bode well for earnings. With IPOs also reviving after slumping over the past year, green shoots are sprouting for Barclays’ investment banking arm.

Despite that, it’s worth highlighting that further rate hikes could see the stock pull back. But with the shares undervalued, now could be an opportune time to buy into what potentially could be the FTSE 100’s biggest winner over the next 12 months.

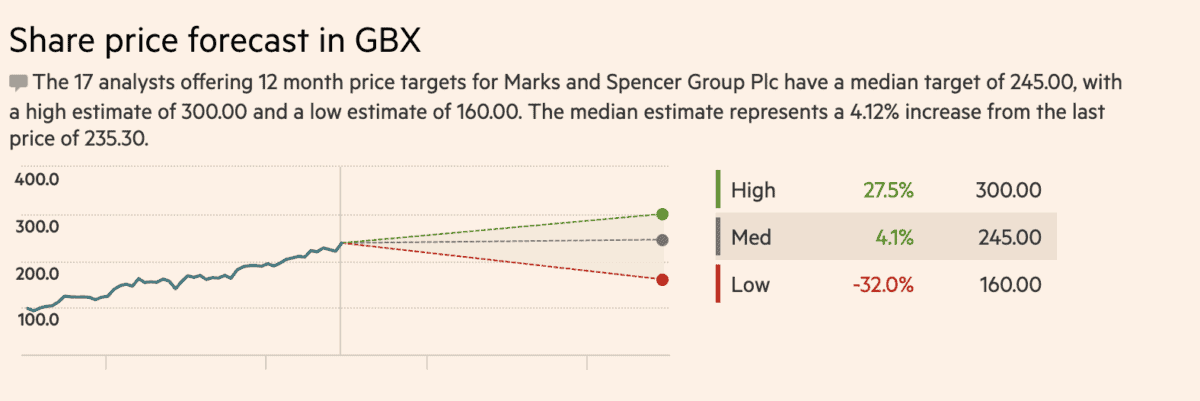

3. Marks and Spencer

Marks and Spencer (LSE:MKS) is another top stock to consider buying after the company got promoted to the FTSE 100 in September.

The retailer’s strong performance can be attributed to the dynamic duo of CEOs Stuart Machin and Katie Bickerstaffe for spearheading an incredible turnaround. The team has transformed M&S from a fading chain to an exciting retailer brimming with potential.

Machin also aims to grow M&S’ food market share by 1% yearly, possibly overtaking Waitrose as soon as 2024. Although the shares are approaching fair value, revamped stores and supply chain improvements suggest that the comeback story still has room to run.

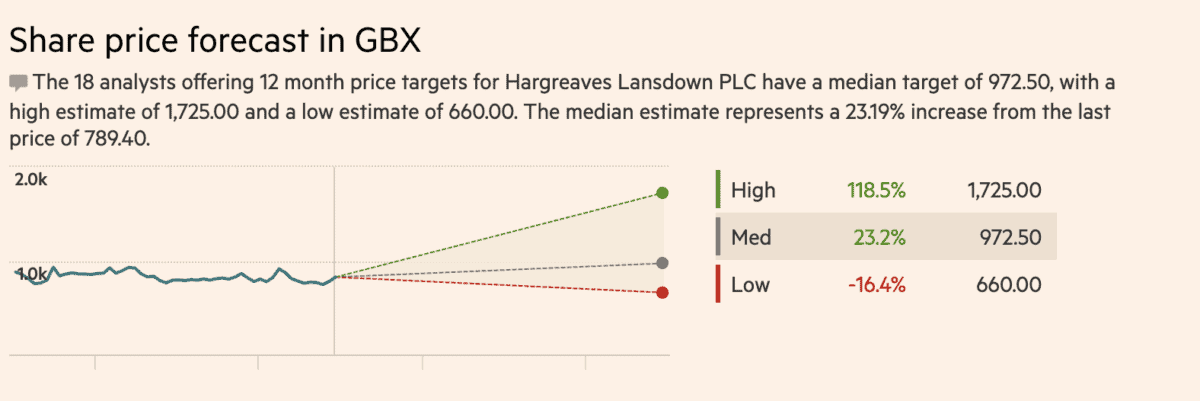

4. Hargreaves Lansdown

Hargreaves Lansdown (LSE:HL) shares have been stuck at their year lows. But for dividend lovers, this could be a perfect buy-in point for one of the FTSE 100’s most reliable dividend payers. Even though it aced its latest earnings, the platform continues to get the cold shoulder despite its 5%+ dividend yield and reasonable valuation.

Bears are right to be worried about net interest income declining as rates decline in the medium term. However, the firm states that it can keep up its high level of interest income as long as rates stay above 2%. Combined with a commanding market share (41.8%), Hargreaves is positioned to ride a wave of investing enthusiasm once the stock market rebounds. If rates peak soon, the FTSE 100 could rally and bring Hargreaves Lansdown shares up with it.