A year ago, the Rolls-Royce (LSE:RR) share price was around 65p. Today, shares in the engineering giant trade for around 220p. It’s among the strongest turnaround I’ve ever come across.

The stock is also benefiting from a rare ingredient in the UK right now, and that’s positive momentum. Rolls-Royce just keeps on delivering. So, will the share price hit £3? And if so, when?

Valuation

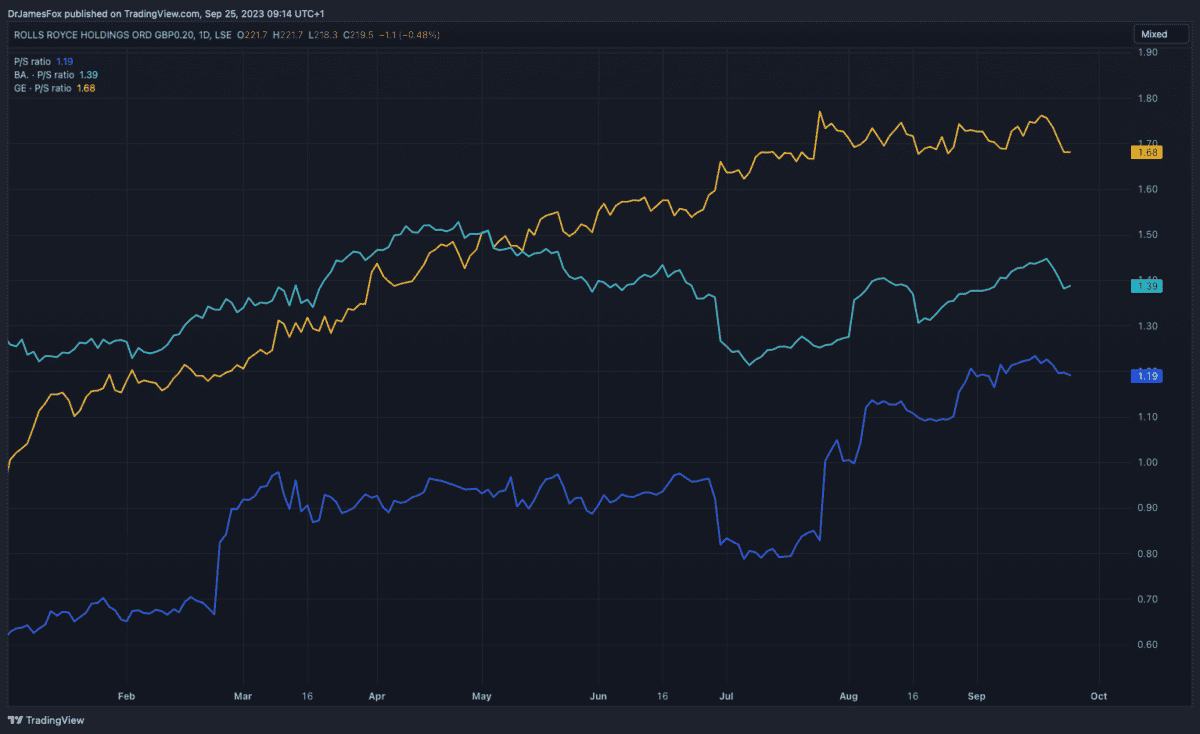

On a valuation basis, Rolls-Royce continues to look attractive in some areas. Using the price-to-sales ratio, we can see that the firm is trading at 1.19 times, which is slightly below the 1.33 times average for the industrials sector.

The below chart demonstrates how Rolls, despite its surging share price, appears cheaper than defence peer BAE and aerospace peer General Electric using the price-to-sales ratio.

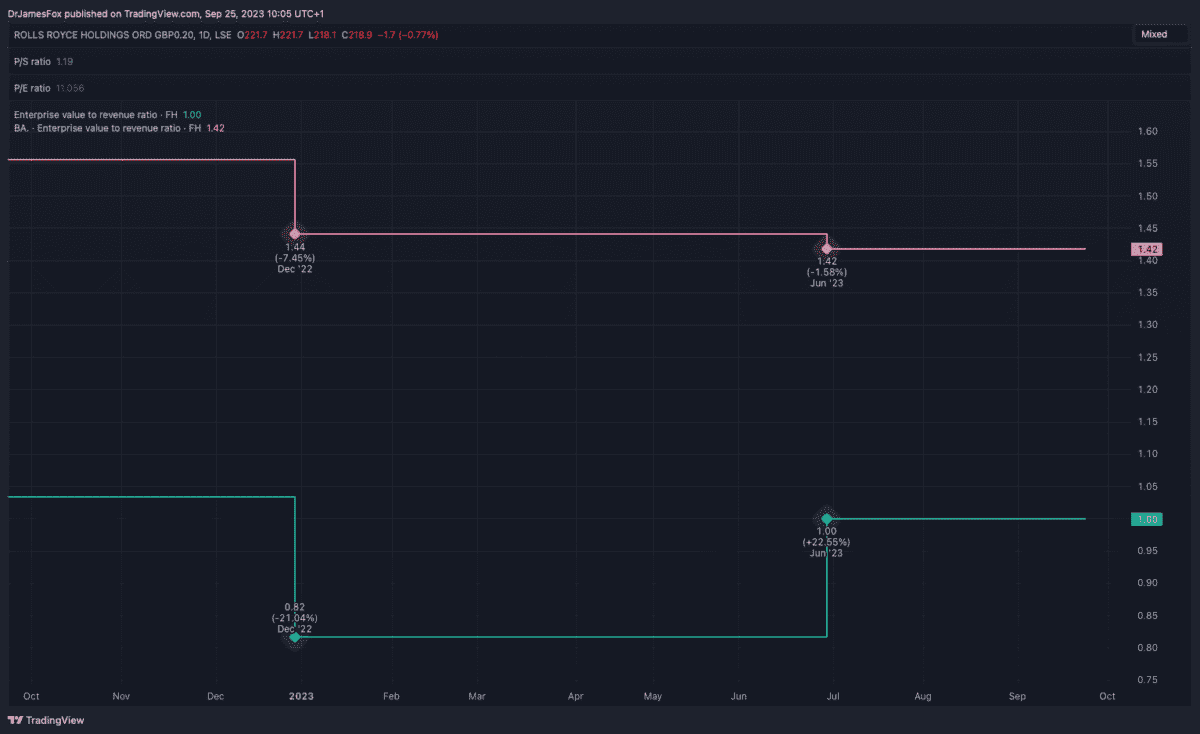

A similar trend emerges when we look at other revenue-related metrics, however it’s not so clear when we look at earnings-based metrics. As Rolls is still, to some extent, in recovery mode following the pandemic, we’re yet to see earnings normalise.

For example, the $19.6bn in revenue over the past 12 months remains below the $21.9bn earned in 2019 and $24bn in 2013. With regards to profit, we’re yet to get a clear idea of where the company sits.

Looking at the near-term valuation picture, there’s some limited room for growth. However, investors may soon become hesitant as the share price already appears to reflect 2019 levels of operating profit.

Long-term prospects

While Rolls may be trading near fair value when we look at these near-term valuations, there’s a very good case that broader industry trends, especially in civil aviation, will lead the stock higher over the long run.

In civil aviation, which is Rolls-Royce’s largest sector, there are promising signs of a significant upswing in air travel demand. This surge is influenced by factors such as population growth and the expanding middle class worldwide.

Airbus projects a need for approximately 40,850 additional aircraft by 2042, with a substantial 80% of them being single-aisle planes.

Rolls-Royce is strategically positioned to play a key role in meeting the propulsion and engine requirements of this growing global aircraft fleet.

Nonetheless, to fully seize this opportunity, it should consider shifting its focus towards single-aisle jets. Historically, Rolls’s engines have predominantly powered wide-body aircraft.

Moreover, in defence, Russia’s war in Ukraine and China’s increasing assertiveness, has sparked a raft of Western defence spending hikes. While this should generate a long-term tailwind, Rolls said the war in Ukraine wouldn’t have a tangible impact.

Is £3 on the cards?

Given the moment we’ve seen, I wouldn’t be surprised to see Rolls-Royce shares extend as high as £3 over the next six months. However, this would have to reflect a realisation of the firm’s long-term prospects, or a further outperformance in the near term. And I’d be unsurprised if it didn’t reach that price.

Personally, I believe there’s better value to be found elsewhere on the FTSE 100 and I’ve redirected my attention accordingly. With near-term valuations in mind, investors may pull back from the stock. Instead, I’m looking more closely at banks, which I expect to experience a huge tailwind in the coming years.