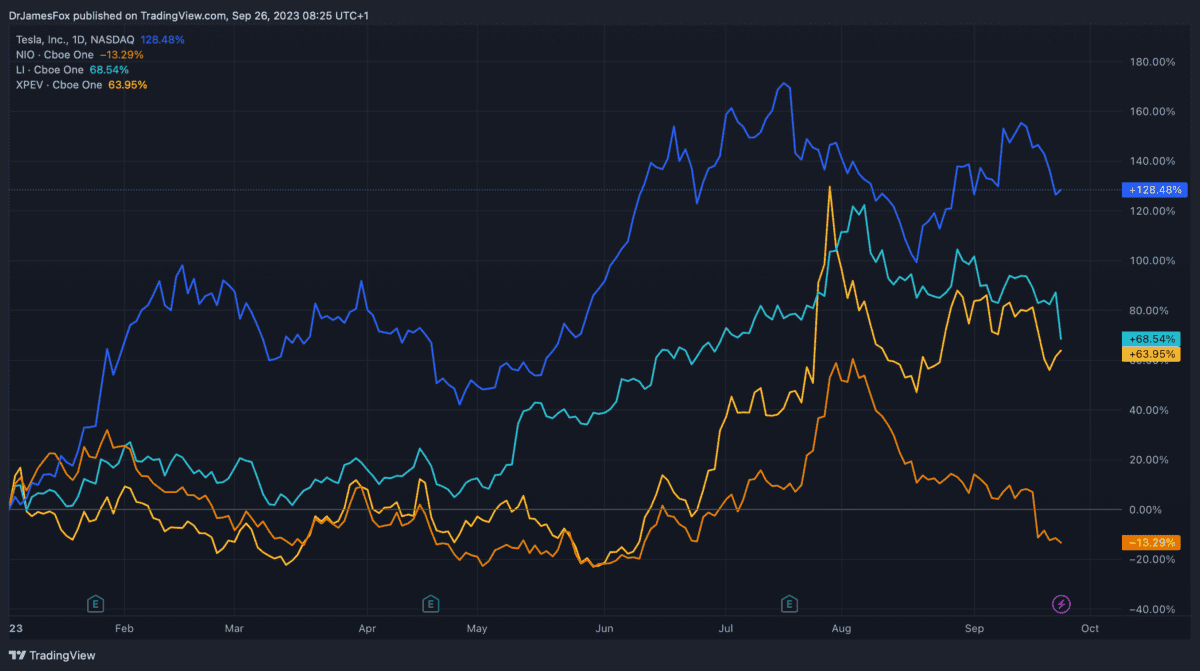

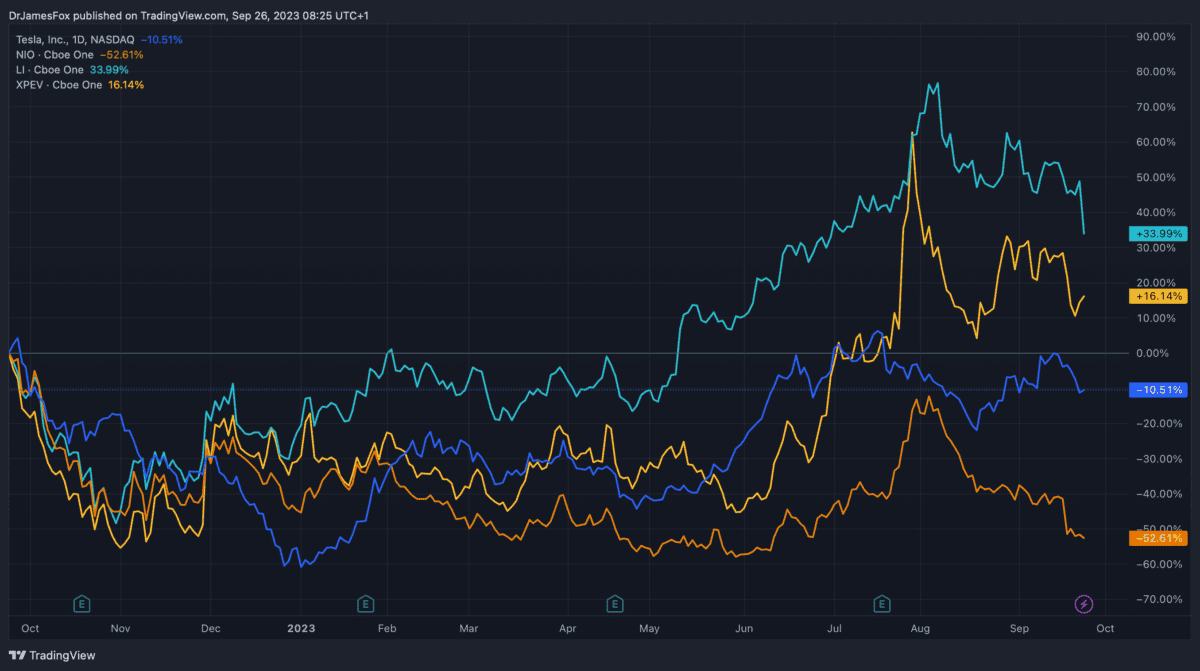

The Tesla (NASDAQ:TSLA) share price has demonstrated a significant amount of volatility over the past two years. Over one year, it’s down 10%. But year to date it’s up 128%. My feeling is that the stock is currently towards the peak of its cycle.

As such, if I want exposure to the electric vehicle (EV) sector, I may be better off exploring Tesla’s peers rather than investing in its own inflated stock. Today, I’m looking at Chinese peers Li Auto, NIO, and Xpeng. Here’s how they compare.

Price return

NIO — which surged during the pandemic — is the standout worst performer when we look at price returns. The EV company, despite a summer rally, is down 52% over 12 months and 13% year to date.

NIO is also the closest stock to its 52-week low, which was $7. More recent losses related to rumours of a capital raise that the company has denied.

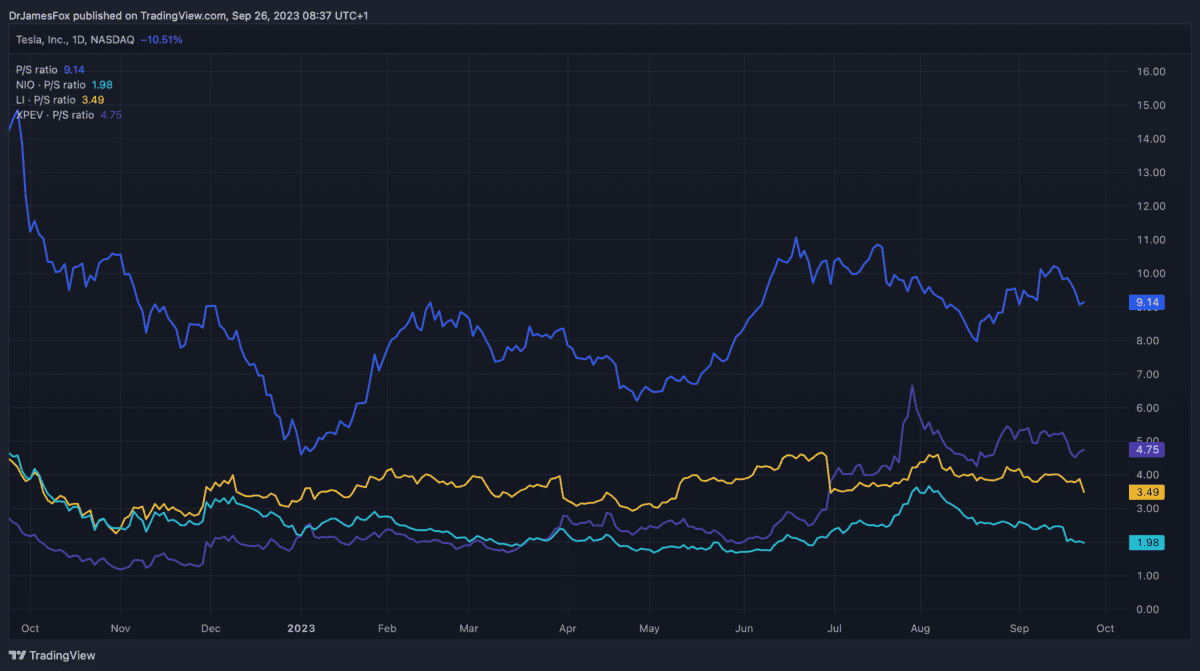

Valuation

We’ve known for a while that Tesla trades at a premium to its peers. Other US peers, including Rivian, aren’t cheap either. Broadly speaking, US stocks tend to trade at a premium versus the international average. Meanwhile, Chinese companies, even those listed in the US, tend to trade at a discount, partially due to the economic and geopolitical risks.

It’s hard to make a price-to-earnings comparison as only Tesla and Li are profitable. However, it’s interesting to note that Li’s forward P/E (38 times), is substantially less than Tesla (71 times).

Growth, margins, ownership

Li’s premium to NIO is perhaps deserved when we look closely at growth figures. The manufacturer has surged this year, despite only have three models on sale.

| Tesla | Li Auto | NIO | Xpeng | |

| Revenue growth YoY | 40% | 102% | 21% | -27% |

| Forward revenue growth | 33% | 79% | 32% | 31% |

Another reason Li looks particularly attractive is its relatively high margins. The sector has seen some margin compression over the last year after Tesla decided to lower its prices to protect market share. NIO’s margins have also fallen because it’s been selling on models using legacy platforms.

| Tesla | Li Auto | NIO | Xpeng | |

| Gross profit margin | 21% | 20% | 5% | 6% |

There are also several other things worthy of consideration, including the size of the float and short interests. Short interest provides valuable insights into market sentiment, potential price movements, and risk levels associated with a stock.

| Tesla | Li Auto | NIO | Xpeng | |

| Float | 85% | 52% | 76% | 58% |

| Insider | 14% | 31% | 9% | 26.5% |

| Institutional | 43% | 23% | 30% | 28% |

| Short interest | 3% | 6% | 7.4% | 9.5% |

Attractive entry point?

I follow the NIO share price quite closely and should rumours about a capital raise be untrue, I see the current share price as an attractive entry point. I’m also very impressed by Li Auto’s growth over the past 12 months.

However, I’m also acutely aware of the economic and geopolitical risks facing Chinese companies — although I see this as less of an issue in hard tech sectors like this.

Of course, I should note that I can gain exposure to the EV sector through a host of other stocks. There are traditional manufacturers in addition to newcomers like VinFast — which still looks hugely overpriced.