Over 12 months, the BAE (LSE:BA.) share price is up 24%. Over five years, the stock is up 60%, an impressive outperformance of the FTSE 100 that’s up just 1.1% over the same period.

If we were to assume this rate of growth is sustainable, the defence giant would see its share price swell to £15 within a few years. So, is this possible?

The catalyst

While Russia’s war in Ukraine was a major catalyst for the share price. It had both direct and indirect effects on it.

BAE isn’t receiving major arms orders from Ukraine, but the need to resupply munitions and weapons from Western allies has indirectly impacted the company.

Furthermore, the global repercussions of Russia’s actions, coupled with China’s attitude, have prompted countries worldwide to ramp up their defence expenditures.

In fact, even in the event of an immediate cessation of hostilities, BAE would continue to see a tailwind as a result of the conflict.

That’s because governments across the globe already have committed to expanding their defence budgets and programmes, ensuring an enduring boost for the company.

This outlook underscores the sustained potential for growth in BAE Systems’ operations.

Valuation

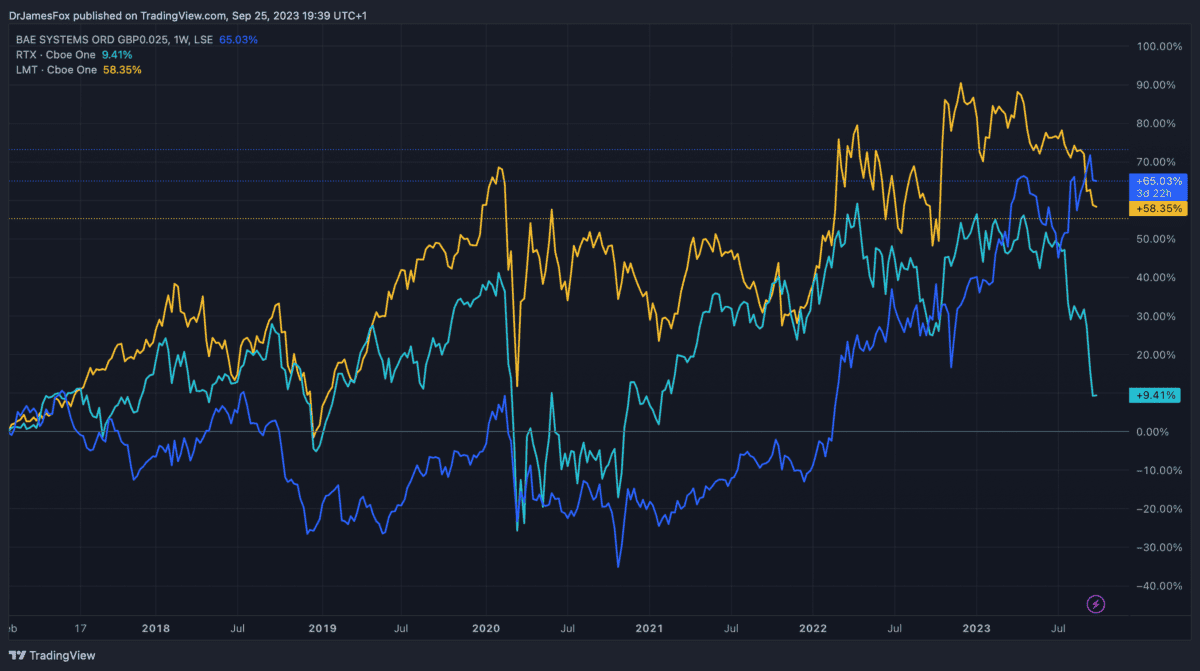

It’s interesting to note how BAE has outperformed its peers including RTX Corporation and Lockheed over the past five years.

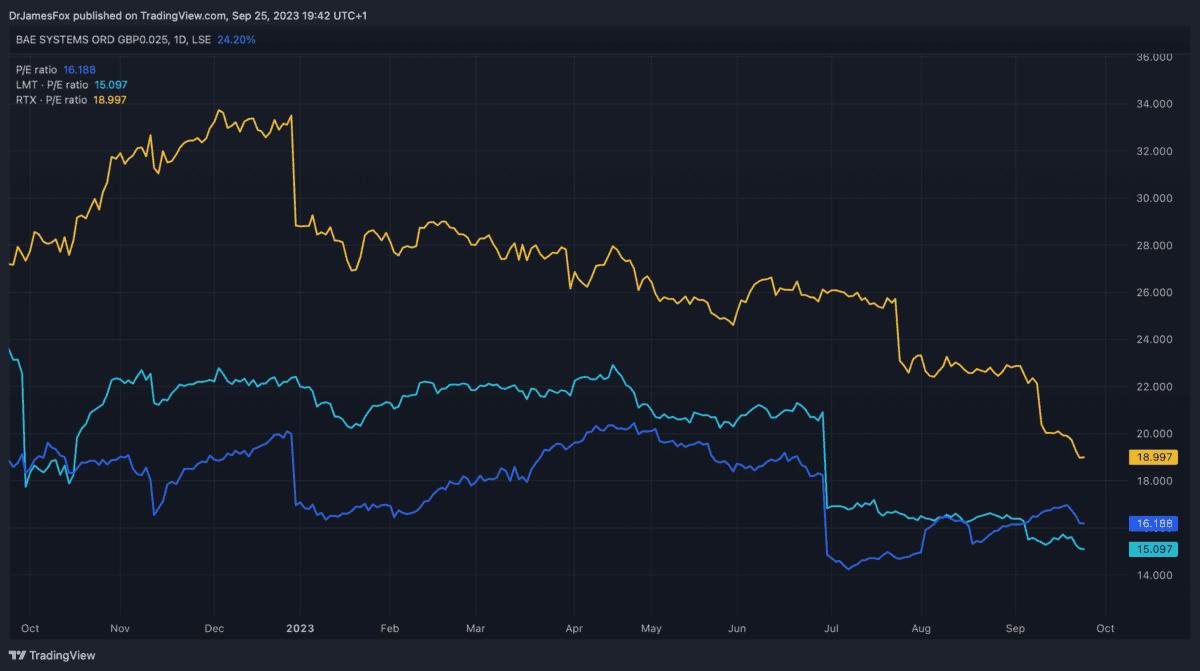

We can see that over the past year that valuations have converged and diverged as the BAE share price has surged. In fact, using the price-to-earnings ratio, BAE Systems is now more expensive than Lockheed Martin.

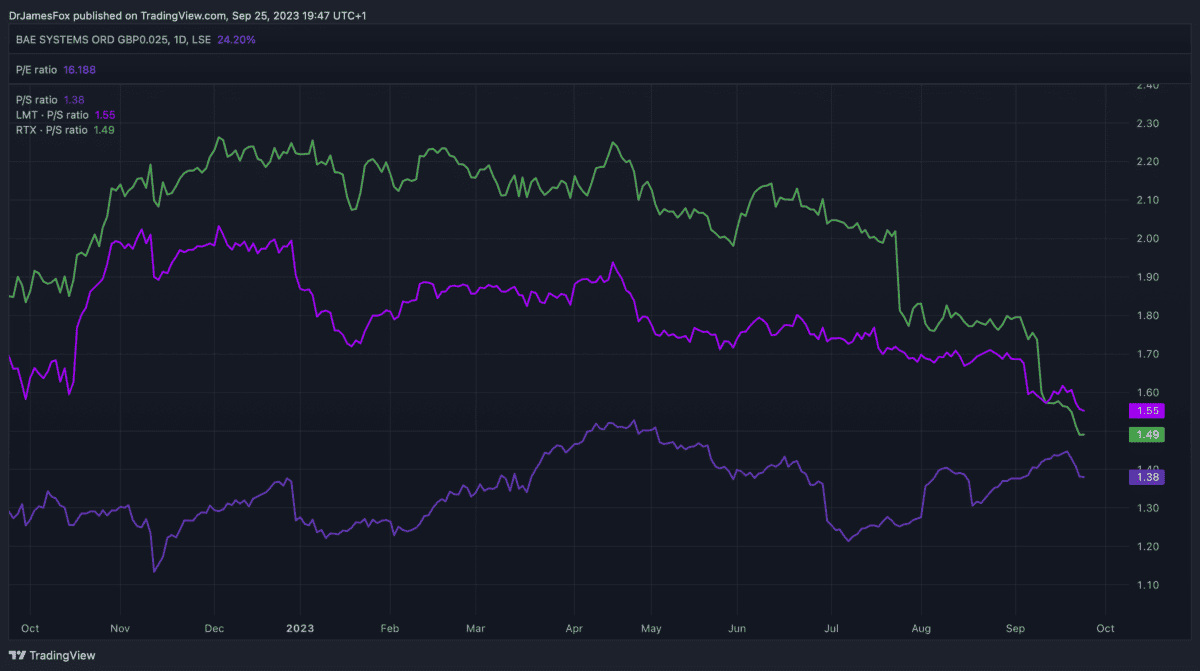

However, when we look at the price-to-sales ratio, BAE appears cheaper than its two US peers. Given the above, the data suggests that BAE has lower margins than Lockheed.

As UK stocks rarely trade at parity with their US counterparts, it could be argued that BAE is already trading at fair value.

Tailwinds

While BAE Systems may not seem undervalued compared to its US counterparts, its exposure to the conflict in Ukraine may set it apart.

The company’s prominence in Europe, coupled with Ukraine’s demand for various weapons and equipment supplied by this UK-based defence contractor, makes BAE uniquely positioned.

It’s also worth remembering that the UK is Ukraine’s second largest military donor.

However, BAE Systems also stands to benefit from other geopolitical trends. Its involvement in the AUKUS programme, particularly in the construction and maintenance of new submarines, holds promise should the US Congress give its blessing.

While an expansion of the AUKUS programme could represent another tailwind, it would only be around ‘Pillar 2’. This concerns the development of defence technologies like EW and hypersonic weapons — BAE also has an offering here.

So, could the share price reach £15? While it’s a possibility, certain geopolitical developments must align for this to occur, so it may not happen. For now, it could be trading near fair value.