Given Warren Buffett‘s success, investors can do a lot worse than following his lead. The 93-year-old has carved out a fortune worth £123bn, making him one of the wealthiest individuals in the world.

So, how did Buffett do it? Let’s explore his method for building wealth.

Don’t lose money

It sounds obvious and easier said than done, but not losing money is key. However, this reflects Buffett’s approach to investing, which emphasises investing in undervalued shares with significant margins of safety.

Should you invest £1,000 in St. James's Place Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if St. James's Place Plc made the list?

To understand this properly, we have to remind ourselves that investing in stocks is actually about owning shares of companies. And when Buffett invests in companies, he wants to know that he’s getting a discount.

So, how do we know if we’re getting a discount?

Well, to find the answer we’ve got to do our research. There are numerous models and metrics we can use, such as the price-to-earnings (P/E) ratio, the price-to-book (P/B) ratio, and the discounted cash flow model.

For example, I’d suggest that if Buffett invested more readily in UK stocks, he’d like Barclays. That’s because the blue-chip stock trades at just 5.2 times earnings, and 0.45 times P/B.

The P/B is particularly interesting as it suggests that Barclays is at a 55% discount versus its tangible net asset value. In this respect, Barclays is phenomenally cheap compared to its peers. Most US banks trade with a P/B ratio around one, so their valuation is in line with asset value.

Generating wealth

Buffett has a long investment horizon. He holds stocks for decades and he also continually reinvests. This has allowed him to benefit from a concept known as compound returns.

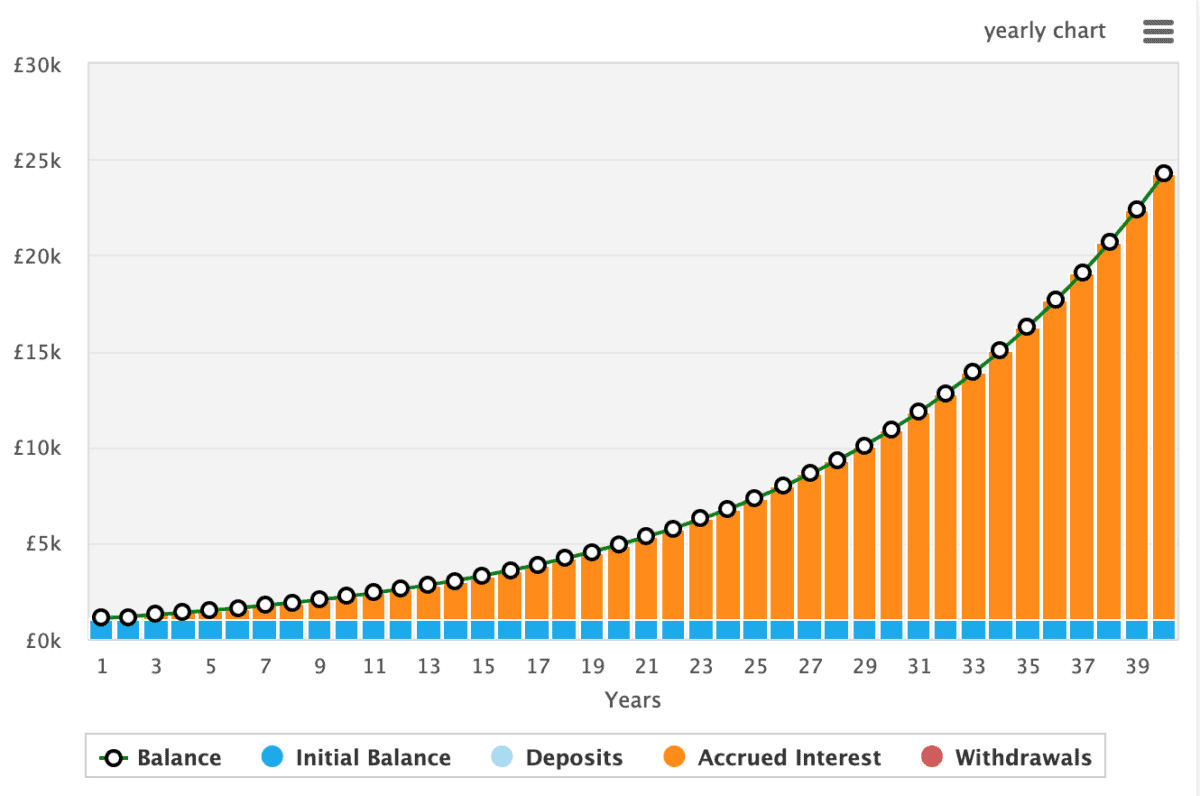

Compound returns happens when we reinvest our returns year after year. In turn, this allows us to earn interest on our returns in addition to our original investment. It literally compounds year over year. This strategy also leads to an exponential growth rate as highlighted below.

Regular and disciplined savings play a fundamental role in building wealth in stocks over the long run. Consistency in contributing to my investment portfolio, even with modest amounts, has the power of compounding on its side.

Moreover, when I consistently invest a fixed amount at regular intervals, I’m essentially buying shares at various price points, benefiting from both market highs and lows. This strategy, known as pound-cost averaging, minimises the impact of market volatility and reduces the risk associated with trying to time the market.

But risk can’t be ignored. I need to recognise that if I invest poorly, I could lose money.

What if we have no starting capital?

These days we can kickstart an account just by committing to invest a proportion of our monthly earnings. With £100 a month, I could slowly but surely build wealth, and by following Warren Buffett’s investment lessons, hopefully get rich.

Of course, being ‘rich’ is a subjective concept, but when starting with nothing, even developing a portfolio worth in excess of £10,000 could feel like a win!