The HSBC (LSE:HSBA) share price is up 90% over three years. In fact, it’s one of the strongest performers on the FTSE 100. However, it’s recently given back some of its gains amid concerns about the Chinese and global economy.

So, is there life left in the HSBC bull run?

Interest rates still a tailwind, just!

The company has experienced significant growth due to rising interest rates. In the first six months of the year, profit before tax (PBT) reached an impressive $21.7bn, marking a substantial increase of $12.9bn from the year before.

However, this performance was exceptional, not just because of interest rates. HSBC attributed the growth in part to a $2.1bn reversal of an impairment related to the planned sale of its retail banking operations in France and a provisional gain of $1.5bn from the acquisition of Silicon Valley Bank UK.

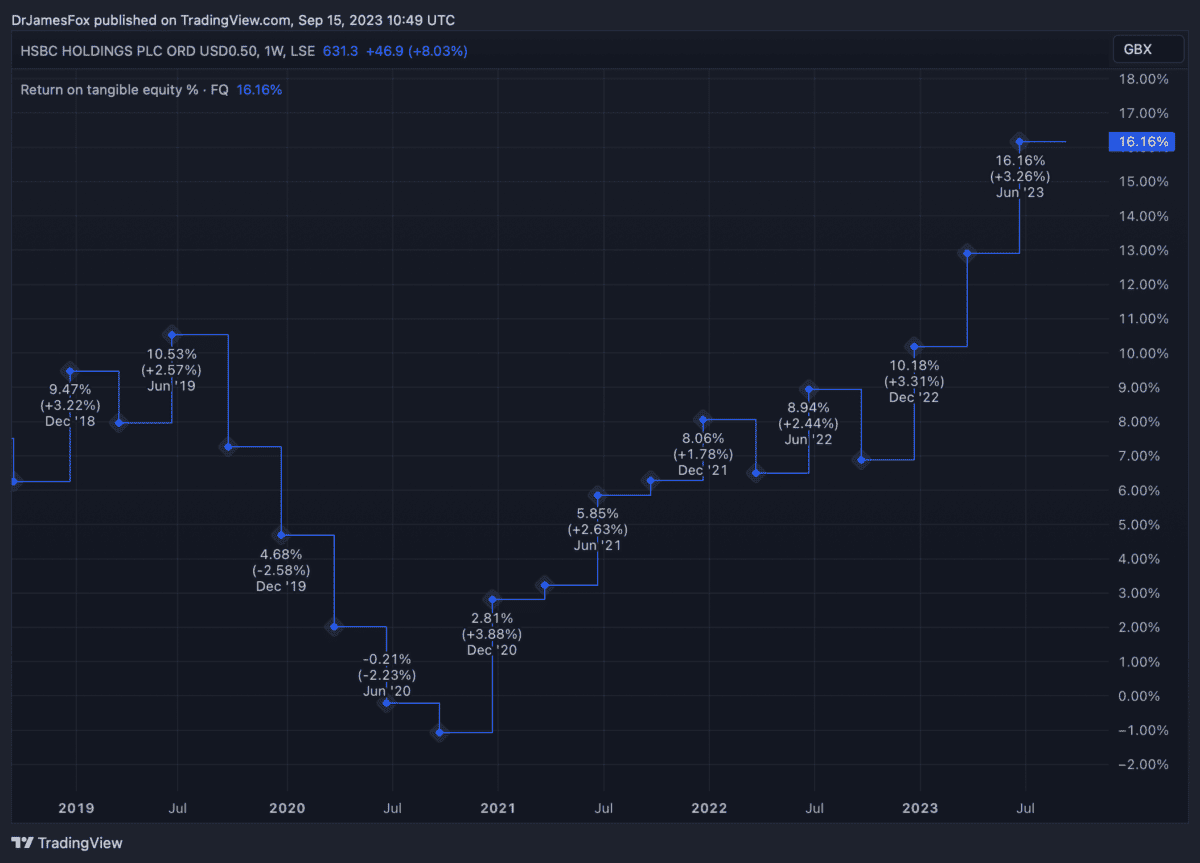

Nonetheless, higher interest rates have led to an improved return on tangible equity (RoTE). It now anticipates RoTE in the mid teens for 2023 and 2024. The below chart highlights how strong the current RoTE performance is versus the past five years.

A major reason for this is the expanding net interest margins (NIMs). In fact, in H1 HSBC surprised positively, noting more NIM growth despite the Chinese government lowering its Loan Prime Rate during the period.

Out of the Goldilocks zone

In developed economies, lenders perform best when central bank interest rates fall into a ‘Goldilocks zone’. That’s when interest rates are somewhere between 2% and 3%.

However, interest rates have extended far beyond this point now in the UK. And that brings with it a host of fears relating to credit defaults.

While the tailwind from net interest income remains greater than credit losses, in H1 the FTSE 100 lender reported larger-than-expected impairment charges totalling $1.3bn.

The issue is that monetary tightening works on a lag. So, we’re yet to see the full impact of rate rises on households in the UK, Europe and the US.

While it could get messy, with inflation falling, it looks like the worst-case scenario has been avoided.

China issues?

There’s indeed a valid cause for concern regarding the Chinese economy. In 2022, the bank derived a significant portion of its pre-tax profits (approximately one-third) from China and Hong Kong. Unfortunately, the reopening of these regions has shown less dynamism than expected.

However, it’s important to acknowledge that the firm has a relatively low level of exposure to the struggling Chinese real estate sector. This exposure represents less than 2% of its total loans, which does provide a degree of insulation from the challenges facing this particular sector.

Valuation

Recent downward pressure, perhaps reflecting negative investor sentiment in the UK and risks in China, have enhanced the attractiveness of the firm’s valuation.

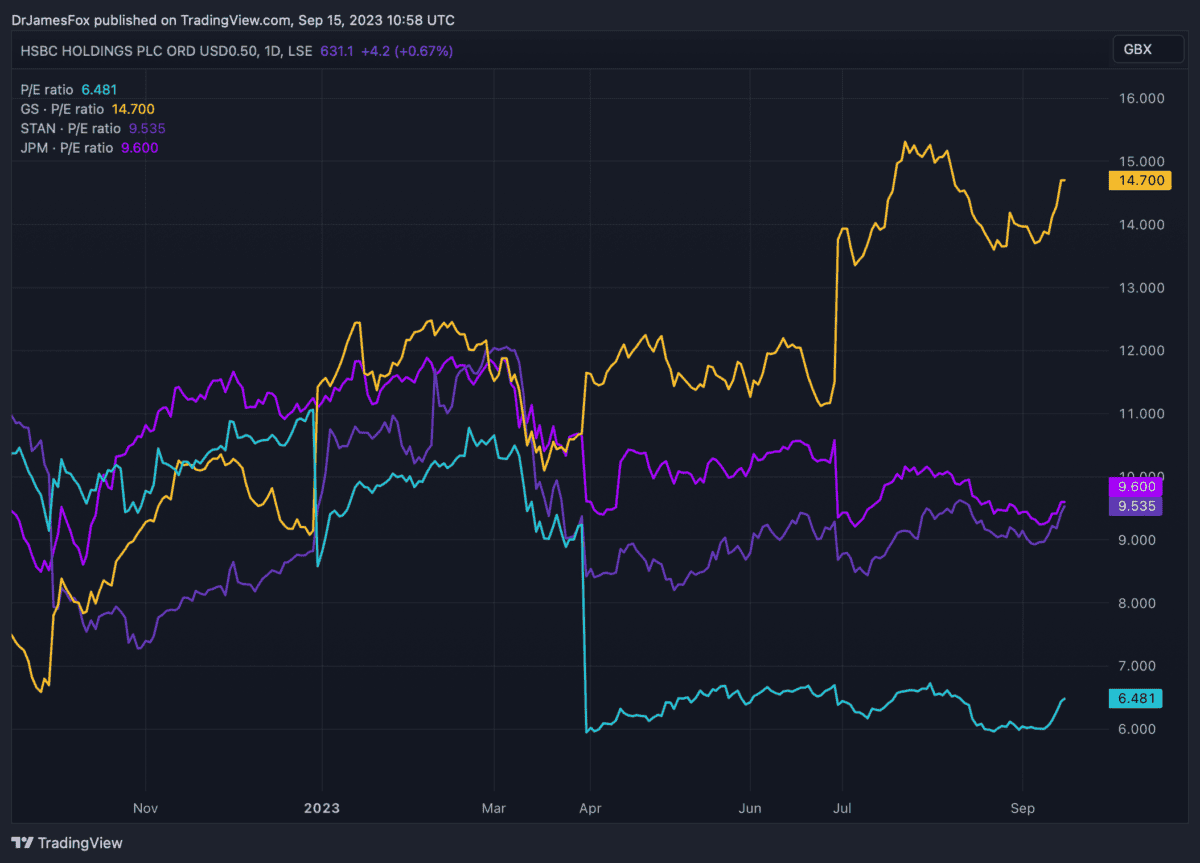

HSBC currently trades at 6.5 times earnings on a trailing 12-month basis. This puts it at a significant discount to the global industry average of 9.6 times.

So, even when considering the exceptional nature of the H1 results, this all suggests the bull run has further to run. However, it’s worth noting that HSBC is more expensive than UK peers, including Barclays and Lloyds.