Creating passive income by investing in stocks is simple. It may not seem that way when starting with nothing, but it’s entirely possible to turn an empty portfolio into one that generates substantial sums of passive income.

Starting with nothing

To begin, I need to open an account. This can be done through numerous brokers like Hargreaves Lansdown, and we’ll want to use a Stocks & Shares ISA if we haven’t already.

Next, if I’m starting without existing capital, I need to recognise that I’ll need to make regular contributions to my account. In an ideal world, I’ll be saving monthly.

Should you invest £1,000 in British American Tobacco right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if British American Tobacco made the list?

Then I should adopt an investment strategy aligned with income goals and risk tolerance. This may encompass diversifying my portfolio by investing in stocks, bonds, or funds.

Discipline

Now I’m not going to turn an empty portfolio into a huge pot overnight. I need to recognise that it’s going to take time.

If I’m comfortable saving £200 a month, it will take a number of years and constant reinvestment for my portfolio to grow accordingly.

As such, navigating this path necessitates a disciplined mindset coupled with consistent and periodic savings practices.

Compounding

Compounding isn’t the sexiest topic in investing, but it’s how portfolios grow over the long run. It’s also how investors like Warren Buffett became so rich.

“My wealth has come from a combination of living in America, some lucky genes, and compound interest,” Buffett famously once said.

Compound returns come into play when I reinvest my earnings annually. This enables me to earn interest not only on my initial contributions but also on the interest I’ve already earned.

In turn, this creates exponential growth, much like a snowball gathering more snow and expanding as it rolls downhill.

As a result, the longer I invest, the quicker my investment grows. With its increasing size, I can expect to receive more interest in the form of dividends.

Using the ISA

One of the primary advantages of a Stocks & Shares ISA is that any capital gains or dividends I earn from investments within the ISA are tax-free.

This means if my investments appreciate in value, I won’t have to pay capital gains tax when I sell them, regardless of the amount of profit I make.

Likewise, as I’m investing passive income in the long run, I won’t have to declare my dividend income.

But even seasoned investors get it wrong. And I must be aware that I could lose money if I make poor investment decisions.

Bringing it all together

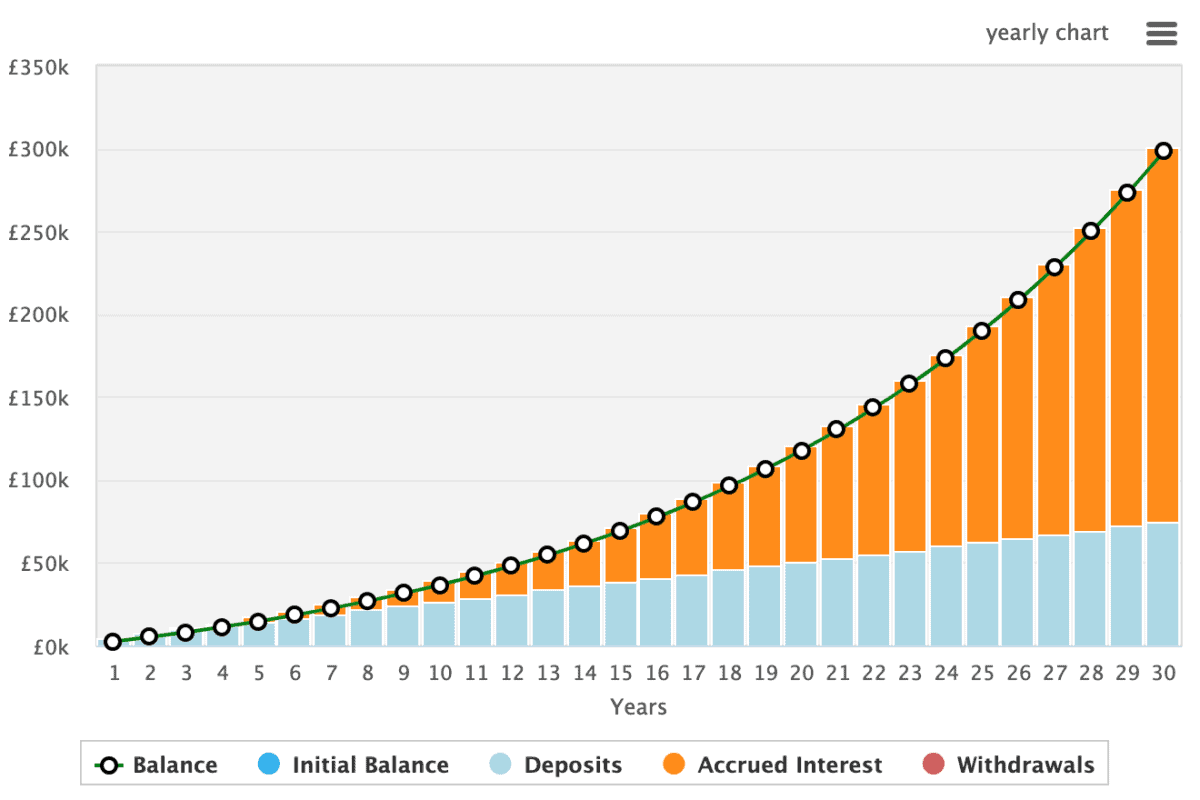

Let’s assume I’m saving £200 a month. And as noted, I’m reinvesting my returns every year to benefit from compound returns and, over the course of my investment, I annualise 8% returns. here’s what could happen.

| Years invested | Size of portfolio |

| 5 years | £14,695 |

| 10 years | £36,589 |

| 20 years | £117,804 |

| 30 years | £298,071 |

At any point within this investment journey, I could stop reinvesting and start taking. But the longer I’ll leave it, the faster it’ll grow. Just take a look at this chart below. And in terms of passive income, after 30 years, my portfolio could be generating £22,000 a year. Even taking into account inflation, that’s not a bad passive income source.