RC365 (LSE:RCGH) shares have fallen 75% since peaking at 180p earlier this year. Currently, the stock trades for 45p a share and has a market-cap of £58.1m.

But is there a recovery on the cards? Let’s take a closer look.

Valuation

If I bought RC365 shares today, would I be getting a good deal? The evidence suggests not.

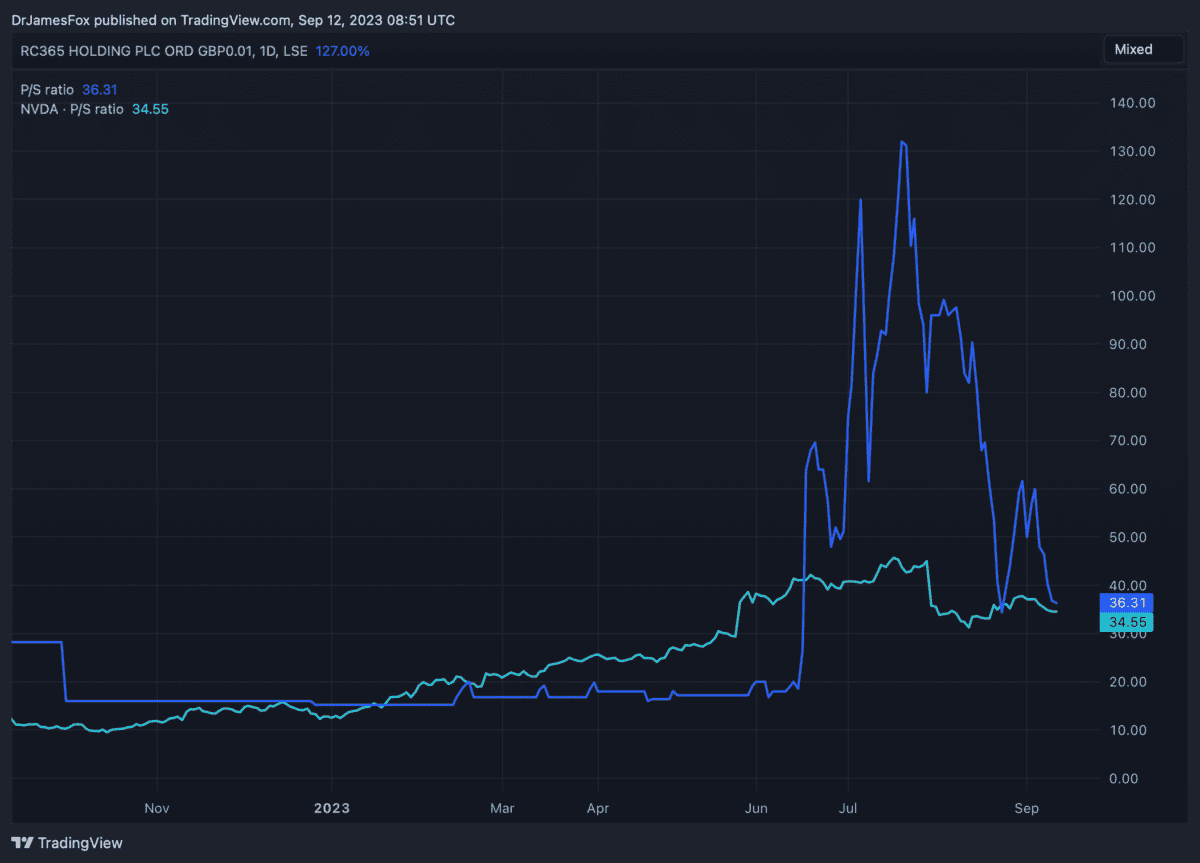

Let’s start by looking at the price-to-sales (P/S) ratio. RC365 isn’t profit-making, so we can only assess its revenues and losses.

The Hong-Kong-based firm currently trades at 36.3 times revenues. This is phenomenally expensive as a company with a P/S ratio above 10 is normally considered expensive.

For the purpose of comparison, I’ve compared the firm with Nvidia — one of the most expensive stocks by trailing 12 month (TTM) P/S.

The big difference is that Nvidia’s forward P/S ratio is approximately half its TTM ratio, reflecting the vast forward demand for its GPUs. As far as we can tell, RC365’s forward P/S is very similar to its TTM ratio.

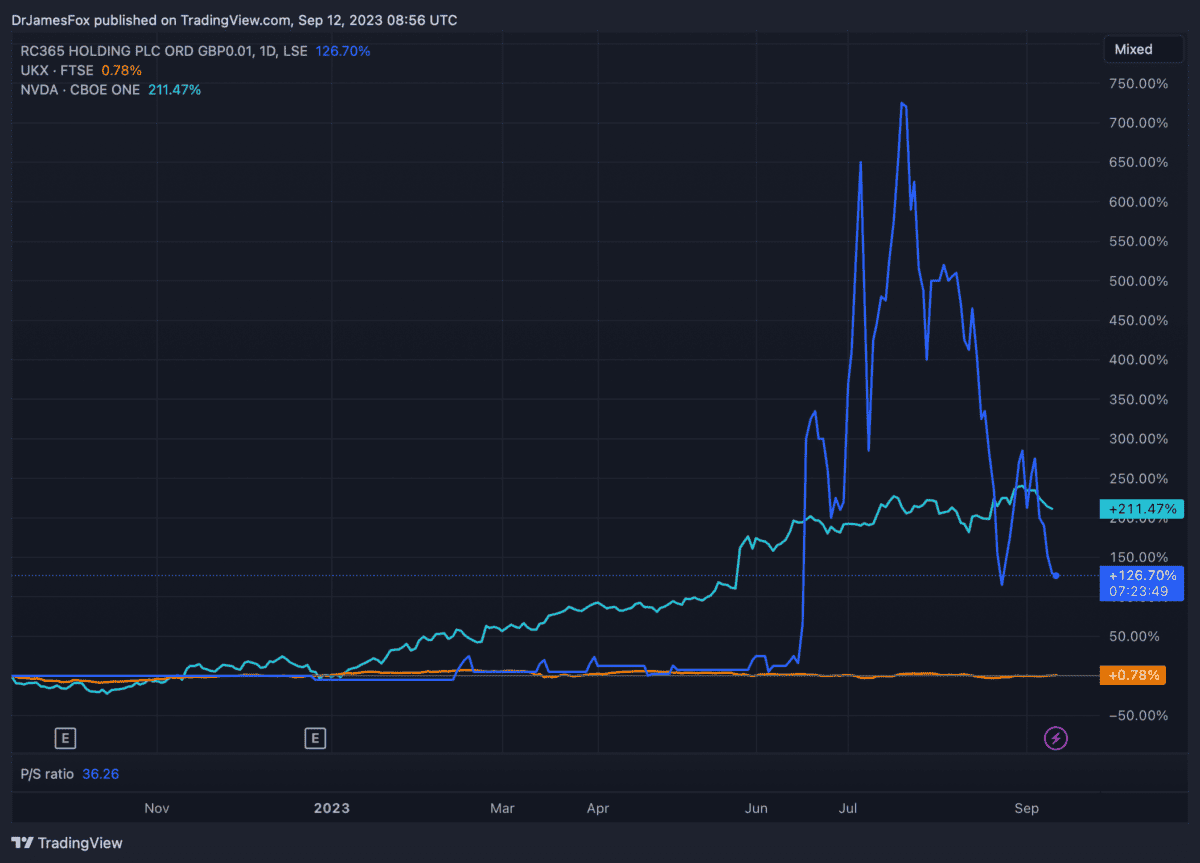

It’s worth highlighting that Nvidia’s gains have actually outpaced RC365 now. At one point however, the UK-listed firm had experienced near 800% share price growth.

Growth prospects

RC365 has made a significant number of announcements this year. These include:

- The acquisition of Mr Meal Production Limited

- Collaborations with APEC Business Services

- An memorandum of understanding (MoU) established with Hatcher Group, focusing on the delivery of an AI solution

- A deal to feature its brand on Mastercard credit cards intended for Hong Kong residents

- A deal to feature its brand on Mastercard credit cards intended for Malaysia

While it may look like RC365 has been busy, there’s little concrete evidence these deals will transform the company’s fortunes.

In fact, the Malaysia deal, which allows RC365 to issue and manage Mastercard Prepaid Card services in the country, is expected to be rolled out to just 40 customers and 1,200 cardholders by 31 December 2024.

If this is anything to go by, these deals may have a limited impact on growth prospects.

Worth the valuation?

In July, RC365 announced that revenue had doubled over the FY2023 to HK$16.9m (£1.5m). Meanwhile, losses extended to HK$5.4m (£530k), up from HK$3.9m in the previous year.

While we can see significant revenue growth, even if the current trajectory is sustained, the valuation is hard to justify.

Personally, I expect to see further downward pressure on the share price until its P/S ratio falls below 10.

This also raises the question as to why the RC365 share price surged in the first place.

Personally, I believe a possibly sponsored article titled “Missed Nvidia? This London-based AI stock has the potential to achieve a remarkable surge of over 1,000%“, may have been the reason.

With investors hot on AI this year, the comparison with GPU-maker Nvidia likely sent demand for the stock soaring.

With less than half the shares of this relative minnow floated, an increase in demand would have had a profound impact on the share price.