The BT Group (LSE:BT-A) share price has been on a wild ride in 2023. While basically unchanged since the start of the year, this FTSE 100 stock has risen then collapsed 25% in the past six months as concerns over the UK economy have mounted.

Could this present an attractive investment opportunity for long-term investors like me?

P/E ratio

A good starting point is to consider the telecoms company’s forward price-to-earnings (P/E) ratio. At 113p per share, the firm trades on a ratio of just 7.35 times.

By comparison, the corresponding average for FTSE 100 shares sits at a far higher 14 times. But this isn’t all. BT shares also look like solid value when compared to the broader telco sector, as the chart below shows.

Based on this financial year’s predicted earnings, it’s cheaper than fellow Footsie business Vodafone Group (LSE:VOD), which trades on a P/E ratio close to 8.2 times. BT also carries a more attractive rating than European peers Deutsche Telekom and Telefonica, and North American telecoms colossus Verizon Communications.

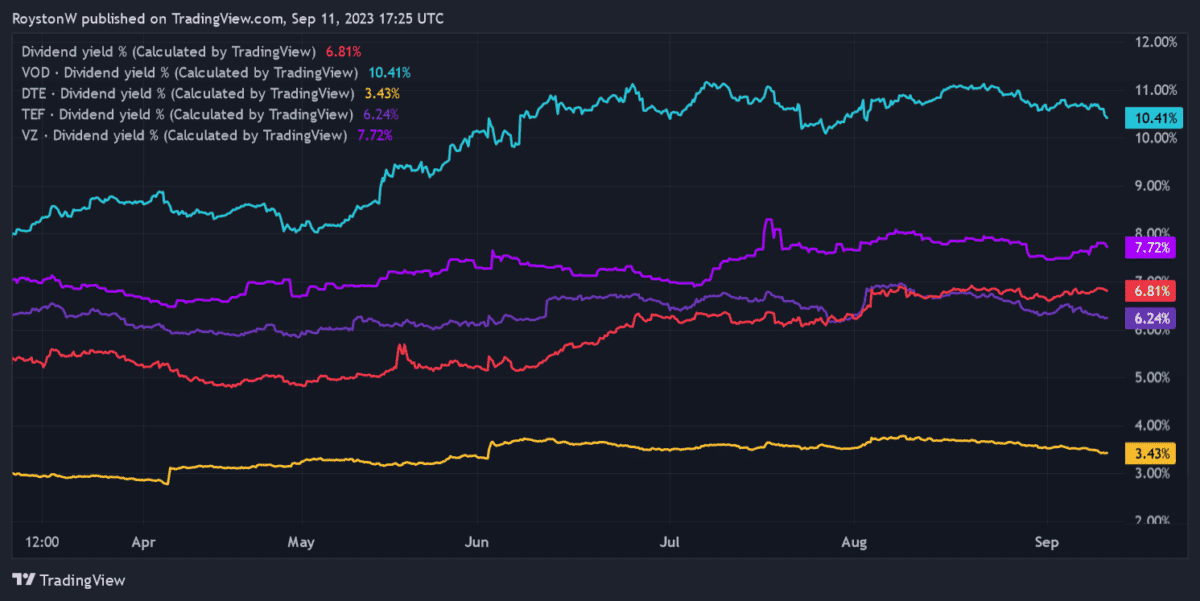

Dividend yield

BT also scores pretty highly when it comes to predicted dividends. Its yield for this financial year clocks in at 6.8%, three full percentage points ahead of the FTSE 100 average.

Having said that, the company’s yield doesn’t smash the sector average, unlike its P/E ratio. It’s trumped by Vodafone’s 10%+ yield, as the chart below shows, as well as Verizon’s reading for this year. The company does beat Telefonica and Deutsche Telekom though.

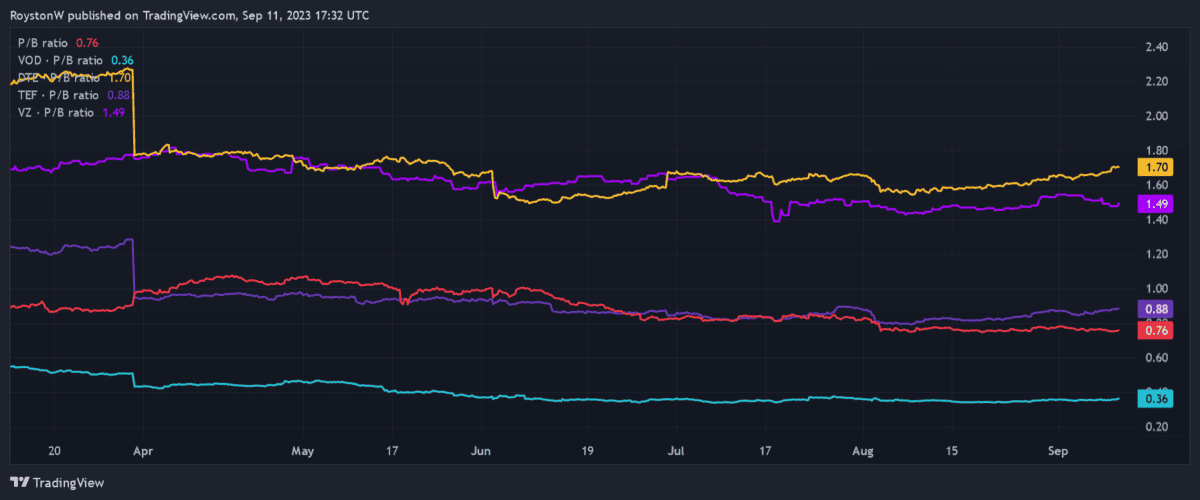

P/B ratio

Finally, let’s look at the price-to-book (P/B) value of BT shares. This divides a firm’s stock price by its book value per share, which is defined as total assets less any liabilities.

As the chart above indicates, BT beats all of its international rivals on this front, even surpassing Verizon and Deutsche Telekom quite comfortably. Its reading comes in at just 0.76. However, the reading is higher than that of FTSE 100 competitor Vodafone.

Should I buy BT shares?

The charts suggest BT shares offer excellent all-round value. But as an active investor myself I’d much rather buy shares in Vodafone today.

It’s not just because the latter offers largely better value, according to the charts. It’s because Vodafone has a wider geographical footprint than its UK rival with operations in Europe and Africa. This helps to reduce risk and provides me with exposure to fast-growing emerging regions.

By contrast, BT generates the lion’s share of profits from the UK. And with the domestic economy facing a prolonged period of weakness the profits outlook here is pretty grim. City analysts expect annual earnings to drop 4% in this financial year (to March 2024) before basically flatlining in the following two years.

Vodafone has problems too following changes to product bundling laws in Germany. But as a long-term investor I’d still rather buy this company to try and make money from the telecoms sector.