I have some spare cash sitting in my Stocks and Shares ISA right now. It’s not creating any wealth for me of course, so I’m building a list of top FTSE 100 stocks to buy.

“Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down“. Those famous words by billionaire investor Warren Buffett form an important plank of my investing strategy.

And following recent market volatility, there are tonnes of FTSE-listed stocks trading at dirt-cheap prices right now. Here are two I’m considering buying in the days ahead.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

DS Smith

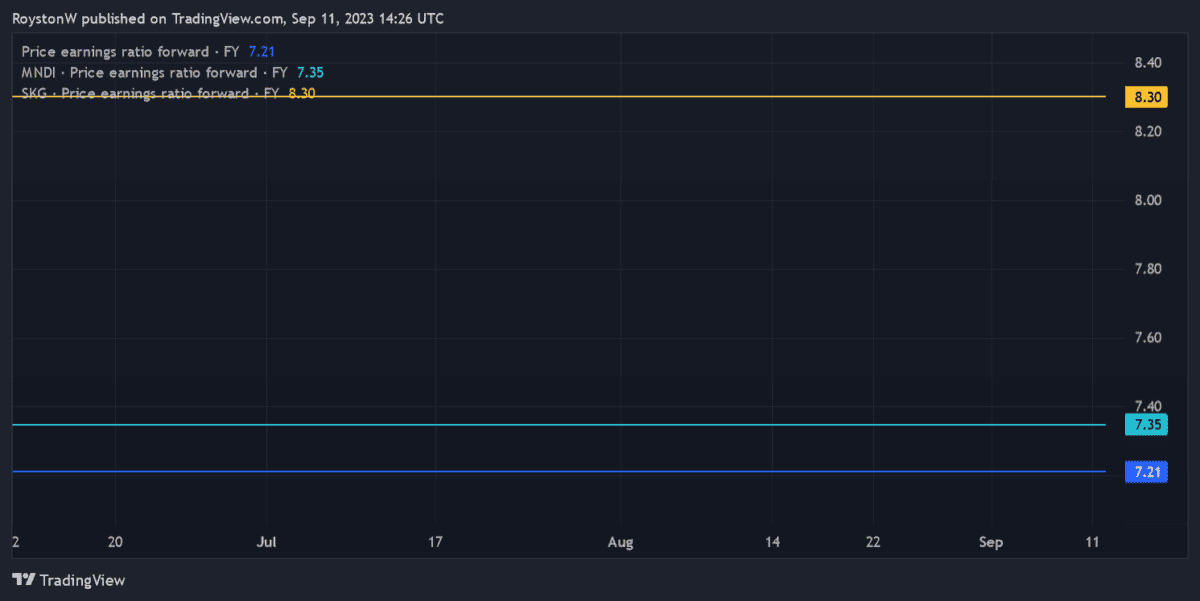

Packaging manufacturers like DS Smith (LSE:SMDS) have long commanded price-to-earnings (P/E) ratios below the FTSE 100 average of 14 times.

Their low valuations reflect the prospect of sustained revenues weakness as the global economy struggles. But as a long-term investor, I think these companies are top buys at current prices.

As the chart above shows, DS Smith — along with industry rivals Mondi and Smurfit Kappa — all trade well below the index average. In fact, the first stock I mention is the cheapest among the pack.

I expect these companies’ earnings to rise strongly over the next decade. Steady growth in the e-commerce, grocery, and fast-moving consumer goods (FMCG) sectors should boost demand for boxes and other sorts of packaging.

I like DS Smith especially because of its particular focus on sustainability (it sold its plastics division back in 2020). This could make it the supplier of choice for companies that are looking to maximise (and advertise) their green credentials.

At current prices of 291p, this business also carries a juicy 6.1% dividend yield.

HSBC Holdings

Asia-focused banking giant HSBC (LSE:HSBA) is another FTSE share offering excellent all-round value. It trades on a P/E ratio of just 5.7 times for 2023, less than half the blue-chip index’s forward average.

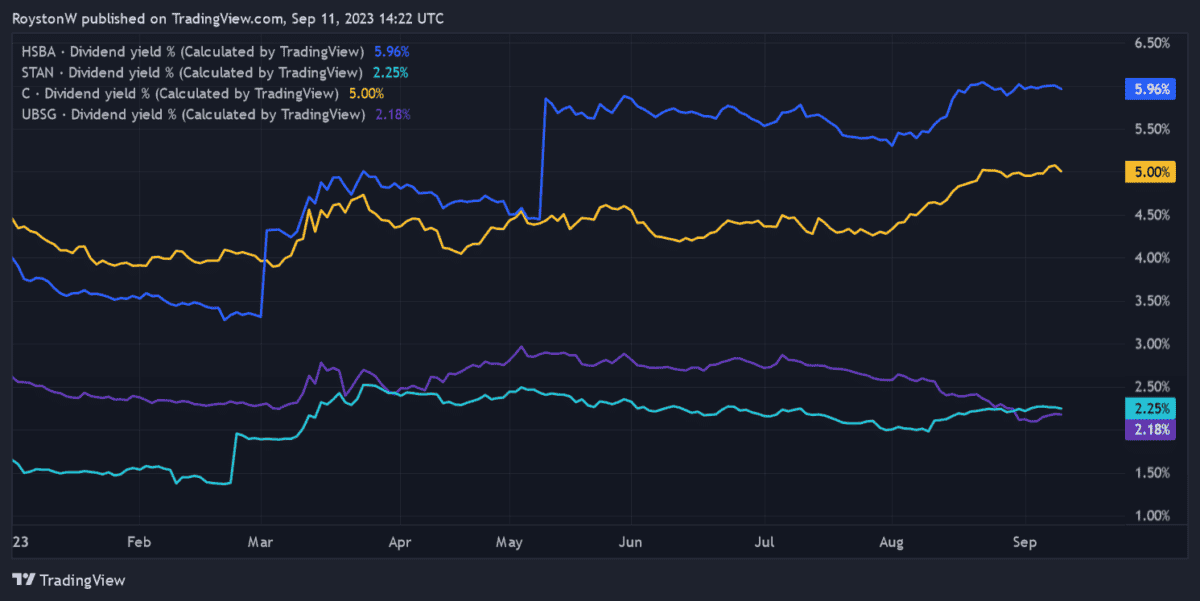

I’ve also compared the bank’s prospective dividend yield to those of other financial services companies Standard Chartered, UBS, and Citigroup. These businesses make for solid comparisons given they also have sprawling Asian operations.

As the chart below shows, HSBC’s dividend yield for this year comfortably beats those of its rivals. The yield for 2023 beats that of its closest rival, Citigroup, by a full percentage point.

The bank could suffer in the short term if China’s property crisis escalates. But continued support from the country’s government and central bank raise hopes that a crisis can be averted.

I’d buy HSBC shares to capitalise on soaring personal income levels in the region and steady population growth. Analysts at McKinsey & Co expect Asian banking revenues to grow by 7% to 8% per annum through to 2026, for example, as new customers emerge and existing customers buy more products.

Financial product penetration in these emerging markets is low, and HSBC has the brand power to make the most of this growth opportunity. I’d happily split any money I have to invest between HSBC and DS Smith shares right now.