The Stocks and Shares ISA is an investment wrapper available to UK residents. It’s on all major UK investment platforms and it allows us to build wealth and generate passive income without paying tax.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Getting started

Starting with a Stocks & Shares ISA is a straightforward process that can help me invest in the stock market while enjoying tax advantages.

First, I’ll need to choose a financial institution or platform that offers Stocks & Shares ISAs. Many banks, investment firms and online platforms provide these accounts.

My personal preference is the Hargreaves Lansdown platform. Although if investing with smaller sums, some may prefer a lower-fee platform.

Once I’ve selected my provider, I’ll typically need to open an account. This often involves providing personal and financial information, as well as completing the necessary paperwork.

Objectives and affordability

After my ISA account is set up, I’ll need to establish my objectives while recognising what I can afford to invest. Naturally, the more I contribute, the larger my portfolio will be, assuming other variables remain the same.

Next, I’ll need to decide how I want to invest within the ISA. This involves selecting the specific stocks, bonds, or investment funds I wish to include in my portfolio. It’s important to consider my investment goals, risk tolerance, and time horizon when making these decisions.

Building wealth

I should also keep in mind that Stocks & Shares ISAs come with an annual contribution limit of £20,000. This is set by the government, so there’s no variations among platform providers.

However, most of us don’t have £20,000 to put aside every year. Instead, we can look to invest smaller figures, such as a couple of hundred pounds a month.

Of course, if I were investing just £200 a month, I wouldn’t be in a position to earn a significant amount of massive income for a while.

So the strategy should revolve around compound returns. This is the process of reinvesting my returns year after year so that, after the first year, I start to earn interest on my contributions as well as the interest earned in previous years.

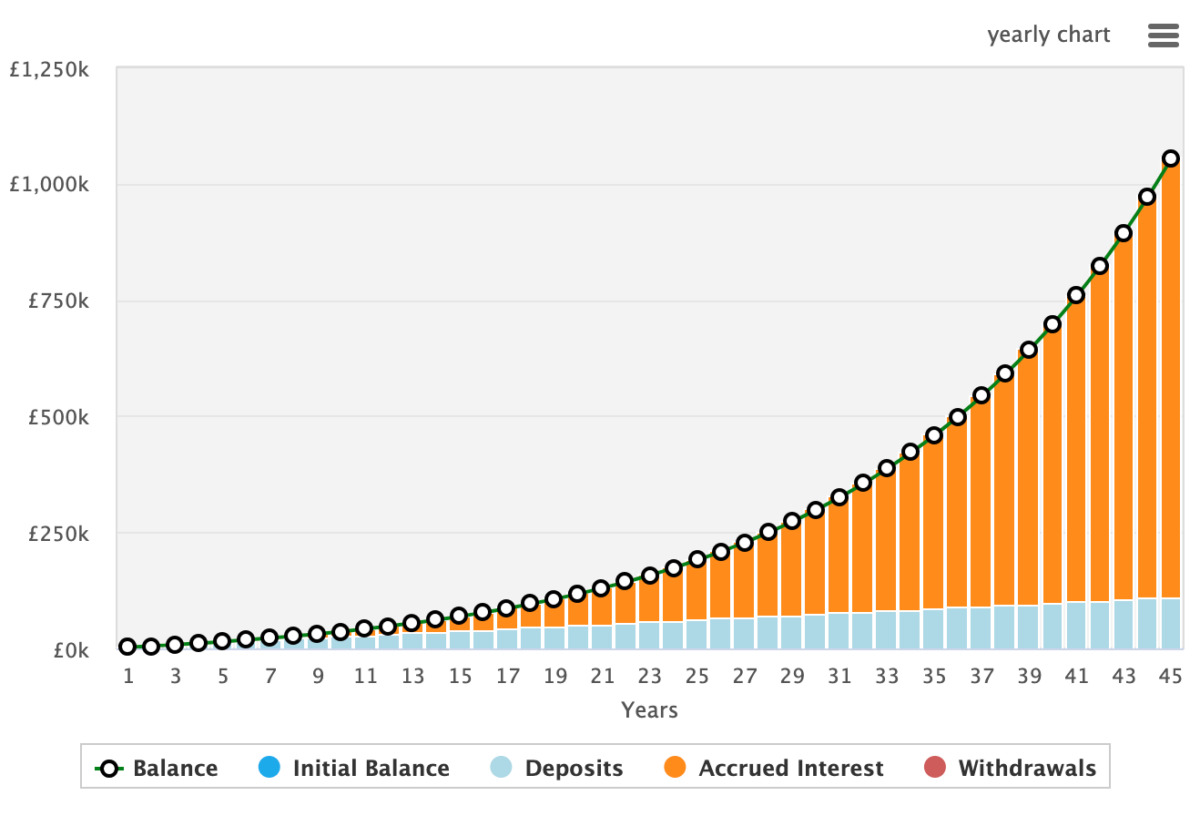

It might not sound groundbreaking, but this is how we achieve exponential growth. Here’s how a £200 monthly contribution could grow over 45 years assuming an annualised 8% rate.

Of course, at any point on this growth curve — which reaches £1.05m — I could look to start taking a passive income rather than reinvest. Assuming 8% returns, after 45 years, the portfolio could generate around £80k a year.

In the above example, I assumed an achievable 8% yield. Seasoned investors may look to achieve greater returns.

Nonetheless, it’s essential to acknowledge that investing isn’t risk-free. If I make poor investment choices, there’s a real possibility of incurring financial losses. To mitigate these risks, I need to carry out thorough research and diversify.