There are various ways to create passive income. While alternative methods exist, my personal preference is to invest in publicly-traded stocks, looking to generate returns through share price appreciation and dividends.

Why stocks?

Many Britons have gone down the buy-to-let route as a way to earn passive income. However, on average, the yields just aren’t that great despite the success stories we may see posted over social media. One in 10 properties on the market currently were formerly buy-to-let. What does that tell you?

Investing in stocks and shares offers greater accessibility to many individuals in the UK, as we can begin with almost no starting capital. The same cannot be said for buy-to-let investments. It’s certainly less time consuming than many a portfolio of houses, and it can be much more financially rewarding.

How’s it done?

Getting started is simple. We can open an investing account with any major broker. There are plenty of online brokers to choose from these days. However, if starting with smaller sums, it may be beneficial to choose a platform with lower fees. Although it’s worth noting that Hargreaves has removed fees for Junior ISAs.

If I hadn’t already, I’d also want to use a Stocks and Shares ISA. This is available through any major broker and allows me to generate wealth without paying any tax on it. I can put as much as £20,000 a year into an ISA portfolio.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Discipline and compounding

The reality however, is that most of us don’t have £20,000 a year to put into an ISA. So if we want to build a portfolio that’s large enough to generate a significant passive income, we need to be disciplined savers, shrewd investors, and patient.

Firstly, if starting with very little capital, I should look to save regularly — ideally monthly. So if I were to set aside £5 a day, I could contribute £150 a month to my ISA. With this disciplined approach, I could start fuelling my portfolio while benefitting from pound-cost-averaging.

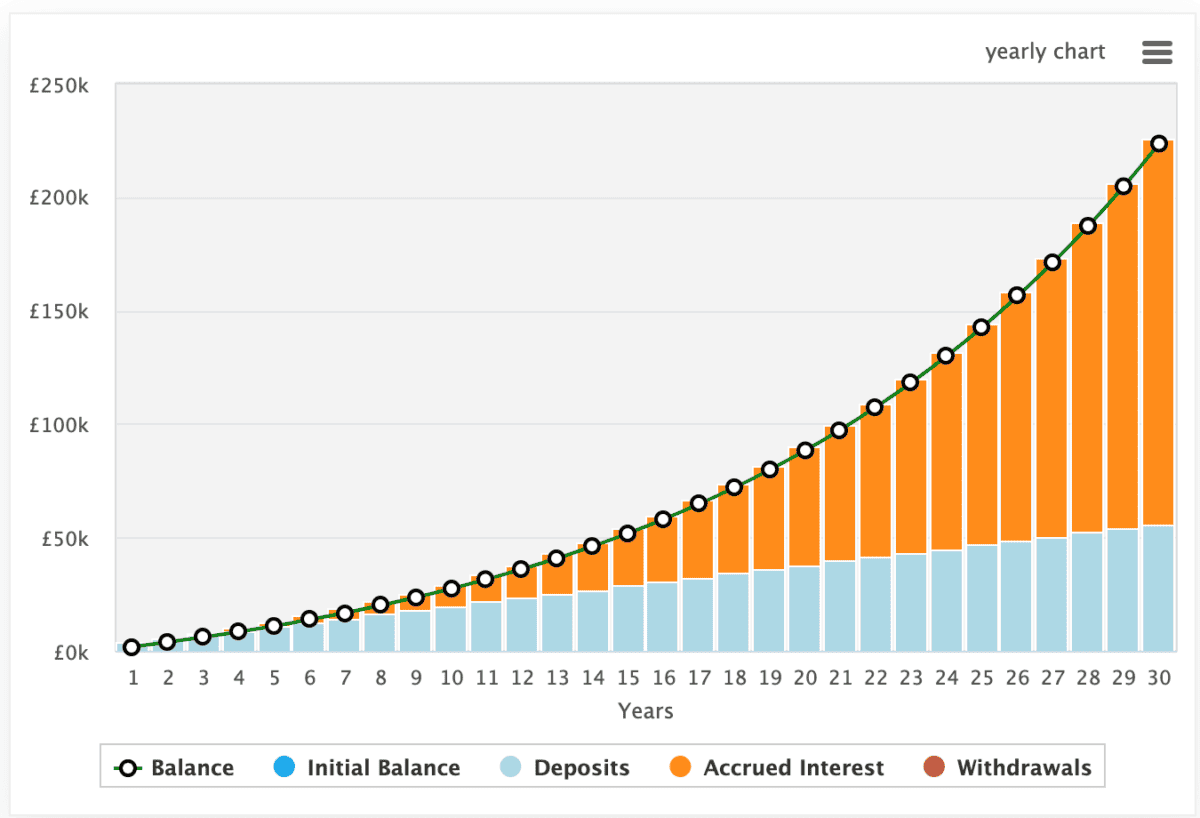

I’ll also want to take advantage of compound returns. This is the process of reinvesting my returns year after year to generate exponential growth. It allows me to earn interest on my interest. It’s genuinely a game changer.

The above chart shows how £150 a month could be transformed into £225k over 30 years when actualising an 8% annualised return.

Risk vs reward

In the above example, after 30 years my portfolio would be generating £17,500 a year. I appreciate that figure might not be game-changing in three decades, but it’s a decent return for just £5 a day. It’s also worth recognising that the contribution should become easier as time goes on and inflation takes its course.

However, before everything else I need to make sure that my contributions are sustainable and in line with my objectives. If £5 a day is too much, then I’m going to need to revisit my strategy.

It’s also worth noting that 8% returns, while very achievable, are only possible if I make shrewd and informed investment decisions. It’s important that I do my research before buying individual stocks.