The retreat of the abrdn (LSE:ABDN) share price this summer was so pronounced that the stock dropped out of the FTSE 100 for the second time in a year.

However, despite losing the benefits associated with being a FTSE 100 constituent, could abrdn be an interesting prospect for investors?

Down 27% over three months, let’s take a closer look at this asset manager.

Underperforming

The share price dropped after H1 results, which failed to impress investors.

There were some positives. Operating revenue grew 4% versus the same period last year and adjusted operating profit rose by 10%.

However, the business still ended up in the red with a loss before tax amounting to £169m. Although smaller than the H1 2022 loss, it was still concerning.

Perhaps the most significant blow came from the shrinking assets under management (AUM), declining from £500bn to £495.7bn.

AUM serves as an important gauge for the company’s financial performance, as they directly influence its fee income.

The underperformance was attributed to the lower average AUM as well as net outflows. Outflows were particularly pronounced for equities as clients moved to debt products and cash amid rising interest rates.

Valuation

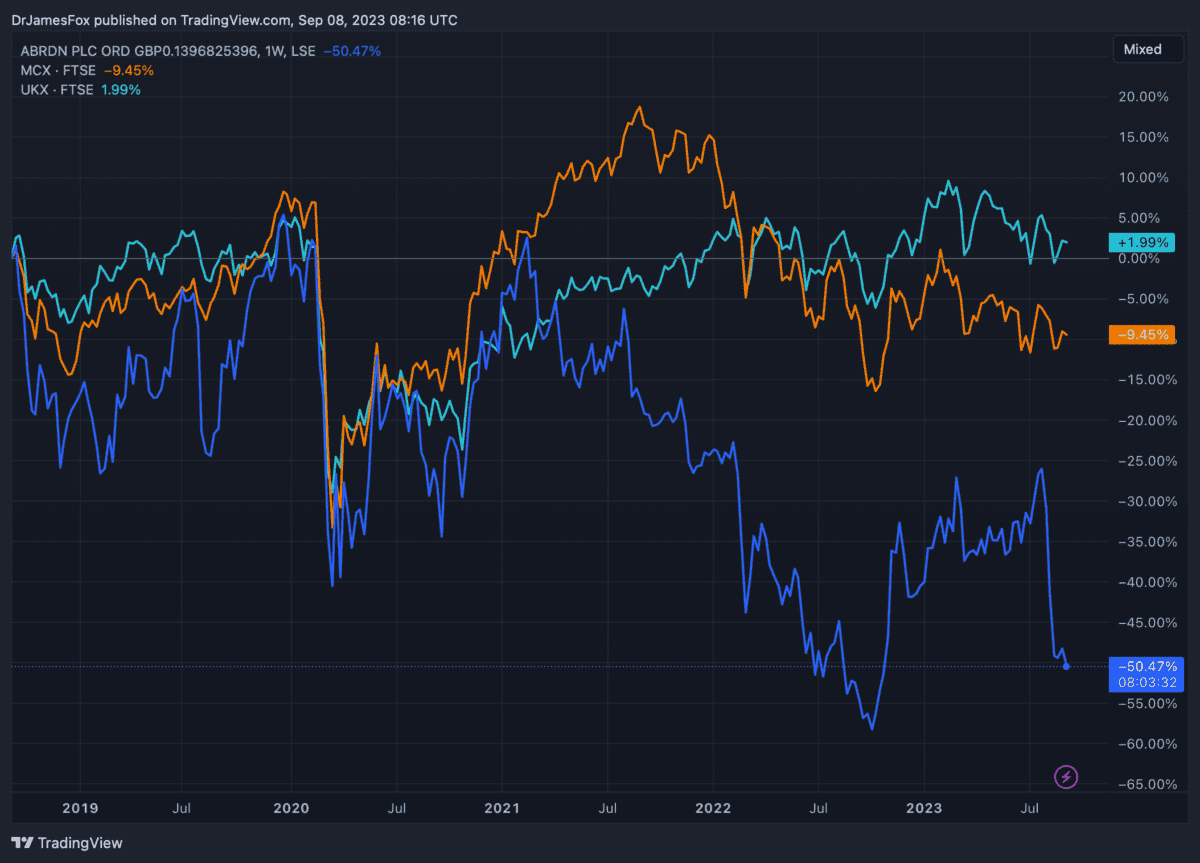

As we can see from the chart below, abrdn has greatly underperformed the lacklustre FTSE 100 and FTSE 250 over the past five years. The asset manager has lost 50% of its value.

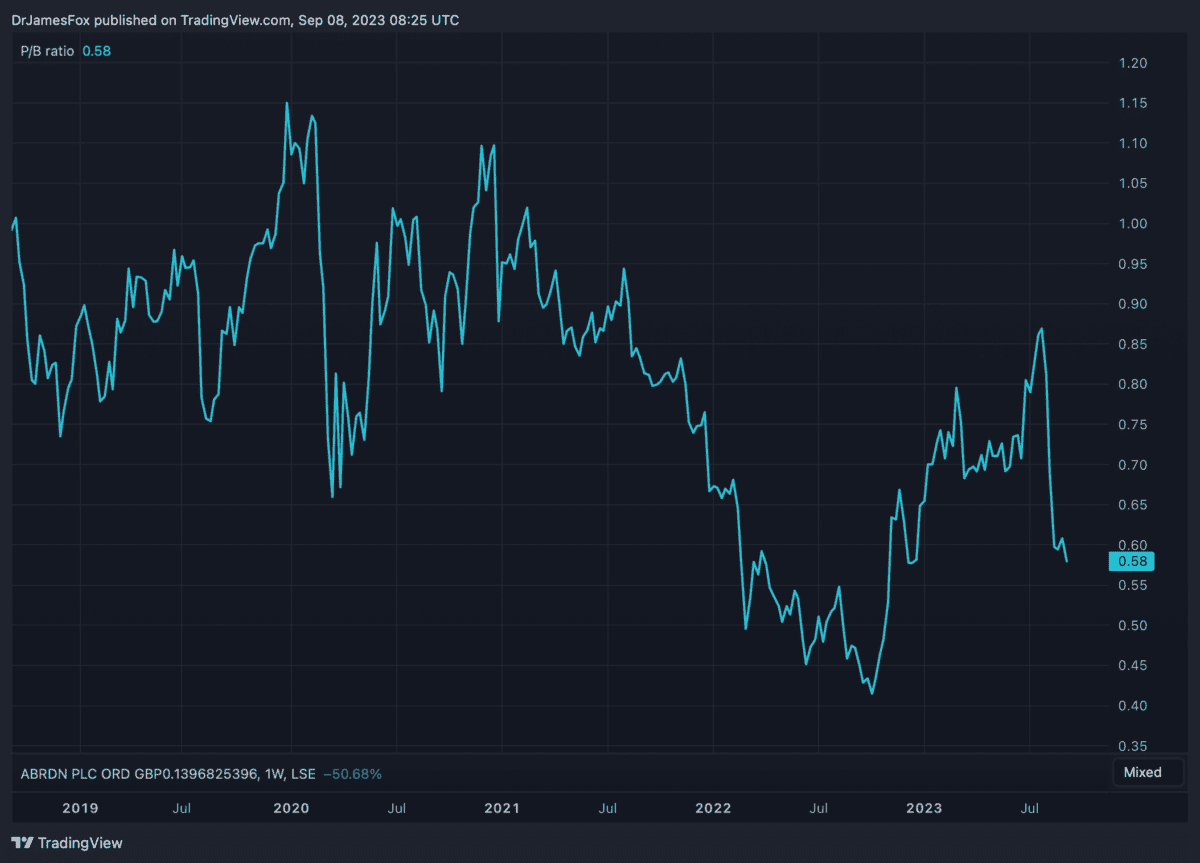

However, intriguingly, we can also see that abrdn trades at a discount to its book value. This is around 42%, inferring a significant discount to the company’s net asset value. This is often a feature of undervalued shares.

Dividends

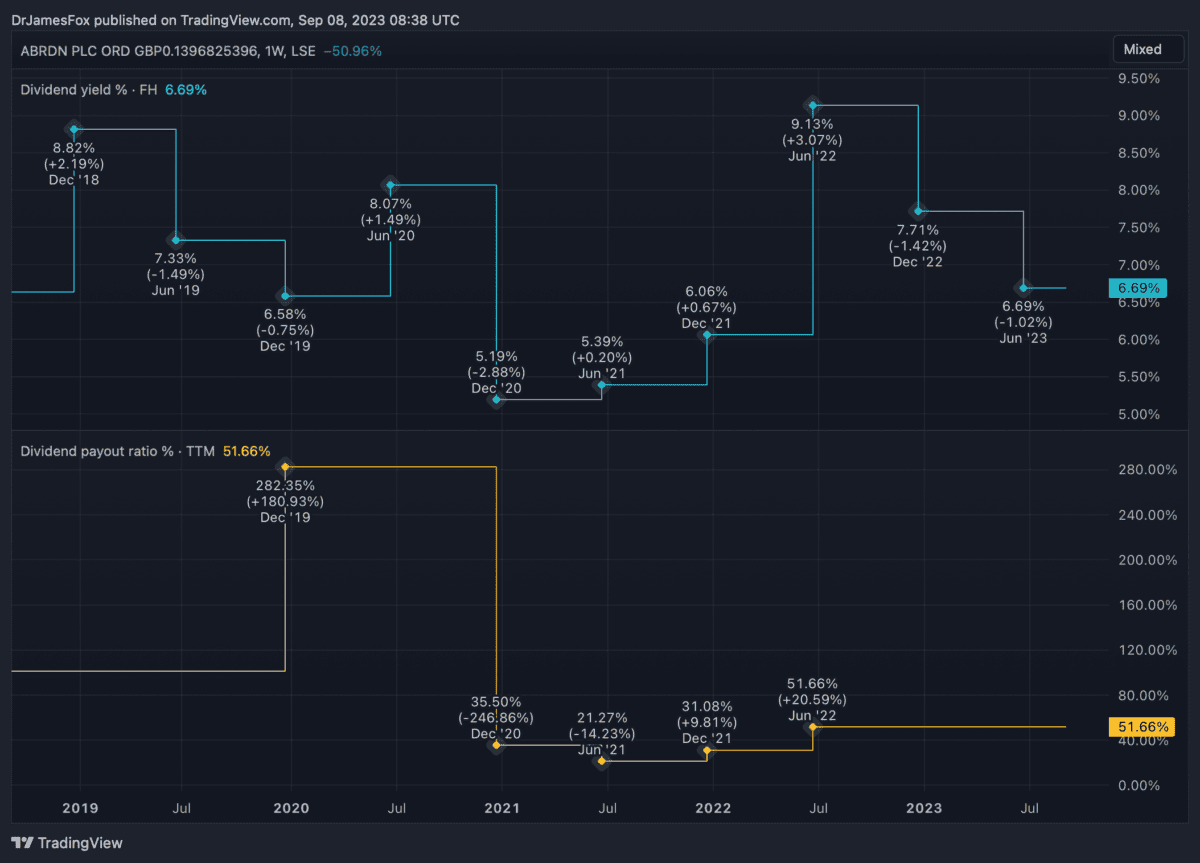

Investors might be attracted to the appealing 9.3% dividend yield and the prospect of potential gains, but the situation isn’t straightforward.

It’s important to consider that the fund’s interim dividend, at 7.3p, is currently only supported by adjusted capital generation at a coverage ratio of 1.0 times.

At this moment, it appears that the dividend could be in trouble. If there were to be a reduction in dividend payments, it could potentially exert additional downward pressure on the abrdn share price.

A diamond in the rough?

Investors often misunderstand cyclical businesses, and abrdn is a prime example. Its performance relies heavily on market conditions.

In good times, people invest more, but during downturns, they pull back. Right now, the abrdn share price reflects a market in a downturn.

Furthermore, the recovery for its investment business might take time. Interest rates are expected to slowly return to 2.5% by 2025.

Even at that point, the playoff between equities and other asset classes isn’t easy.

At 2.5%, cash remains attractive for many Britons, potentially hindering the firm’s medium-term performance.

While several valuation metrics are positive, these could also reflect concerns for the medium term. Consequently, abrdn shares may have limited upside in the current market.