2023 has so far proved to be a miserable time for mining shares. Investors looking for beaten-down stocks to buy have largely avoided companies like Glencore (LSE:GLEN) on worries over the global economy and, more specifically, China.

Glencore’s share price has plummeted 22% in value since 1 January. By comparison, the broader FTSE 100 is basically unmoved. And as a long-term investor I believe this is an excellent dip-buying opportunity. According to data from stock screener Digital Look, so does the City’s army of analysts.

Of the 13 analysts with ratings on Glencore shares, 11 score the company as a ‘buy’, with eight deeming it to be a ‘strong buy’. The remaining two analysts have slapped a ‘hold’ rating on the business.

Here’s why I’d buy the FTSE miner for my shares portfolio today.

Too cheap to miss?

As mentioned, commodities stocks like this continue to tumble as concerns over China mount. Latest data overnight — which showed the country’s services sector grow at its slowest rate for eight months — has increased fears over the Asian economy.

A strong Chinese economy is critical for raw materials demand. But despite trouble in the manufacturing and real estate sectors I’m still looking to buy Glencore shares. Even if earnings slip sharply in the near term, I’m confident this FTSE 100 stock will still deliver exceptional profits growth over a longer time horizon (say a decade).

Besides, I think the threat posed by China’s struggling economy is reflected in Glencore’s low share price. Today, it trades on a forward price-to-earnings (P/E) ratio of 8.7 times, way below the FTSE average of 14 times.

A bright outlook

Long-term growth in the world’s economy and population both mean commodities demand is stomping steadily higher. Pleasingly for investors today, economists expect demand for metals to rise especially quickly during the next decade, pushing prices higher as material deficits emerge.

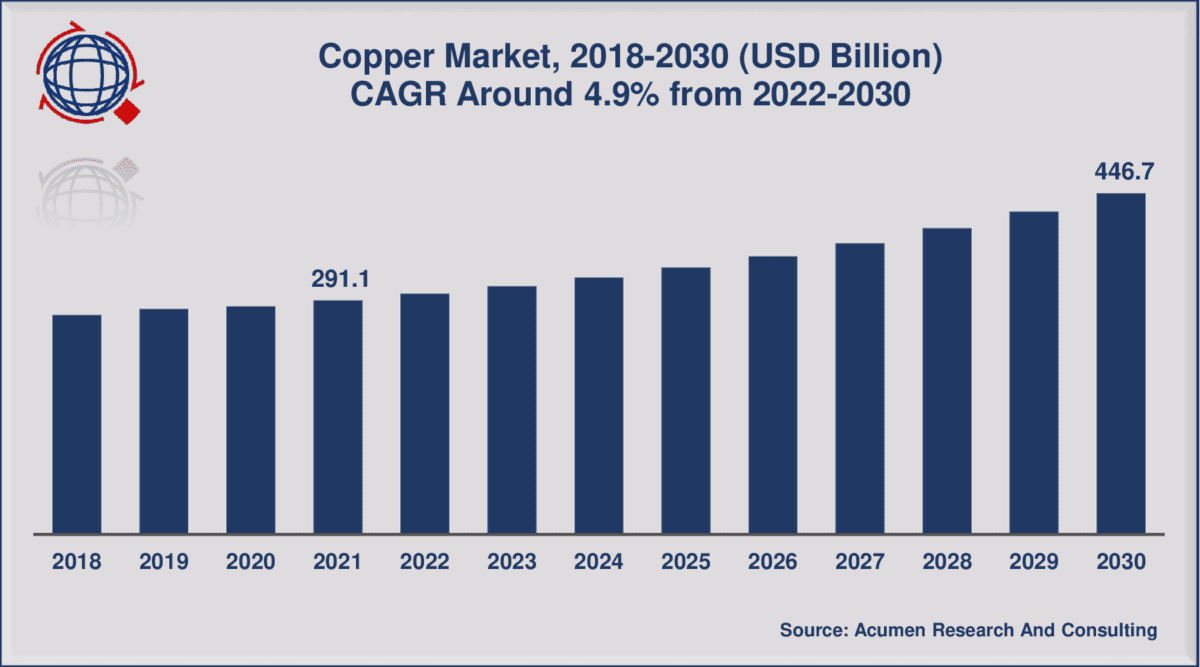

This reflects the transition towards green technology and changes to supply chain models following Covid-19. The chart below indicates how strongly demand for copper alone is tipped to grow through to 2030.

A rock-solid stock to buy

Glencore’s in great shape to exploit this new commodities supercycle. It produces a cluster of key battery metals including copper and nickel. And it markets an even broader range of raw materials, including iron ore, aluminium and gold.

Thanks to its strong balance sheet — net debt stood at a manageable £1.5bn as of June — the firm can invest heavily to supercharge profits growth too. It recently paid $475m to Pan American Silver to take total control of the Mara copper and gold asset in Argentina.

One final thing. Glencore’s healthy financial position means City analysts expect the business to keep paying huge dividends, even as profits fall over the medium term. So the miner boasts market-beating dividend yields of 8.5% and 6.7% for 2023 and 2024 respectively.

All things considered, I think the mining mammoth is too cheap to miss at current prices.