I think these value stocks are too good to miss at current prices.

Begbies Traynor Group

Buying some classic counter-cyclical shares could be a good idea as the economy splutters. And insolvency specialist Begbies Traynor Group (LSE:BEG) is one such UK share on my radar this month.

Should you invest £1,000 in Diageo right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Diageo made the list?

Profits at the Alternative Investment Market (AIM) company soared 16% in the 12 months to April. This was above expectations as work volumes flooded in. What’s more, if fresh forecasts from the Centre for Economics and Business Research provide correct, it can expect sales to keep booming.

The think tank has predicted an average of 7,000 insolvencies every quarter in 2024 following further interest rate rises. It notes that the 6,700 insolvencies reported during the last quarter more than doubled the usual second-quarter numbers as the Bank of England kept raising borrowing costs.

Begbies Traynor is more than just a solid stock to buy for the short term, though. It’s grown annual earnings by double-digit percentages for quite some years now. This is thanks to its aggressive acquisition-based growth strategy. The firm has a strong balance sheet, which it can use to keep its successful plan going (it had £3m worth of net cash on its books as of April).

Acquisitions don’t always go to plan, of course. And when they do go wrong they can significantly erode shareholder value. However, Begbies Traynor’s solid performance on this front so far helps soothe any fears I have.

Today the company trades on a low forward price-to-earnings (P/E) ratio of 11.9 times. It also carries a healthy 3.1% dividend yield. I think if offers excellent value at current prices.

Central Asia Metals

Since the beginning of 2023, mining business Central Asia Metals (LSE:CAML) has lost a whopping 20% of its value. Investors have been selling out as worries over a sharp fall in commodity consumption have grown.

Rising interest rates, and a lumpy post-pandemic economic recovery in China, both pose a threat to metals demand and the company going into 2024. But as a long-term investor I remain positive about much of the broader commodities sector.

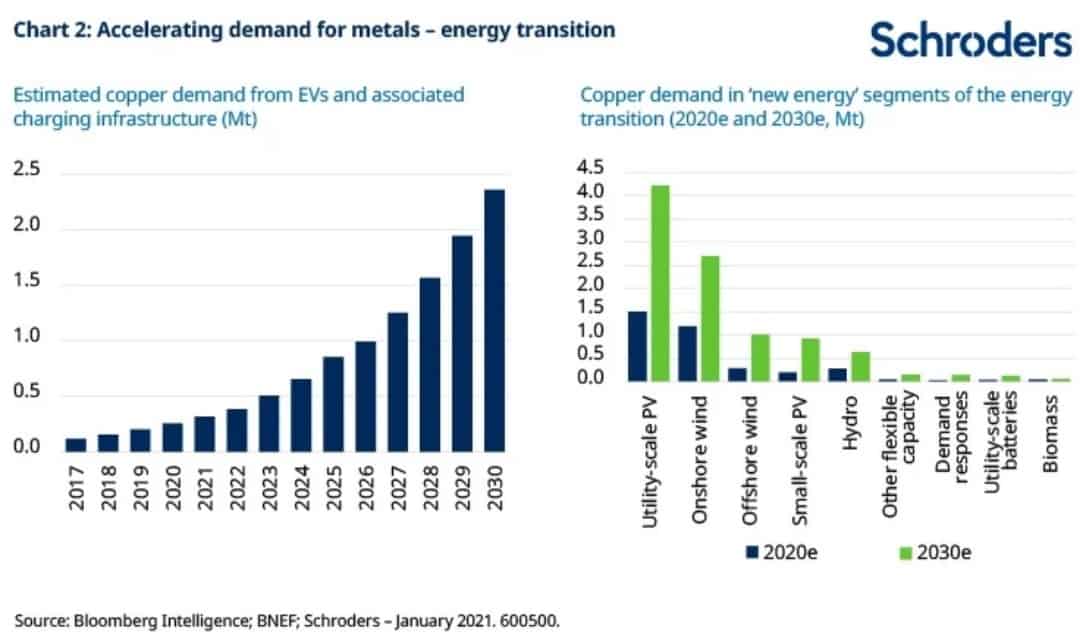

Central Asia Metals, for instance, owns and operates the Kounrad copper project in Kazakhstan and Sasa zinc-lead mine in North Macedonia. As the copper chart below illustrates, demand for critical battery metals like these is set to surge as the construction of electric vehicles and related infrastructure gets under way.

I dont think this is baked into the AIM company’s rock-bottom valuation. It trades on a forward P/E ratio of 7.7 times.

What really grabs my attention is Central Asia Metals gigantic 8% dividend yield. Of course, this is based simply on what payouts brokers are predicting. But I think there’s a great chance the company will meet current forecasts.

Dividend cover is okay (if not ideal) at 1.6 times. On top of this, the business has a robust balance sheet it can use to pay those large dividends. It cash in the bank of $50.6m and no debt as of June.