I’m searching for the best cheap FTSE 250 shares to buy in September. And I’ve built a shortlist of possible contenders for when I next have spare cash to invest.

The companies I’m looking at are NextEnergy Solar Fund, ITV, Bakkavor Group, and Greencoat UK Wind. The following charts illustrate why they could be great buys for value investors like me.

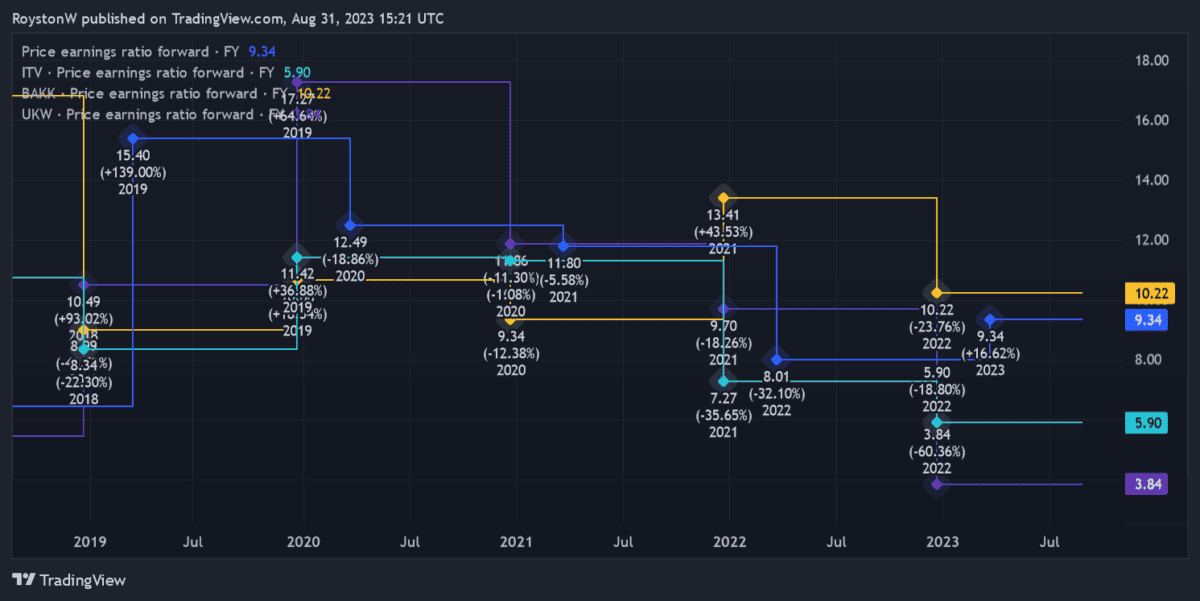

Low P/E ratios

As the graphic shows, NextEnergy Solar Fund trades on a forward-looking price-to-earnings (P/E) ratio of 10.22 times. This is some way below the average of 11.4 times for FTSE 250 shares.

Should you invest £1,000 in Barratt Developments right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Barratt Developments made the list?

The rest of the companies I mention trade on even lower multiples. Fellow renewable energy stock Greencoat UK Wind trades on a P/E ratio of below four times.

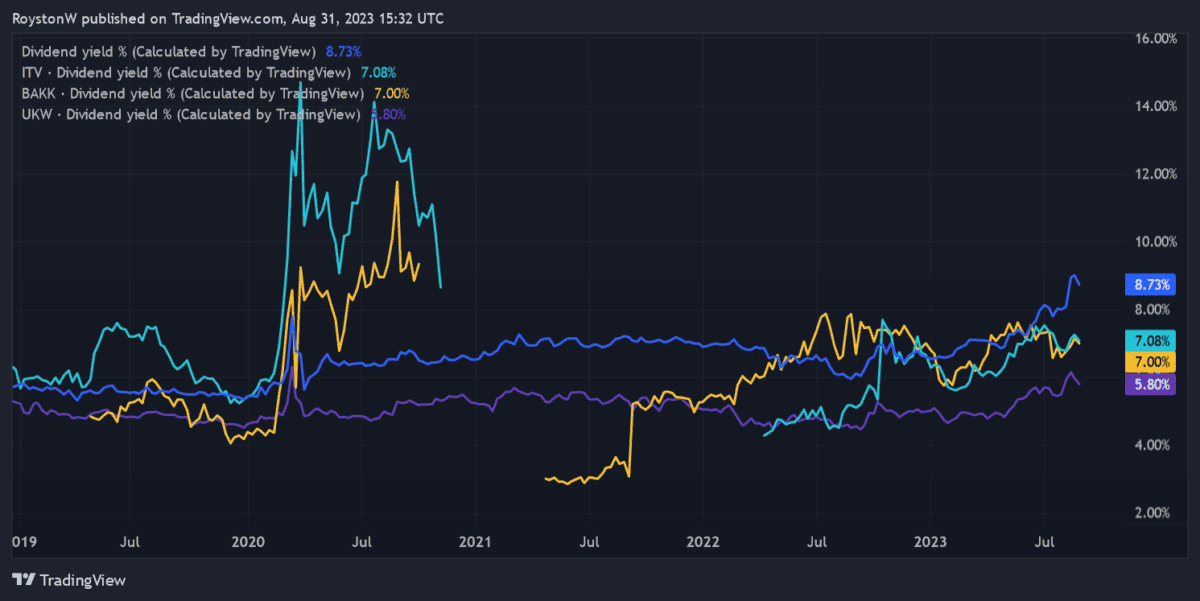

Huge dividend yields

All of the shares I’m looking at also carry large dividend yields. As the chart indicates, they all offer forward dividend yields above the 3.4% FTSE 250 average.

NextEnergy Solar Fund offers the largest yield of all these businesses. But ITV and Bakkavor’s yields are also twice as large as the index average.

Why I’d buy these stocks

Here’s why I’d snap these stocks up for my portfolio today:

NextEnergy Solar Fund: Fears over high interest rates have dented investor demand for renewable energy funds like this. It means these firms have to pay more to service their enormous debt piles. It also puts a dent in their expansion plans.

But I still think NextEnergy Solar Fund is an attractive share this September. The company’s essential operations give it better earnings visibility than many other FTSE 250 shares. I’m expecting demand for its green power to grow strongly as the fight against climate change intensifies too.

ITV: There are two reasons I’d buy shares in ITV today. Viewing figures at the firm’s ITVX streaming service are impressive (monthly active user numbers leapt 29% in the first half, to 12.5m). There’s room for further strong growth too as viewing habits evolve.

I’m also encouraged by ITV Studios’ continued momentum at its expands globally. I’d buy the former FTSE 100 stock even though advertising revenues could remain under the cosh in 2023.

Bakkavor Group: Unusually high input costs are a problem for Bakkavor Group. But I expect profits at the fresh food maker to detonate over the long term as consumer needs change.

People’s lifestyles don’t always make room for preparing meals. This means the salads, pizzas, desserts and other ready-made products Bakkavor turns out are growing in popularity. The company’s US and Chinese markets are especially ripe for growth.

Greencoat UK Wind: Like NextEnergy Solar Fund, Greencoat UK Wind is also under pressure from rising interest rates. Furthermore, its narrow geographic footprint means it’s more vulnerable at group level to unfavourable weather conditions.

Yet I still think the company is an attractive buy. Firms like these will play a vital role in helping the government meet its climate targets. And their ability to grow earnings will be boosted still further if, as expected, planning rules for onshore wind farms are loosened in the next few years.