The NVIDIA (NASDAQ:NVDA) share price has seen incredible gains this year. The stock has spearheaded the AI revolution and continues to surpass expectations. But having seen such massive gains, NVIDIA stock is now rather expensive, with markets not accounting for several risk factors.

Super earnings

NVIDIA recently reported yet another quarter of stunning growth. This was driven by soaring demand for its advanced AI-powering processors. Consequently, the NVIDIA share price has surged another 8% since, hitting a high of $494.

Revenue hit $13.5bn for the quarter, and easily beat Wall Street forecasts, which were upgraded to $11.2bn just months ago. In addition to that, NVIDIA’s earnings also impressed. The company posted a non-GAAP diluted earnings per share (EPS) of $2.70, compared to expectations of $2.08.

The clear standout was the firm’s data centre unit, which makes semiconductors for cloud computing and AI applications. This segment delivered a massive $10.3bn in revenue. This was around $3bn more than analysts had been anticipating. Driving this growth was the robust demand for NVIDIA’s cutting-edge A100 and H100 AI chips. So, as more and more companies transition to AI computing, is the only way up for the NVIDIA share price?

“A new computing era has begun. Companies worldwide are accelerating their adoption of accelerated computing and generative AI”.

CEO Jensen Huang

Short fuse?

While the earnings beat was certainly impressive, Huang did warn about potential headwinds from China, which represents 20%-25% of its data centre revenue. This is something that doesn’t seem to have been baked into the NVIDIA share price as the market continues to buy into the hype cycle.

The chip giant warned that “Restrictions prohibiting the sale of our Data Center GPUs to China, if implemented, will result in a permanent loss and opportunity”. This refers to the possibility of new US export controls aimed at limiting China’s access to advanced technologies like AI chips.

China’s economy has been slowing down, which could start to negatively impact NVIDIA’s earnings, considering that it relies rather heavily on China for a sizeable portion of sales. The point here is that, with a sky-high forward price-to-earnings (P/E) ratio of 41.4, the NVIDIA share price doesn’t seem to consider the risk of lower Chinese demand.

Can the NVIDIA share price rise to $600?

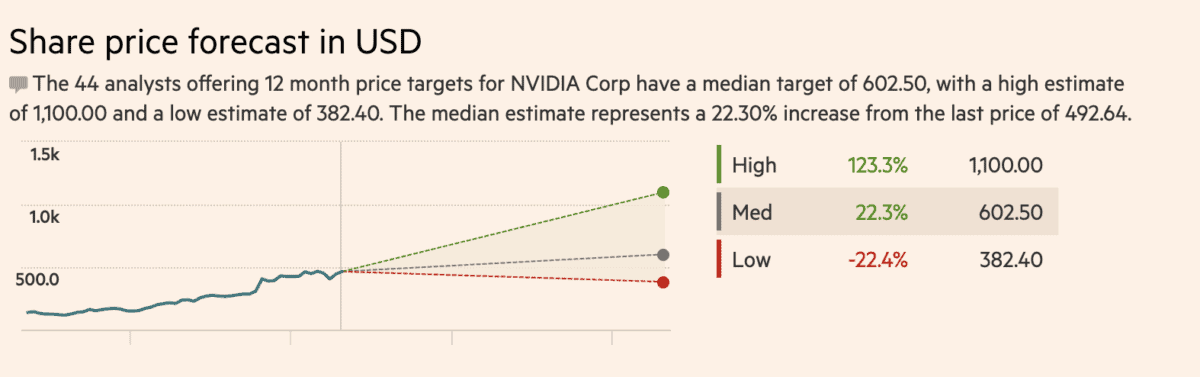

Given NVIDIA’s blowout earnings and massive share buybacks, it’s tempting to think the stock could continue its meteoric rise to $600 per share. In fact, several analysts have price targets as high as $1,100. This implies a potential gain of as much as 123% from NVIDIA’s current share price.

NVIDIA’s growth story is arguably only getting started. After all, AI only constitutes 1% of IT budgets today. However, potential headwinds like export restrictions on China sales and an expensive valuation could put brakes on the rise of the NVIDIA share price.

NVIDIA stock could easily rise to $600, as the conglomerate has proven its doubters wrong so far. Thus, such a high price target can’t be ruled out if results continue to impress. That said, investors should also be wary of the risks that could halt its incredible run.