I think these top FTSE 100 shares are trading too cheaply. Here’s why I’d buy them for my UK shares portfolio in the coming days.

Smurfit Kappa Group

Packaging producers like Smurfit Kappa Group (LSE:SKG) are treading a tightrope right now. While the prices they charge are on the up, volumes are dropping as consumer spending remains under the cosh.

Should you invest £1,000 in Airtel Africa right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Airtel Africa made the list?

It’s fair to say that this particular FTSE firm has been struggling of late. Revenues dropped 9% in the six months to June, while pre-tax profits slumped 14%.

High inflation and weak economic growth pose ongoing threats here. And so the company’s shares are on a forward price-to-earnings (P/E) ratio of just 11.6 times, below the FTSE average of around 14 times.

However, I believe now could be a good time to open a position in the Dublin-based business. Smurfit Kappa’s share price has rebounded over the summer and I believe it could keep marching on.

There were also some green shoots for investors to celebrate in its half-year report. In it chief executive Tony Smurfit said:

We saw market share gains across many of the countries in which we operate, and encouragingly, in Europe, during the second quarter, we saw our shipments per day improve on the previous three quarters.

More positive signals from the sector could continue pulling the packager higher. I’m certainly convinced that Smurfit’s share price will surge over the long term. As the e-commerce and discount retail sectors grow, I expect profits here to increase strongly.

A healthy 4% dividend yield for 2023 provides an added bonus for investors here.

Airtel Africa

Like Smurfit Kappa, telecoms giant Airtel Africa (LSE:AAF) offers an attractive blend of low P/E ratios and market-beating dividend yields.

For this financial year (to April 2024), the FTSE 100 company trades on an earnings multiple of 9.3 times. It offers a solid 4% dividend yield too.

Despite the threat of increasing competition, Airtel Africa still has the potential to deliver explosive profits growth. As personal wealth levels soar in its Sub-Saharan territories, demand for its telecoms and mobile money services looks set to soar.

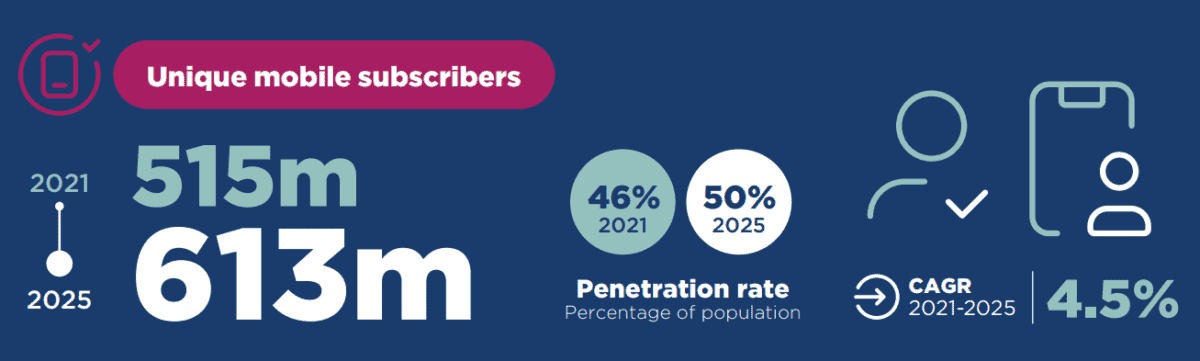

As the graphic above shows, industry expert GSMA Intelligence expects 98m more mobile subscribers to emerge in the region between now and 2025.

Airtel Africa is already growing business at breakneck speed. Its total customer base rose 8.8% between April and June, to 143.1m. As a result, revenues and EBITDA leapt 20.4% and 11.1% (at constant currencies) in the period.

And the business continues spending heavily to improve its infrastructure and build spectrum to keep this momentum going. Capital expenditure rose by more than $100m last year to $748m as it expanded its mobile and fibre networks, boosted its 5G capabilities, and invested in mobile money and data centres in Nigeria.