I might have a few extra pounds to invest in my Stocks and Shares ISA in September. So I’m searching the FTSE 100 for brilliant beaten-down bargains to buy following recent market volatility.

Here are two top shares on my watchlist today.

Anglo American

It’s no shock to see Anglo American (LSE:AAL) sink in value in 2023. Mounting worries over China’s economy also mean concerns are growing over commodities demand.

News this week from the diversified miner’s De Beers diamond unit underlines the pressure many raw materials companies find themselves under. Just $370m worth of precious stones was sold during the firm’s seventh and latest sales cycle of the year, it announced this week. That was down significantly from $638m in the 2022 auction.

The FTSE 100 miner is about much more than diamonds, however. It makes more than 80% of earnings from industrial and precious metals including copper, nickel, platinum and iron ore. And a bright long-term outlook for these markets is making me consider buying the company’s shares for my ISA today.

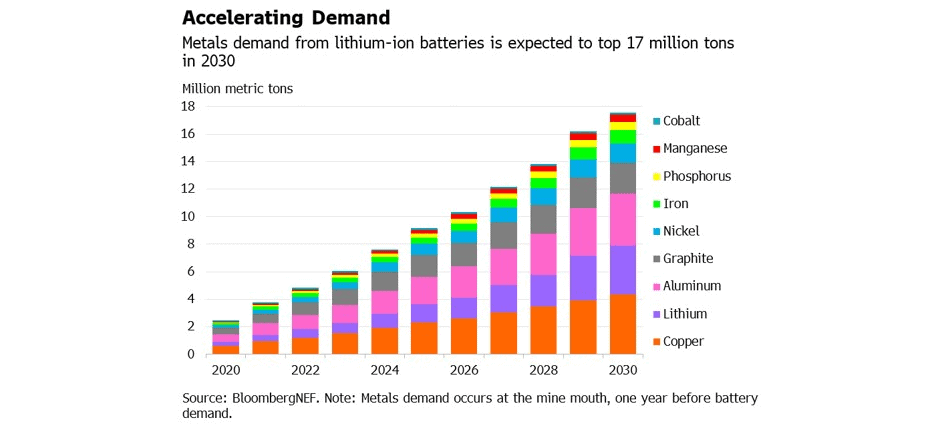

Phenomena including the green energy transition, increasing urbanisation and infrastructure-related spending, and increased digitalisation will all drive metals demand much higher over the next decade. They could even create huge market deficits in many segments.

The chart shows how demand for battery metals is forecast to grow as electric vehicle (EV) sales increase. In this landscape, the prices Anglo American charge for its commodities could rocket.

At £20.95 per share, Anglo American shares trade on a forward-looking P/E ratio of 9.4 times. I don’t think this reflects the miner’s solid investment case.

A healthy 4.4% dividend yield for 2023 provides an added sweetener for investors.

JD Sports Fashion

I’m also considering snapping up some JD Sports Fashion (LSE:JD.) shares on the cheap. Right now, the retailer trades on a forward P/E ratio of 10.8 times.

The company has fallen around a fifth in value in 2023 on fears of sustained pressure on consumer spending. So its P/E multiple has fallen to current levels from its traditional reading in the early-to-mid 20s.

I think this represents an attractive dip-buying opportunity. Changing lifestyles mean that demand for casual sportswear (athleisure) is tipped to continue rising strongly. And this FTSE 100 firm looks in great shape to exploit this booming market as it continues aggressive global expansion.

JD has been rapidly boosting its footprint across Europe, North America and Asia in recent years. It plans to open another 200-300 new stores a year during the next five years as it enters new territories and expands in existing ones.

In recent weeks it signed a deal with Dubai-based GMG to open a string of stores across emerging markets including Saudi Arabia, Kuwait, Egypt and the United Arab Emirates. It’s also acquiring the remaining 49.98% it doesn’t already hold in Iberian Sports Retail Group. The deal, which is expected to be completed in October, will give JD access to a further 460 stores in Europe.

Rapid expansion leaves businesses open to a whole host of risks. But JD’s long track record of success — combined with the big strides it is making in the e-commerce channel — makes it a top stock to buy right now.