The buzz around artificial intelligence (AI) has lifted Nvidia’s (NASDAQ:NVDA) share price through the roof. In the year to date, the Nasdaq-listed company has risen a whopping 210% in value.

The chipmaker isn’t the only tech stock to surge because of AI, of course. UK penny stock RC365 Holding‘s share price, for example, has also rocketed recently. But unlike many other AI stocks, Nvidia is already enjoying spectacular sales growth thanks to the new tech revolution.

Revenues here soared 101% in the second quarter to $13.5bn, way better than forecasts. This was driven by surging demand at its Data Center division (which designs chips for AI applications such as ChatGPT).

Sales at the division hit $10.2bn in Q2, up 171% year on year.

Valuation issues

The company has beaten analyst expectations more than once in 2023. Yet there’s a suspicion that its share price more than reflects the prospect of more estimate-smashing trading updates. In fact, there’s talk that Nvidia’s share price is hugely overvalued.

A good starting point when considering this is to look at the firm’s forward price-to-earnings (P/E) ratio attached. Today this stands at 44.1 times, way above the average of 19.9 times for S&P 500 shares.

Tech shares usually trade at a large premium to the broader market. This is because they’re usually expected to have greater growth potential than most other shares.

But this doesn’t mean Nvidia isn’t expensive at a current price of $460 per share. The broader semiconductor sector trades on a much lower prospective P/E ratio of around 33.1 times. This takes into account the corresponding readings of AMD, Intel, Qualcomm and Taiwan Semiconductor Manufacturing Company.

Another high reading

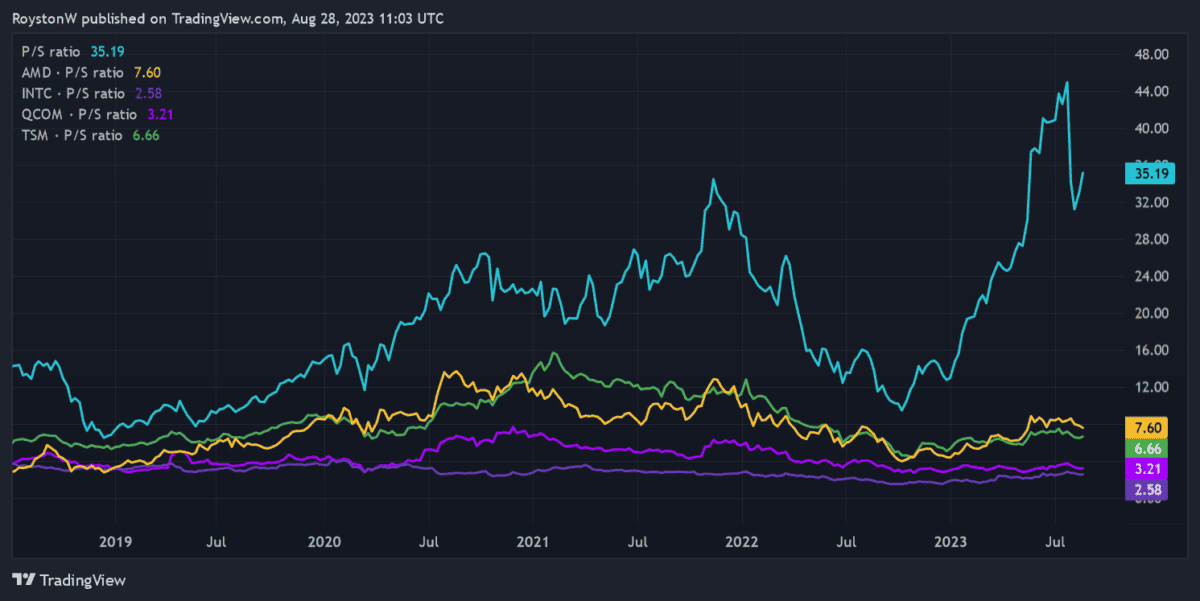

Another useful metric is to see how expensive the chipmaker is on a price-to-sales (P/S) basis. Using this metric it looks even more unreasonably high compared with its sector peers.

As the chart shows, Nvidia trades on a P/S ratio of 35.2 times. This is four to five times higher than that of AMD, and miles ahead of Qualcomm’s and Intel’s readings.

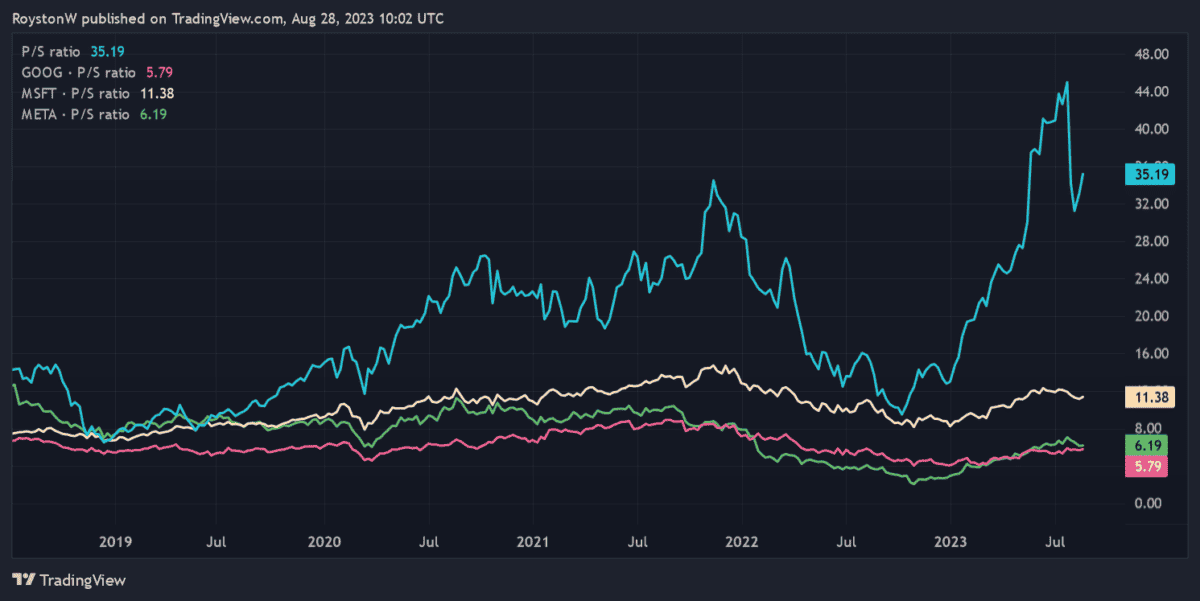

I’ve compared the company’s readings with those of Microsoft, Meta and Alphabet. These stocks are also making huge progress in the field of AI, yet Nvidia shares also trade at a hefty premium to those.

Here’s what I’m doing

I’m a huge fan of Nvidia as a company. And not only because of its impresssive momentum in the AI segment. It also gives investors like me a chance to exploit other fast-growing tech areas like gaming and automotive.

That said, at current prices I’m not tempted to buy the chipmaker. I fear that a bubble has formed around the stock and find it hard to justify its current valuation. In fact, a crash could be just around the corner as worries over how it will meet soaring chip orders grow.

On balance, I’d rather buy other AI stocks right now.