Disney (NYSE: DIS) stock is down 26% over the past five years. Across a 10-year period, it is up by 35.5%, which compares very poorly with the S&P 500‘s 163% gain over the same period. So, is this a timely opportunity to add Disney shares to my Stocks and Shares ISA? Let’s find out.

Why is Disney stock struggling?

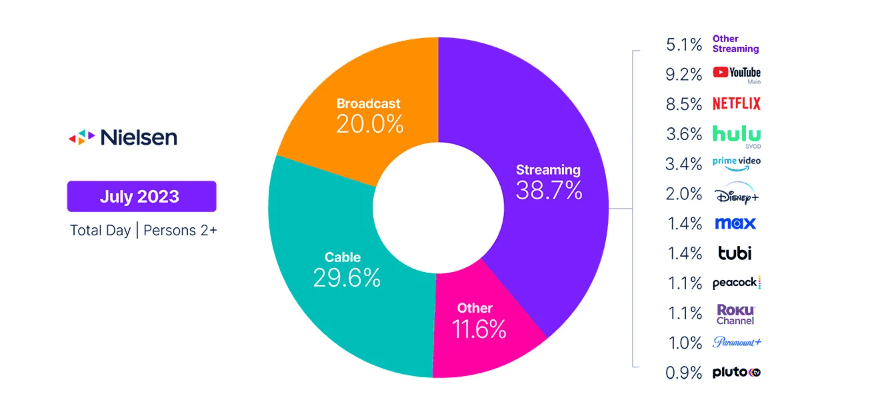

According to TV audience tracking firm Nielsen, an inflection point was reached in July in the consumption of entertainment in the US.

As the chart above illustrates, the combined share of daily broadcast and cable TV viewership in the US was 49.6%. This was the first time this figure has ever dropped below 50%. Meanwhile, the use of subscription streaming services such as Netflix, via a TV, reached a record high of 38.7%.

At a fundamental level, this is the issue. Disney is struggling to convince investors that its transition from cable to streaming will ultimately prove successful. Its operating expenses are rising as it spends more on content while its profits are falling.

Breaking up?

Recently, CEO Bob Iger earmarked three Disney businesses to drive growth in future years. These are its content studios, the amusement parks, and streaming (Disney+). Everything else on the linear TV side, it seems, could be sold off, including broadcast network ABC and ESPN.

At first glance, a simplified company structure makes sense to me, but it would come with risks. After all, the traditional networks, while in overall structural decline, are still throwing off cash that Disney needs to invest in its streaming service, which remains unprofitable.

In that sense, it reminds me a little of the tobacco industry. I suspect these companies would prefer to divest the cigarettes from the less controversial vaping products. But the cigarettes still drive the profits, so the economics just don’t allow for a separation.

It’s a similar story with UK broadcaster ITV. Its legacy terrestrial business (built on adverts) is in long-term decline while its streaming service, ITVX, still isn’t profitable. The shares have dropped 72% in eight years.

All this demonstrates how truly disruptive Netflix’s direct-to-consumer business model has been. And with a share price gain of 9,127% in 15 years, Netflix shows how enriching it can be to identify and back the disruptors rather than the disrupted.

My move

Of course, it isn’t all doom and gloom for the House of Mouse. After 100 years, its vast intellectual property stretches from timeless classics like Cinderella and Star Wars to Pixar’s Toy Story franchise and the Marvel Cinematic Universe. Yes, the studios have struggled lately, but I’m confident they’ll produce box office hits again.

Plus, the company has upped its fees for Disney+ to try and make the streaming business profitable by the end of next year. And the parks still hold their magic, at least if my young daughter’s obsession with Disney World is anything to go by.

Still, I can’t ignore the fact that Disney+ subscribers have declined in recent quarters. This is despite the firm stopping licensing agreements with third-party streaming services to keep its content exclusively on its own platform. Meanwhile, the stock currently pays no dividend.

So, as things stand, I’m not convinced enough to invest in the shares.