Barclays (LSE:BARC) shares are broadly unloved by investors. Just like Lloyds (LSE:LLOY). The market hasn’t been keen on banks since the financial crash. For me, they’re both overlooked and undervalued. But which one is best? Let’s take a closer look.

Business models

Barclays operates as a universal bank, a strategic advantage that bolsters income diversification. With a diverse portfolio of services spanning retail, commercial, investment, and corporate banking, Barclays can tap into various revenue streams across different economic conditions.

This wide-ranging approach reduces reliance on a single source of income and provides resilience in a dynamic market landscape.

Should you invest £1,000 in Centrica right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Centrica made the list?

On the other hand, Lloyds lacks an investment arm, which means its income streams are relatively more concentrated within the retail and commercial banking domains. This renders Lloyds more sensitive to fluctuations in interest rates, as changes in rates can directly impact its profitability.

While this can amplify profitability during periods of rising rates, it also exposes the bank to potential downturns when rates decline.

Both positions carry their share of advantages and disadvantages. Barclays’ diversified income stream mitigates risks but may require additional resources for management. Conversely, Lloyds’ focused approach offers simplicity but leaves it more susceptible to interest rate changes.

Understanding these trade-offs is crucial for investors seeking to assess each bank’s positioning within the market.

Performance

Over the past 12 months, both banks have experienced a tailwind in the form of higher interest rates. However, this could quickly turn into a headwind as very high interest rates could engender a wave of defaults.

Over the period, we’ve also seen customers move their money out of current accounts and into savings accounts — the latter isn’t so profitable for banks. Lloyds has seen a 1.6% reduction in current account balances over 12 months while Barclays saw a 2.3% reduction.

Loss provisions are another major factor. Lloyds impairments have come in 33% above expectation, while Barclays impairments have been 28% less than expected at the half way point.

On the topic of performance, it’s also worth looking at a recent bank stress test. Under the worst case scenario, Lloyds came out on second from top with CET1 (Common Equity Tier 1) levels only falling to 11.6%. Meanwhile, Barclays came bottom, with 8.6% — still way above the threshold.

Valuation

Firstly, we can observe that both stocks are cheap. Barclays trades at 4.6 times earnings while Lloyds trades at 5.5 times earnings. This put them both significantly below the index average.

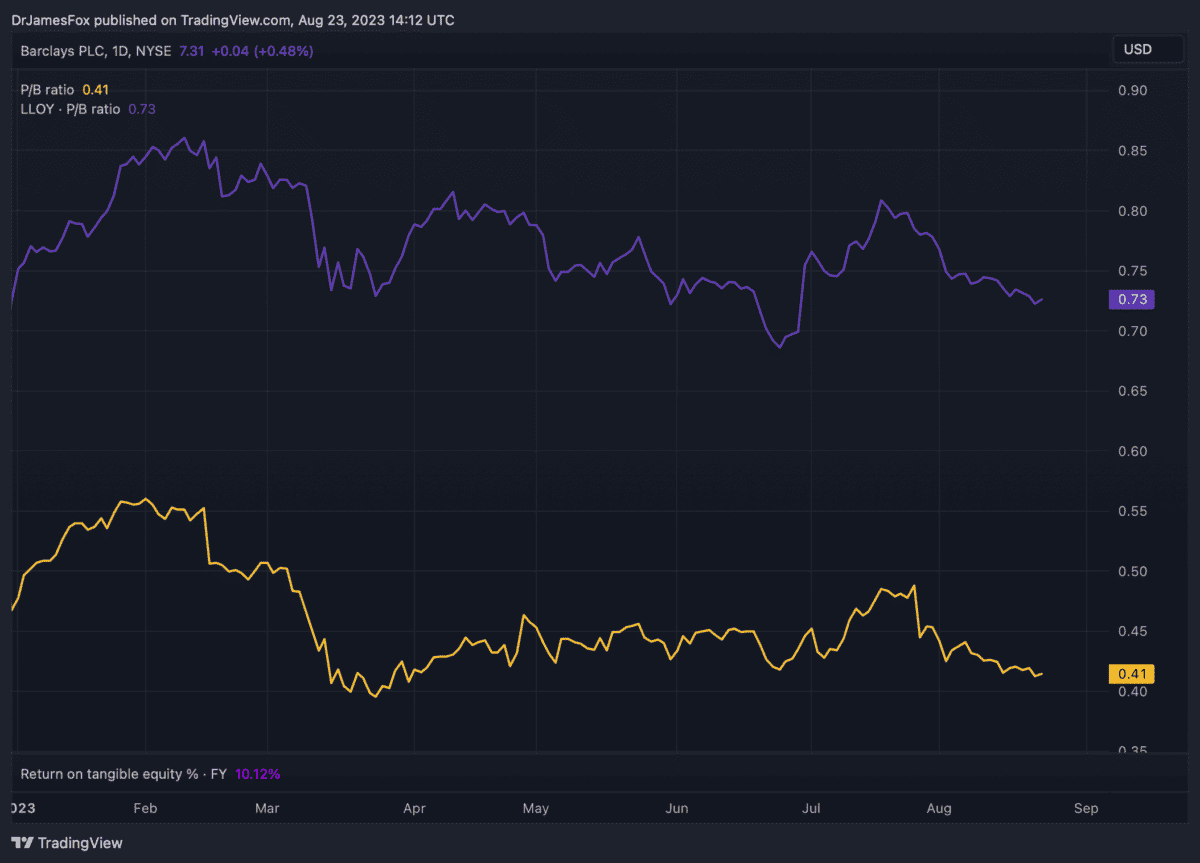

However, when we look at the price-to-book ratio, we can see that Barclays has a huge 59% discount versus its net asset value. By comparison, Lloyds has a significant, yet smaller, 27% discount.

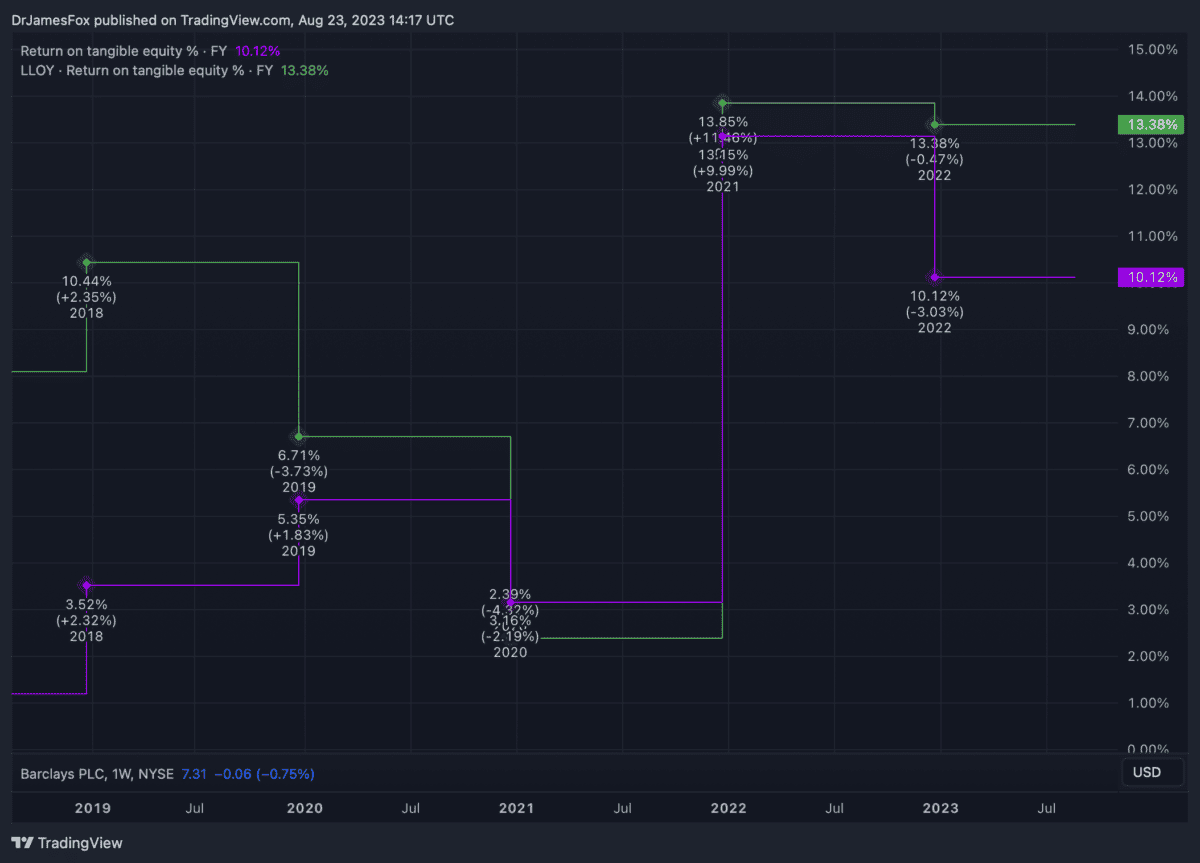

Barclays exhibits comparatively lower return efficiency when compared to Lloyds, as well as other peers. This is evidenced by its below-average Return on Tangible Equity (RoTE).

This financial measure gauges a company’s profitability relative to its tangible equity, essentially reflecting how effectively the company generates profits using its tangible assets.

Both these banks look very attractive to me. Yes, there’s a considerable downside if interest rates cause mass defaults. However, given the possibilities at play, I think these stocks remain undervalued.

If I had to pick one — which I don’t — I’d go for Barclays.