If I had £1,000 in dividend stocks, the most I could realistically generate in passive income is £80 a year. And that’s an exceptional yield. Under normal circumstances, it would be almost impossible to find stocks offering yields around 8%.

However, £80 a year isn’t going to be life-changing. And I believe this is what puts many Britons off investing. They’re aware that with limited capital, they’ll struggle to generate any noteworthy returns in the near future.

That’s not the case, however, when we take a long-term approach to investing. Because with compound returns and regular contributions, we can turn a handful of dividend stocks into a lifelong second income.

Getting started

If I were new to investing, I’d want to make use of the Stocks & Shares ISA. This is an excellent vehicle for creating passive income because all returns generated within the ISA wrapper are tax free.

The process of opening a Stocks and Shares ISA varies, depending on the provider. However, I can open a Stocks and Shares ISA account with most major investment platforms. My preference is Hargreaves Lansdown — by far the UK’s largest brokerage — but investors with limited capital may prefer platforms with lower fees.

Opening an account can typically be done quickly, usually within 15 minutes. Although a deposit is often needed to start a basic account these days, it’s possible to begin with very little initial funding.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Goals and affordability

Moving forward, the next step involves defining my objectives and gaining a clear understanding of what’s feasible within my financial capacity. Naturally, if I have lofty passive income goals, I’m going to need more than just £1,000 in dividend stocks.

Thus, the necessity arises to formulate a systematic savings strategy, preferably on a monthly basis, which will serve as the means to cultivate and expand my portfolio over the course of time.

This methodical approach should not only align with my aspirations but also underscores the importance of discipline in the pursuit of long-term financial growth.

Compound returns

When investing for the long run, I need to harness the power of compound returns. This is a reinvestment strategy that leads to exponential growth. It’s incredibly simple and is often misunderstood by novice investors.

In essence, compound returns involve not just earning from the initial investment, but also from the accumulated interest or profits, leading to exponential growth over time.

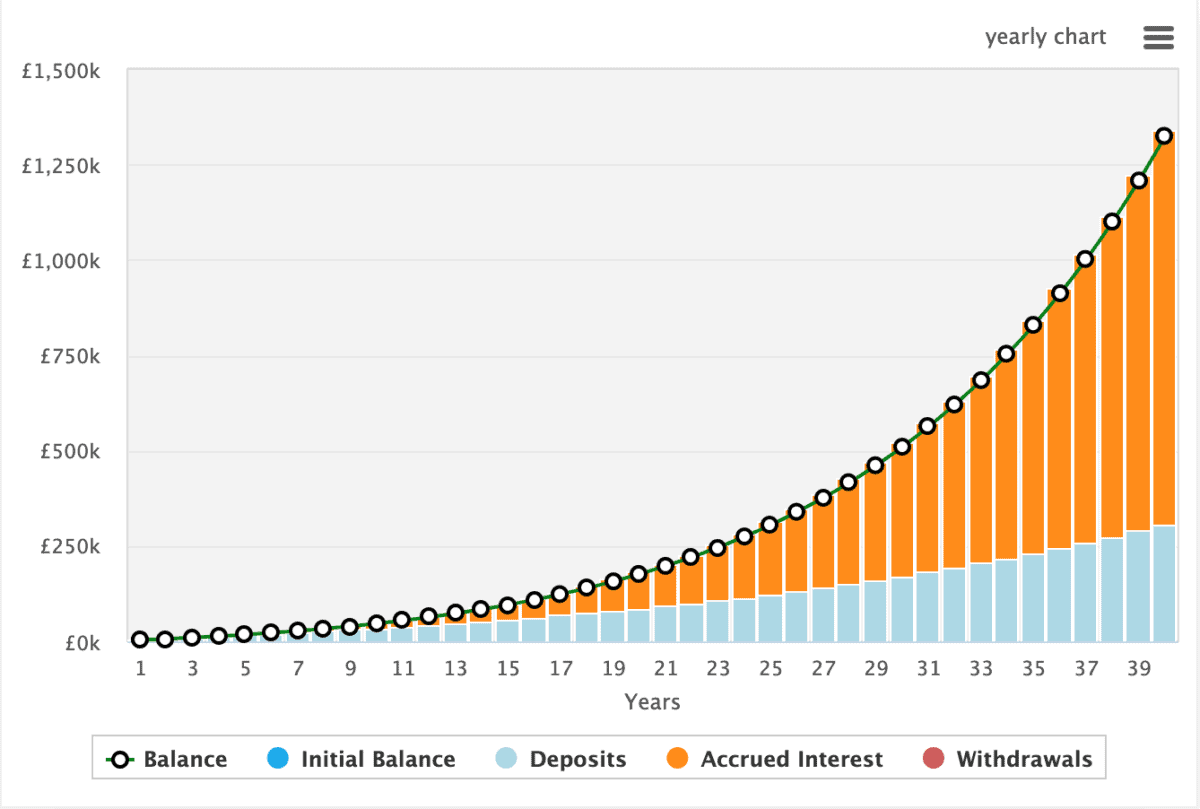

Of course, this works regardless of the figures involved. So, in practice, if I had £1,000 invested in stocks returning 8% a year — it doesn’t matter if the returns come in the form of share price gains or dividends — I’d be reinvesting my returns every year while adding a contribution, say £200, every month.

Here’s a very crude illustration of how a portfolio could grow assuming at 8% annualised return. I’ve also included a 5% increase in the size of the contribution to keep up with inflation.

I have to note that while I could achieve better than 8% annualised returns, I could also do worse. I need to make wise investment choices, and this means doing my homework.

Finally, the second income. It all depends on when I want to withdraw. After 20 years, this plan could yield £13,000 a year. After 30 years, it could yield £38,000. And after 40 years? It could yield £100,000!