The Nvidia (NASDAQ:NVDA) share price could surge Thursday (24 August) when the market opens. The stock more than delivered in its Q2 results earnings after the market closed on Wednesday. Its earnings not only impacted the Nvidia share price, but stocks around the world. The company is also buying back $25bn of stock, raising some questions about reinvestment. So, let’s take a closer look at this stock.

Mic-drop moment

Here’s a summary of the earnings that were described as a ‘mic-drop moment’.

- Revenue jumped to $13.51bn, marking a remarkable 101% surge from the previous year. Analysts projected $11bn in revenue.

- Adjusted earnings per share (EPS) stood at $2.70, a huge increase of 429% compared to the previous year. EPS outperformed predictions of $2.07.

- Nvidia’s forward guidance for the current quarter was $16bn. That’s considerably higher than Wall Street’s $12.5bn forecast.

- The graphics chipmaker’s shares jumped around 9% in after-hours trading on Wednesday, reaching a record peak of $515 per share.

Valuation

Nvidia shares are up 173% over the past 12 months, and understandably that’s had a profound impact on valuation metrics. We can observe the share price gains in the following chart.

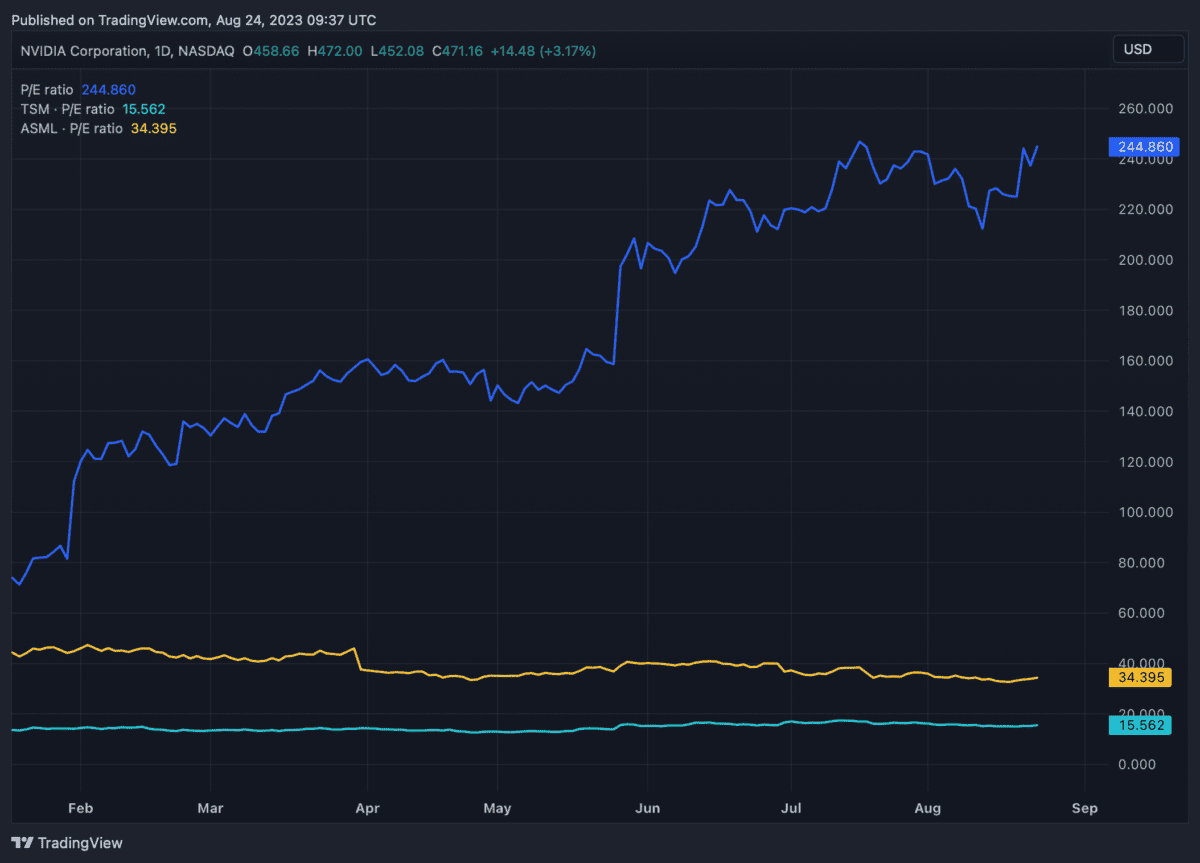

We can see that Nvidia is almost in its own league. It is among the most expensive stocks I’ve ever come across. Starting with the price-to-earnings metric, on a trailing-12-month basis, it trades at 244 times earnings.

As we can see here, Nvidia trades at a huge premium versus peers including TSMC and ASML. Admittedly, neither company is as exposed to the AI boom as Nvidia, but it’s a useful comparison. Nvidia’s GPUs — traditionally used in the gaming sector — are the platform of choice for AI developers around the world.

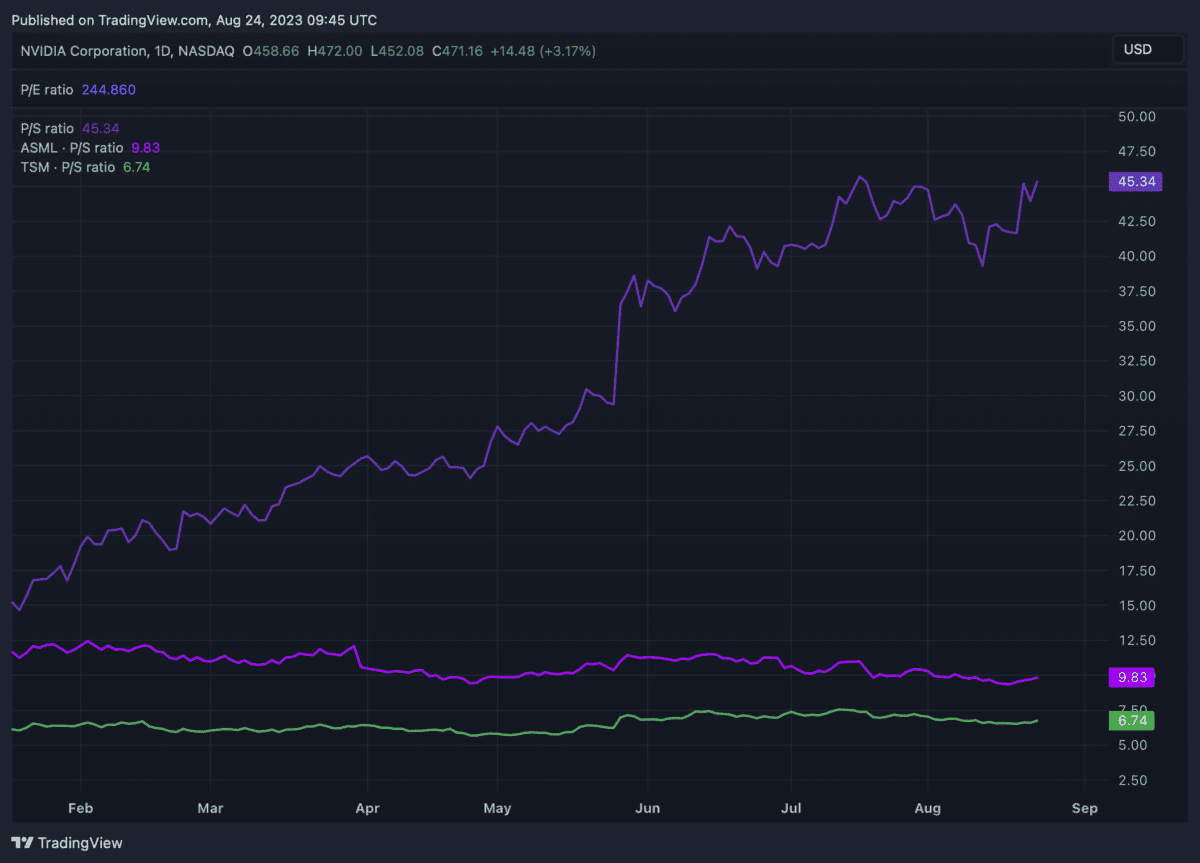

Next, using the price-to-sales metric, we can also see how expensive Nvidia appears. The stock trades at 45 times sales on a trailing-12-month basis. Normally, we’d consider a P/S ratio of 10 or above to be expensive. Clearly Nvidia is an exceptional case.

Nvidia trades at a huge premium to its peers. In fact, it’s around seven times as expensive as TSMC using this metric. Geopolitics is a major reason for the discount on the Taiwanese firm. But it’s interesting to note that TSM, like Nvidia, has a competitive advantage in its field. TSM also makes Nvidia’s chips.

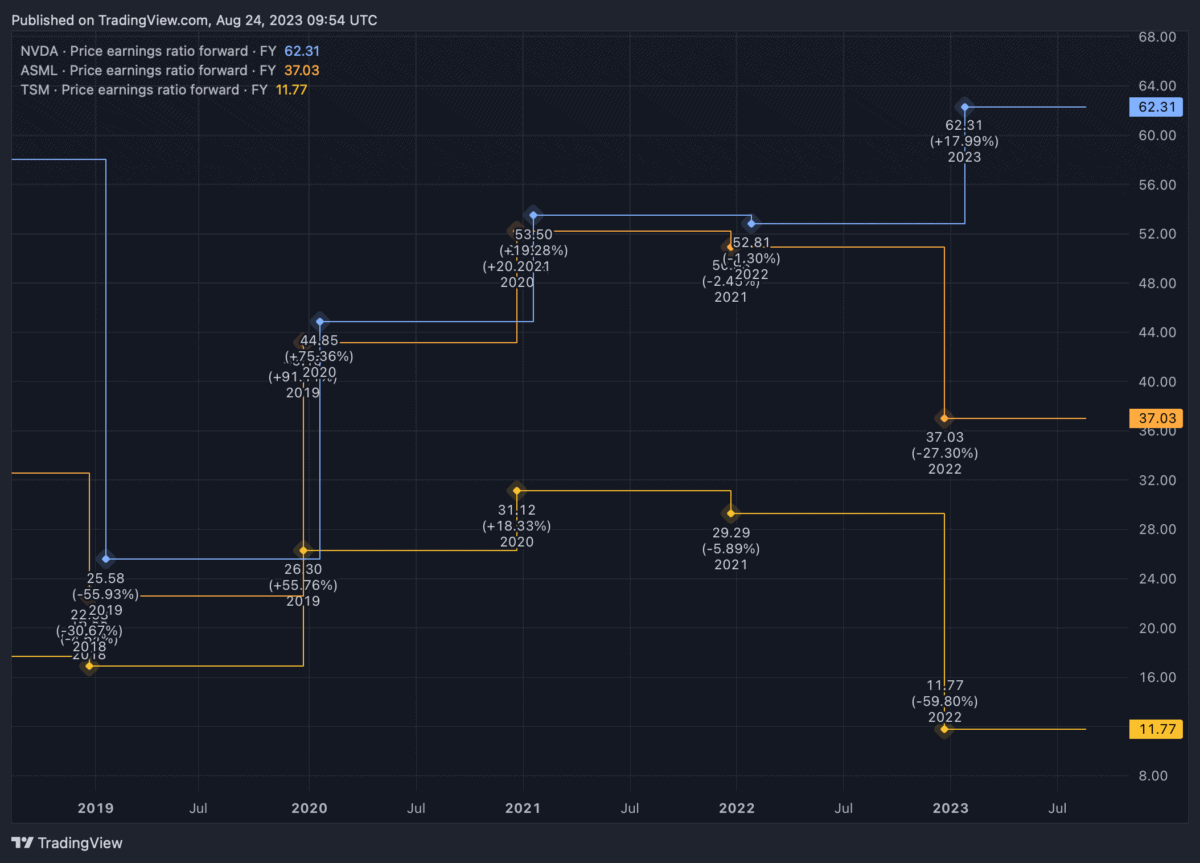

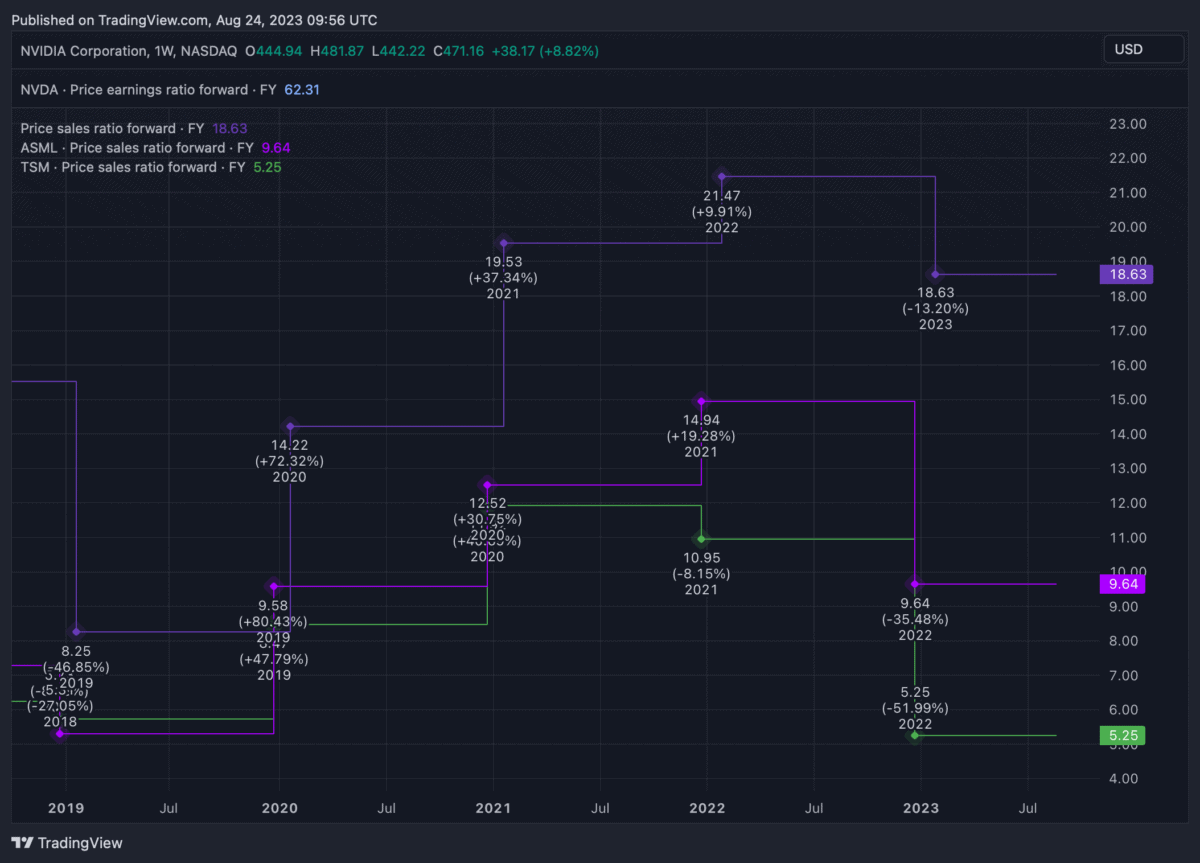

However, on a forward basis, Nvidia starts to look less expensive, although it’s clearly trading at a premium. Of course, it’s worth noting that its intrinsic value is based on its long-term potential to generate revenues on the back of a boom in AI development and usage.

In conclusion, it’s clear that Nvidia trades at a premium to the market and its peers. However, it remains unclear as to whether that valuation is truly warranted. Momentum can be a fickle things when investing. And up 173% over 12 months, there’s clearly a lot of potential for price falls.