The rise and fall of the RC365 (LSE:RCGH) share price is undoubtedly one of the investment stories of 2023. The stock soared in early summer before reaching a high of 170p a share, vastly above the 15p at which it had traded at this time last year.

However, the stock has started its inevitable descent, and now trades around 60p. Is there further to go? Let’s take a closer look.

What’s behind the rise and fall?

The reason behind RC365’s surge remains a mystery. And this is why the collapse seemed inevitable.

The surge has been primarily attributed to a series of announcements, notably its collaboration with APEC Business Services and the acquisition of Mr Meal Production Limited. Additionally, an MoU with Hong Kong’s Hatcher Group regarding AI solutions may have generated some interest.

However, it can pay to be cautious. As my colleague Edward Sheldon pointed out, a significant portion of the stock’s price surge could potentially be linked to a likely sponsored article titled “Missed Nvidia? This London AI stock could jump over 1,000%.”

Curiously, the article, which was spread across the internet, was published by different authors on different sites. This raised questions about the sustainability of the surge and whether it was driven by organic market dynamics or external influences.

The fall has a lot to do with valuation, as we will now explore.

Valuation

RC365 isn’t profit-making. In fact, while revenue surged 109% last year, the company’s losses expanded by 38%. As such, when looking at valuation, it makes sense not to look at the price-to-earnings ratio… because RC365 doesn’t have positive earnings.

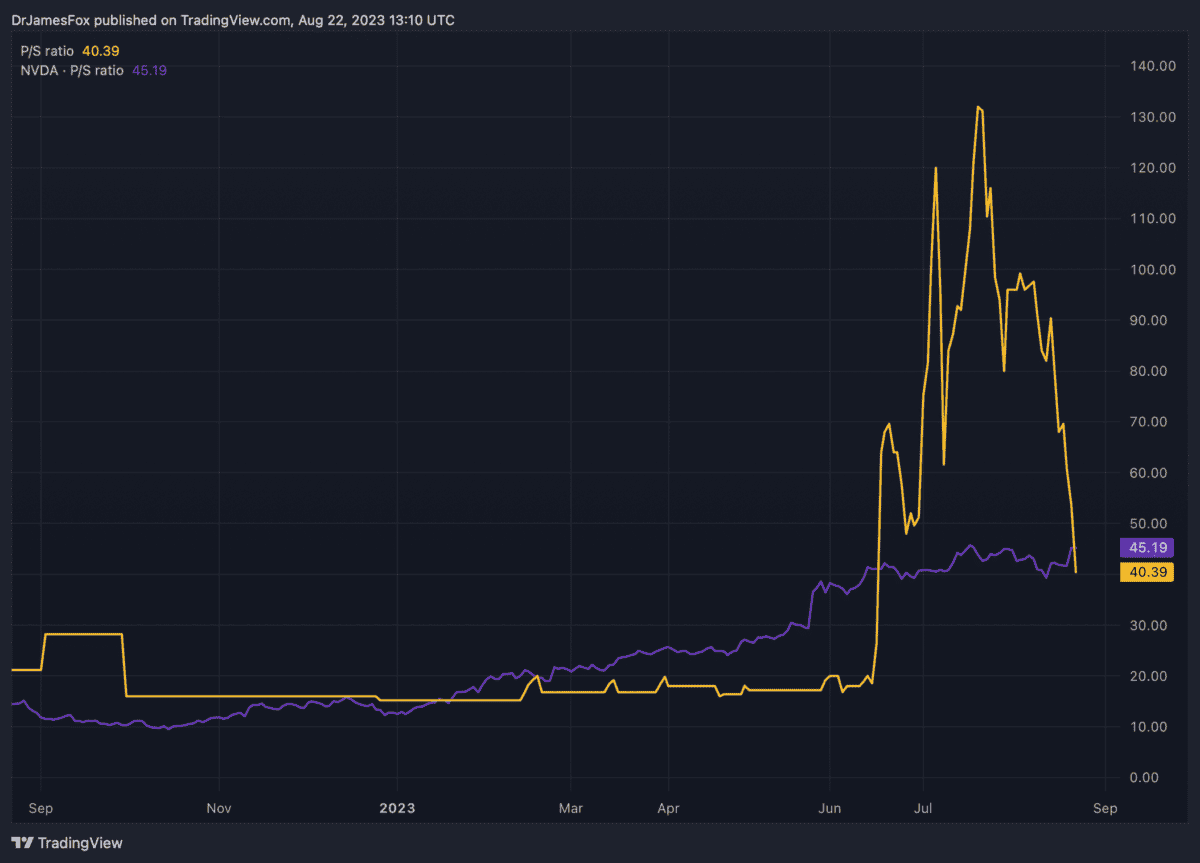

As we can see from the below chart, RC365’s price-to-sales (P/S) ratio extended beyond 130 times at peak valuation. As a means of comparison, a P/S above 10 is normally considered very expensive. To further aid this comparison, I’ve included AI giant Nvidia.

As we can see, Nvidia and RC365 now have valuations that are largely in line with either other. But don’t be fooled, Nvidia is among the most exciting companies in the world right now. Nvidia’s forward P/S ratio is 24 — still expensive, but almost half it’s current position.

Does RC365 deserve a valuation in line with Nvidia? Almost certainly not. There’s nothing within it’s recent announcements to suggest it could deliver the kind of organic growth that Nvidia is experiencing during this AI boom. As such, we should expect more downside.

Moreover, RC365 possesses a restricted float, translating to a scarcity of tradable shares. This scarcity can potentially amplify stock volatility and widen the bid-ask spread. This isn’t good news for a stock that already shedded 60% of its value over the past month.

It’s highly likely that the stock will fall further to reach a more realistic valuation. Fair value, based on what we know about the company, may be closer to 12p a share.