Tesco (LSE: TSCO) stock remains popular with many investors in the UK today. At first glance, that may seem surprising, given that the share price has delivered a 6% loss over 20 years.

This leads me to believe that many investors probably value the dividends on offer from Tesco shares. So, how does the FTSE 100 stock look from a passive income perspective? Here’s what the charts say.

Dividend yield

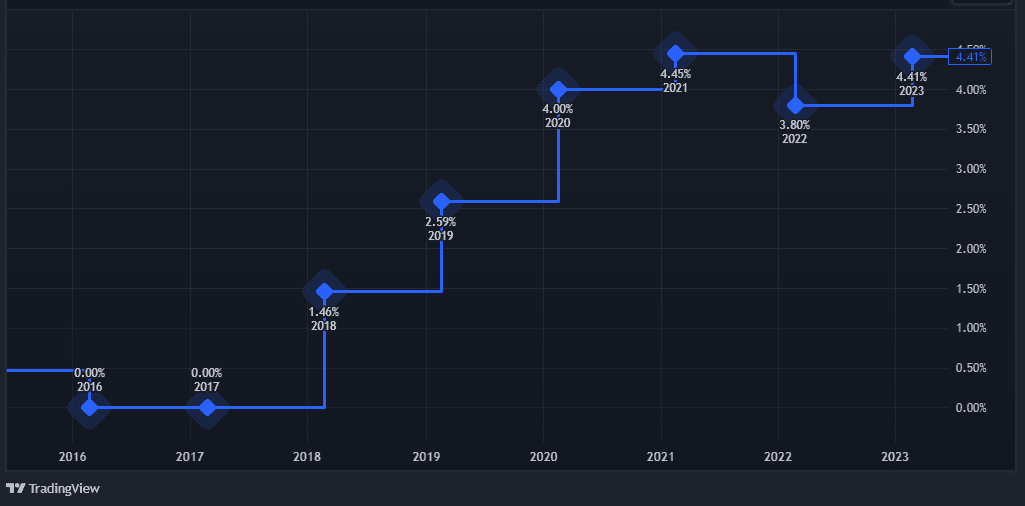

The first thing many investors look at when assessing a dividend stock is the yield. In the case of Tesco, it is currently 4.4%, which is higher than the Footsie average of 3.9%.

Should you invest £1,000 in Barclays right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Barclays made the list?

In the chart below, we can see that the dividend yield has been trending higher since 2018. This was the year that the supermarket giant reinstated its payout after a 2014 accounting scandal knocked it for six. Hence the 0% yield for 2016 and 2017.

That yield doesn’t look as appealing now that interest rates have risen sharply. I mean, I can lock my cash away in a fixed-term savings account today and get between 5% and 6%.

Of course, by doing this, I forgo passive income while my money is locked away. But the eventual return is arguably more attractive as I don’t have to worry about a falling share price or dividend cuts.

On the flip side, I’d be giving up the chance of potential share price gains on top of rising passive income.

Dividend cover

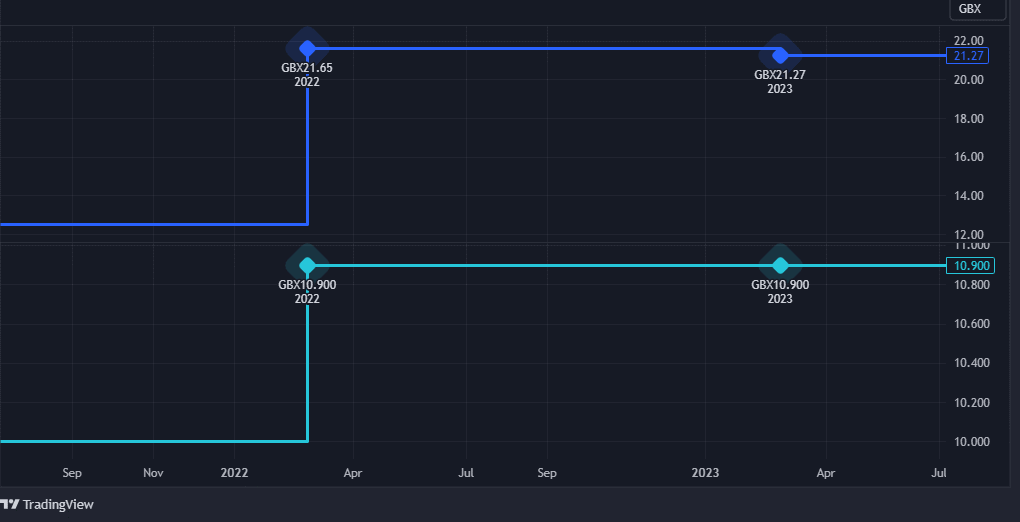

Dividend cover is a popular measure of safety used by income investors. It is calculated by taking the earnings per share (EPS) figure and dividing it by the dividend per share (DPS). Essentially, this metric provides a quick snapshot of how many times the dividend is ‘covered’ by earnings.

The general consensus is that anything around two times or above is considered good coverage.

Above, we can see that Tesco’s dividend is reassuringly covered almost two times by earnings. That is, the EPS figure at the top is that much higher than the DPS figure at the bottom. This means that for every £1 the supermarket pays out, it has another £1 spare (almost) to cover the dividend payment.

Margin compression

Supermarket margins are generally between 1% and 3%. That may not sound like much, but the huge volume of items that Tesco sells means it often adds up to a lot.

However, the company has experienced margin pressure recently. This has been caused by rising input costs from high inflation and fierce industry competition from discounters such as Lidl and Aldi.

Admirably, Tesco has chosen to absorb some of this inflationary pressure rather than passing it all through to cash-strapped customers. But this has compressed its operating margin to 2.3%, down from 4% in 2019.

Would I buy the shares?

The Tesco dividend yield of 4.4% doesn’t sway me to invest in the shares. I can hope to secure double that elsewhere in the FTSE 100 right now.

Meanwhile, industry competition means margins are likely to stay under pressure, resulting in modest dividend hikes. And I don’t see any catalysts on the horizon for long-term share price appreciation.

Putting all this together then, I think there are better passive income options today.